Ato Tax Invoice Requirements Australia - When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to. Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid. The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained.

The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained. When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to. Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid.

Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid. When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to. The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained.

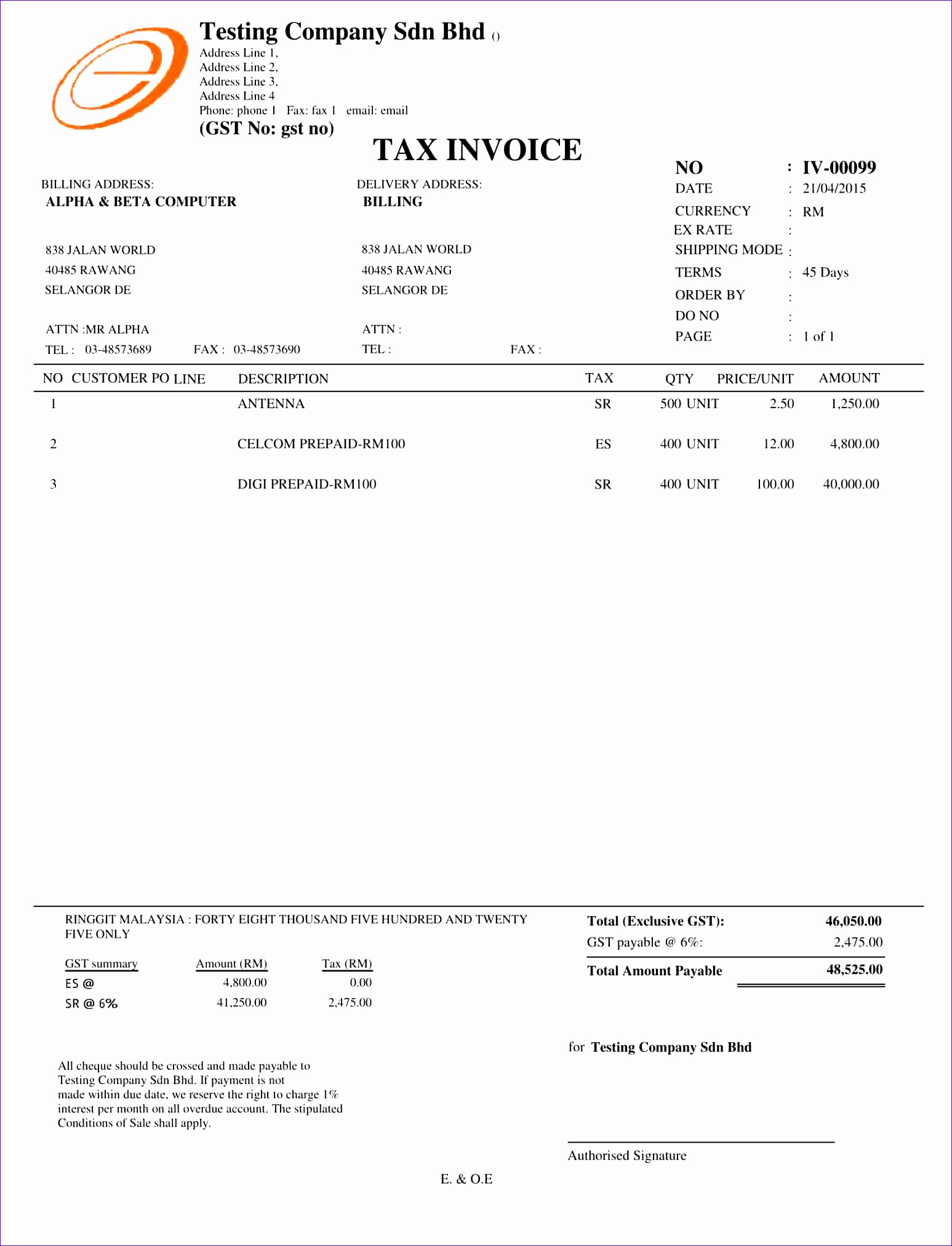

