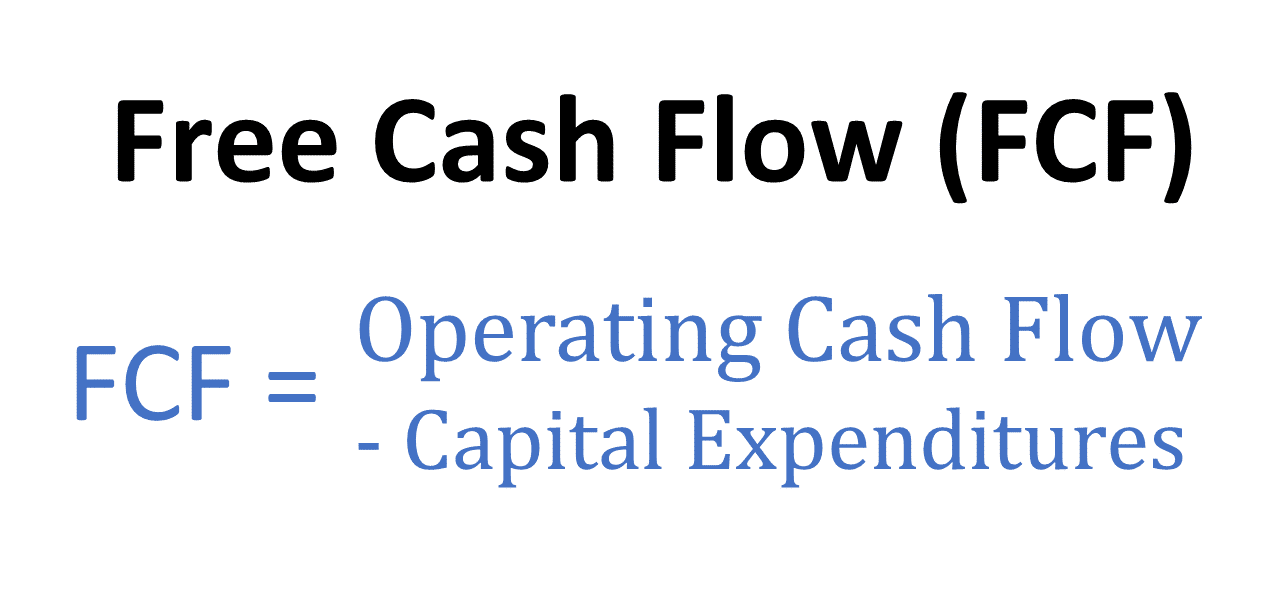

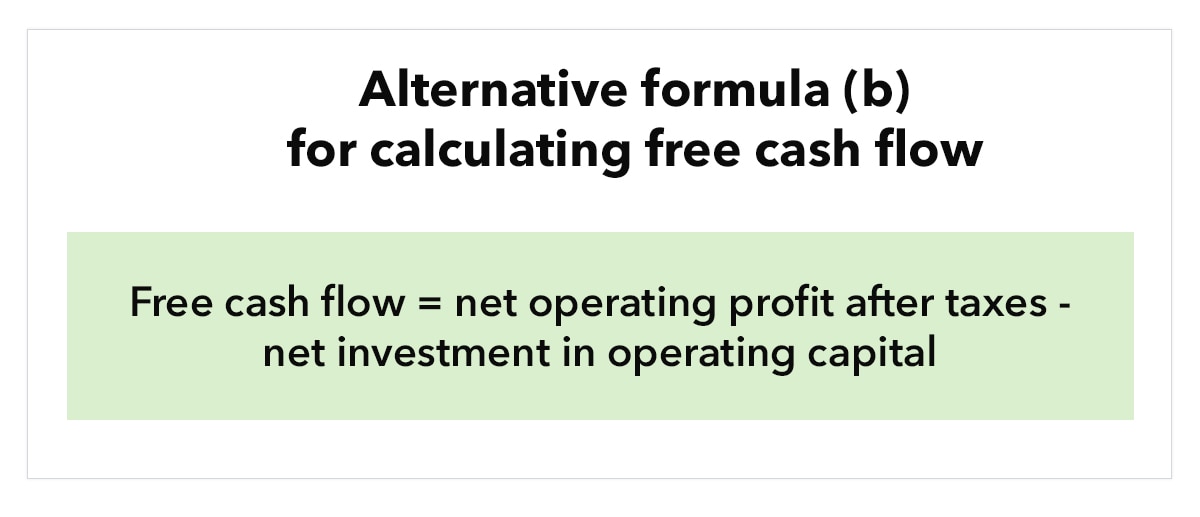

Calculating Free Cash Flow Formula - What is the free cash flow (fcf) formula? Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. 100k+ visitors in the past month

What is the free cash flow (fcf) formula? 100k+ visitors in the past month Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric.

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. 100k+ visitors in the past month What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the.

Discounted Cash Flow Formula

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. What is the free cash flow (fcf) formula? Free cash flow (fcf) formula is used to find the company's remaining cash after meeting.

Levered vs. unlevered free cash flow explained (formulas, examples

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. 100k+ visitors in the past month The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much.

Free Cash Flow What it is and how to calculate it Example and

100k+ visitors in the past month Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and.

Free Cash Flow (FCF) Formula

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. 100k+ visitors in the past month The generic free cash flow (fcf) formula is equal to cash from operations minus capital. What is the free cash flow (fcf) formula? Free cash flow, often abbreviate fcf, is an efficiency.

Free Cash Flow Plan Projections

100k+ visitors in the past month The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula is.

Free Cash Flow What it is and how to calculate it Example and

100k+ visitors in the past month What is the free cash flow (fcf) formula? Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) formula is used to find.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

What is the free cash flow (fcf) formula? Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. 100k+ visitors in the past month Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. The generic.

(FCF) Free Cash Flow Formula and Calculation Financial

What is the free cash flow (fcf) formula? Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. The generic free cash flow (fcf) formula is.

Free Cash Flow, Often Abbreviate Fcf, Is An Efficiency And Liquidity Ratio That Calculates The How Much More Cash A Company Generates.

The generic free cash flow (fcf) formula is equal to cash from operations minus capital. 100k+ visitors in the past month What is the free cash flow (fcf) formula? Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)