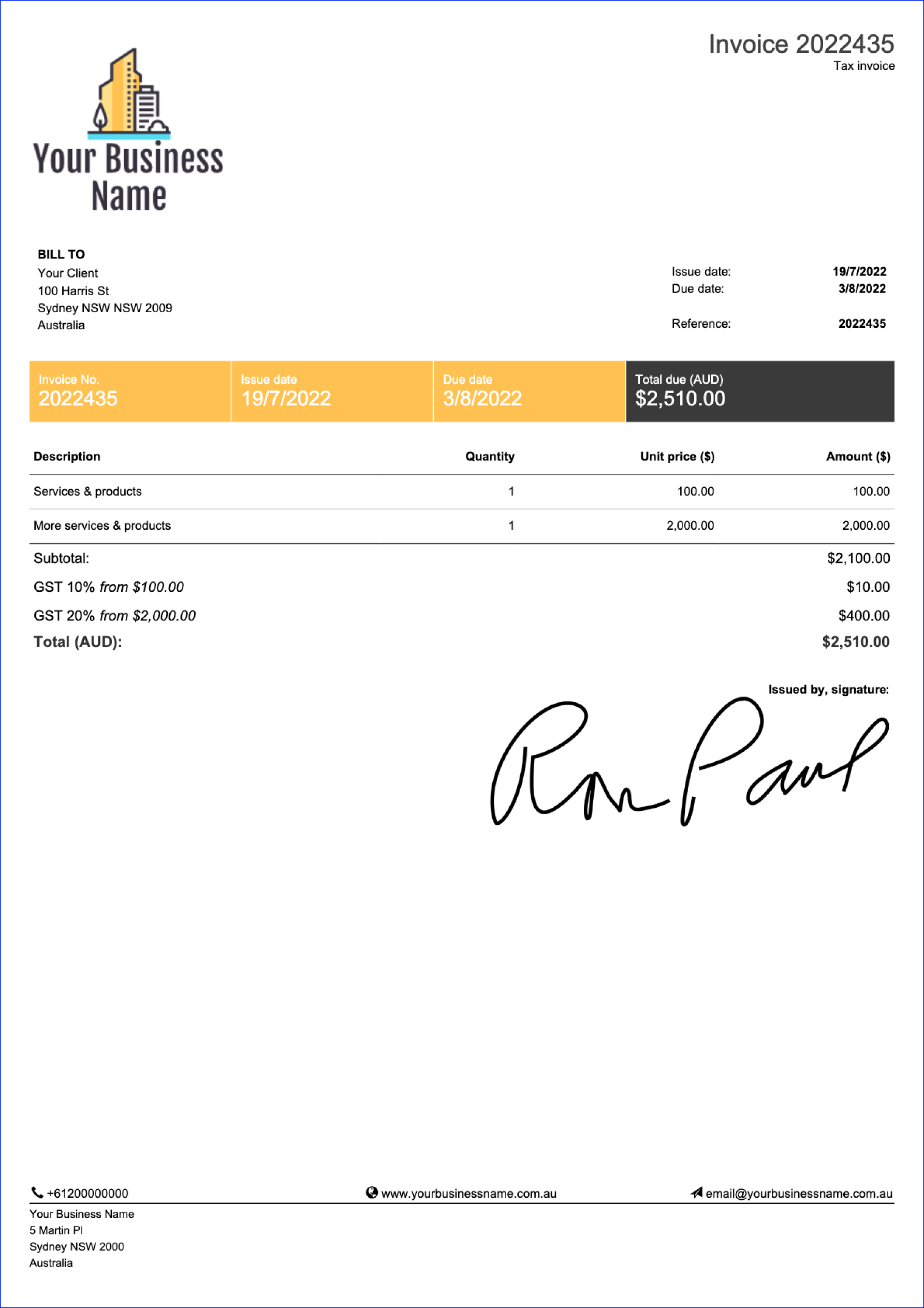

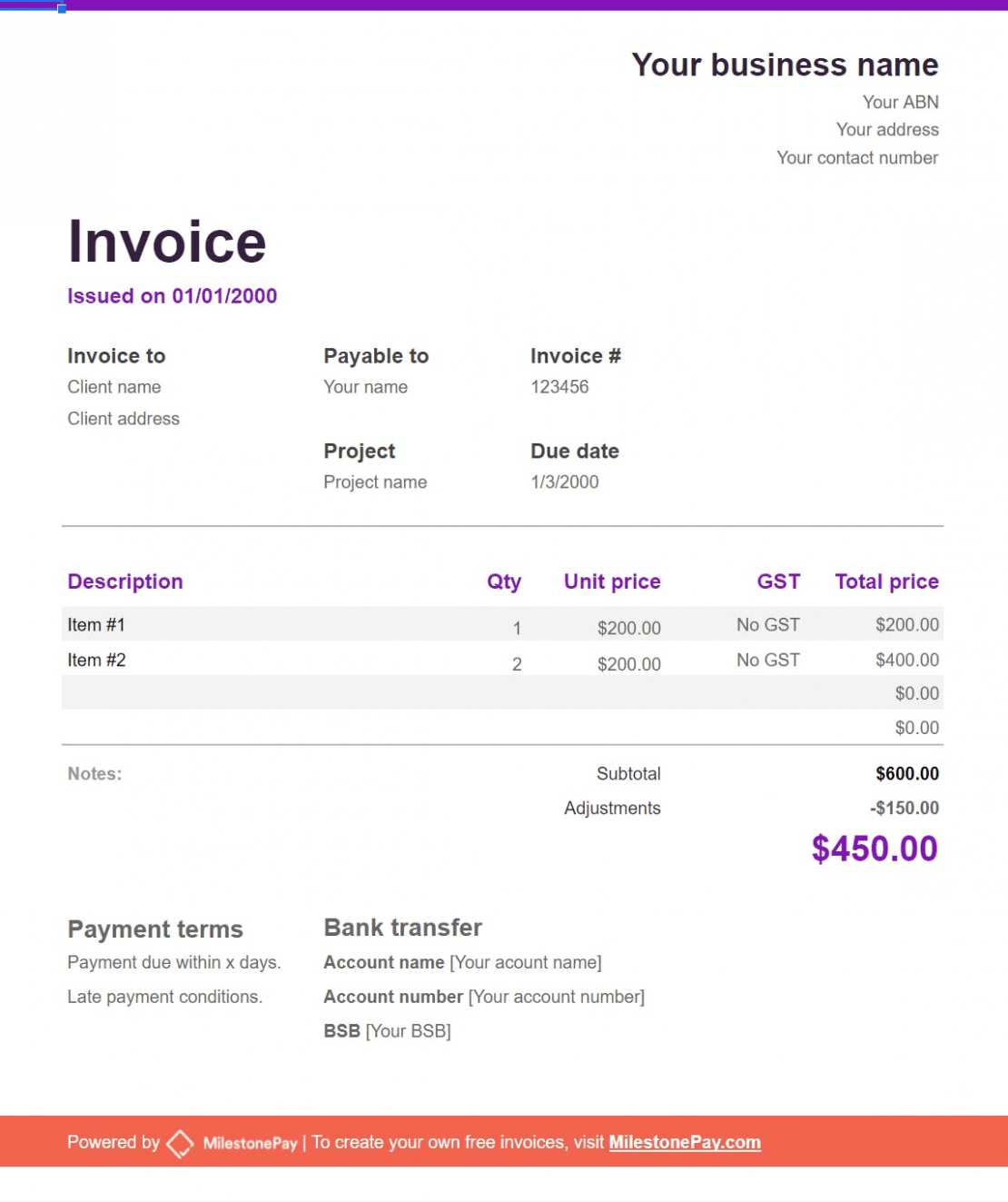

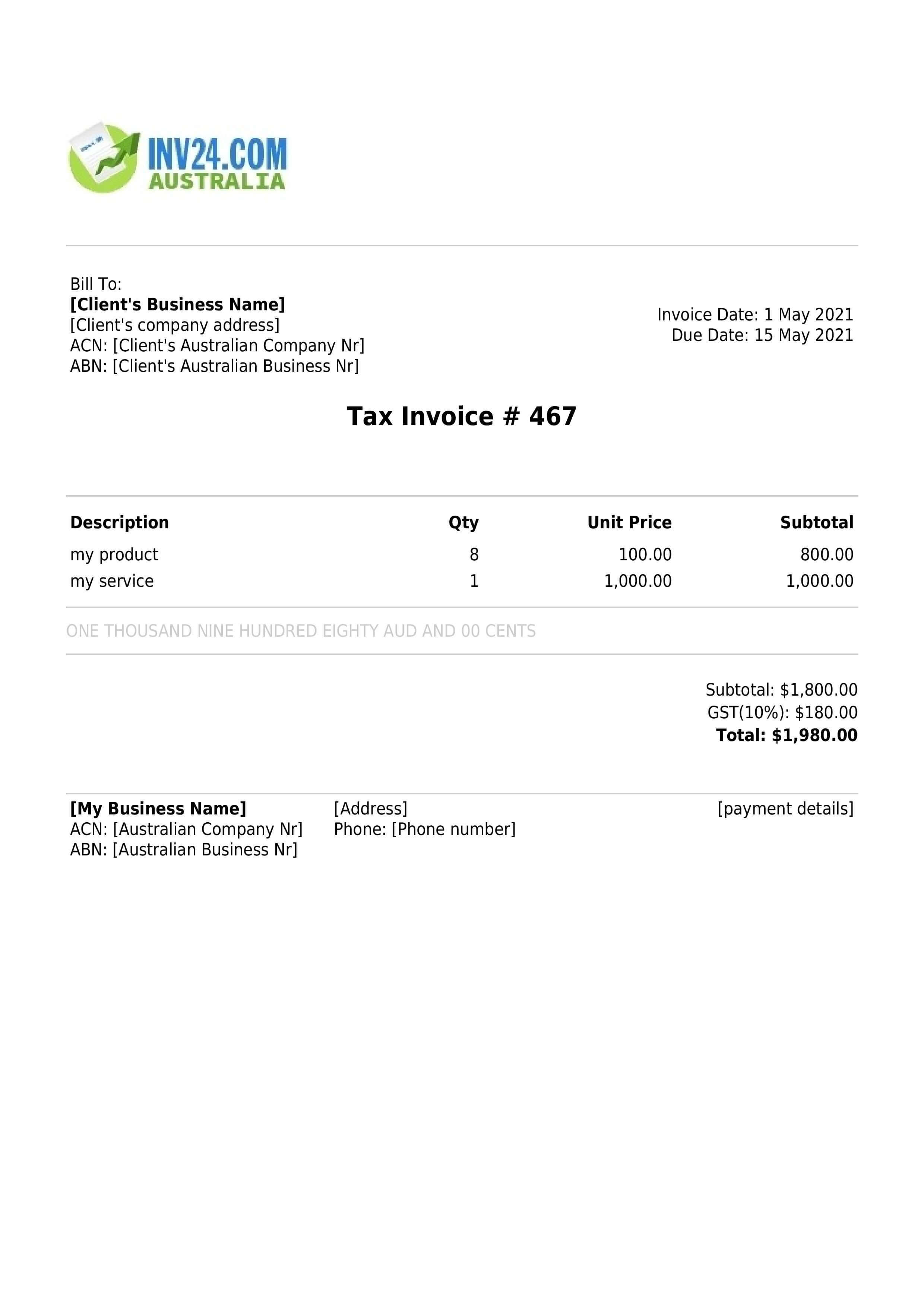

Basic Invoice Template Australia Builder Resumes Examples Database

Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid. When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to. The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained.

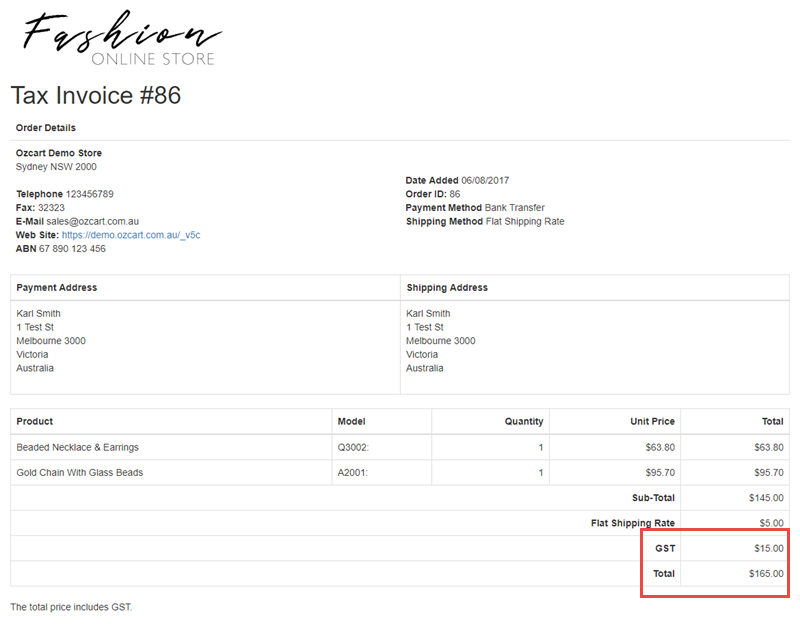

(V5) How do I make my invoices ATO tax compliant? Knowledge Base

When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to. The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained. Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid.

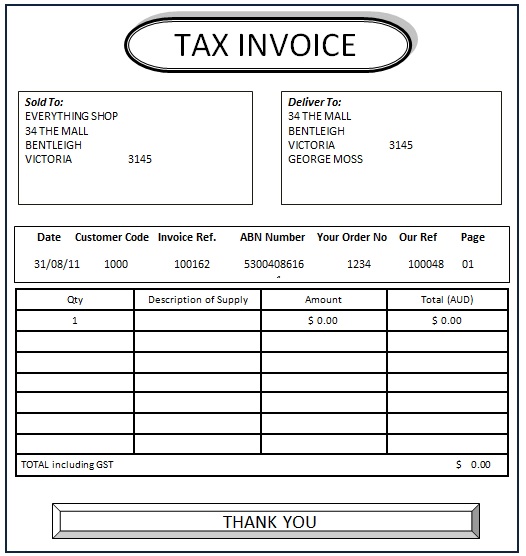

Tax Invoice Template Australia

Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid. When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to. The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained.

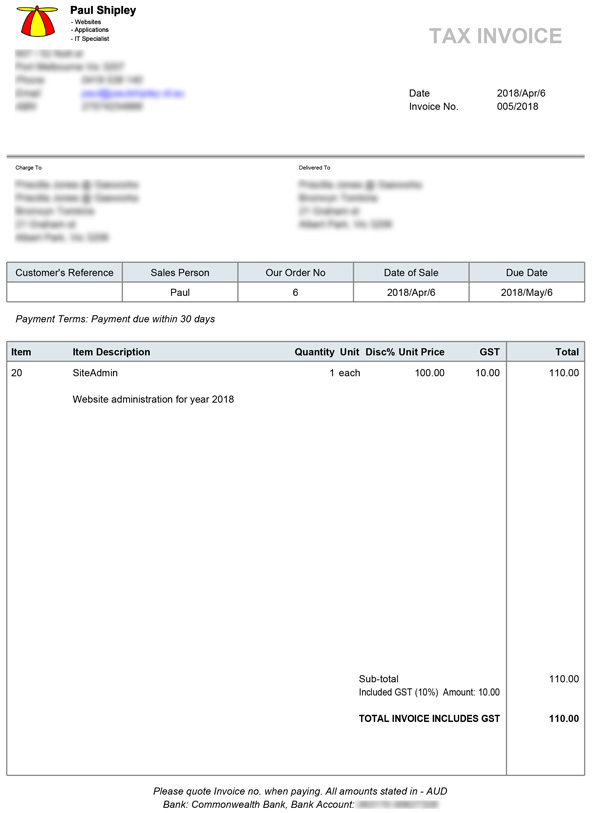

Australian Tax Invoice Template Word

The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained. When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to. Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid.

Australian Tax Invoice Requirements Invoice Template

Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid. The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained. When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to.

Record keeping requirements Australian Taxation Office

Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid. The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained. When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to.

8 Australian Tax Invoice Template Sampletemplatess Sa vrogue.co

When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to. The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained. Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid.

Australian Tax Invoice Template Excel Invoice

The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained. Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid. When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to.

Invoices in Australia All You Need to Know

Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid. When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to. The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained.

Sample Tax Invoice Template Australia Best Business Professional Template

The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained. Tax invoices for sales under $1,000 need to provide seven pieces of critical information to be considered valid. When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to.

Tax Invoices For Sales Under $1,000 Need To Provide Seven Pieces Of Critical Information To Be Considered Valid.

The tax invoice must contain enough information to enable the total price of this supply to be clearly ascertained. When it comes to valid tax invoices according to the australian taxation office (ato), several key elements must be present to.