Calculating Irr In Excel Examples - The tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature. You will also learn how to. Excel has three functions to calculate the irr: It calculates the discount rate that makes all future cash flows. Internal rate of return (irr) is a popular tool used to assess potential profitability. Irr, the modified irr (mirr), and irr for different payment periods (xirr).

Excel has three functions to calculate the irr: You will also learn how to. The tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature. It calculates the discount rate that makes all future cash flows. Internal rate of return (irr) is a popular tool used to assess potential profitability. Irr, the modified irr (mirr), and irr for different payment periods (xirr).

Excel has three functions to calculate the irr: You will also learn how to. It calculates the discount rate that makes all future cash flows. Irr, the modified irr (mirr), and irr for different payment periods (xirr). Internal rate of return (irr) is a popular tool used to assess potential profitability. The tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature.

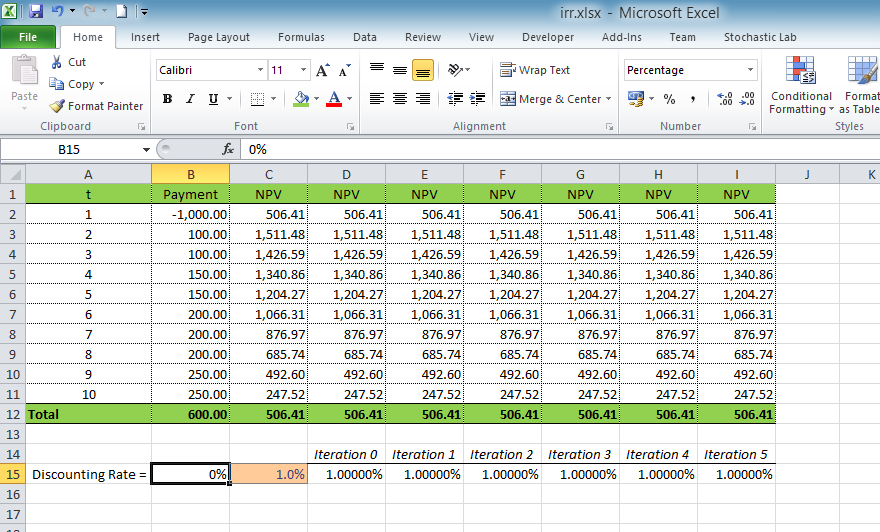

Excel Irr Template

You will also learn how to. It calculates the discount rate that makes all future cash flows. Excel has three functions to calculate the irr: Internal rate of return (irr) is a popular tool used to assess potential profitability. The tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature.

Microsoft Excel 3 ways to calculate internal rate of return in Excel

Irr, the modified irr (mirr), and irr for different payment periods (xirr). You will also learn how to. Internal rate of return (irr) is a popular tool used to assess potential profitability. It calculates the discount rate that makes all future cash flows. Excel has three functions to calculate the irr:

Irr в excel

It calculates the discount rate that makes all future cash flows. Irr, the modified irr (mirr), and irr for different payment periods (xirr). You will also learn how to. Excel has three functions to calculate the irr: Internal rate of return (irr) is a popular tool used to assess potential profitability.

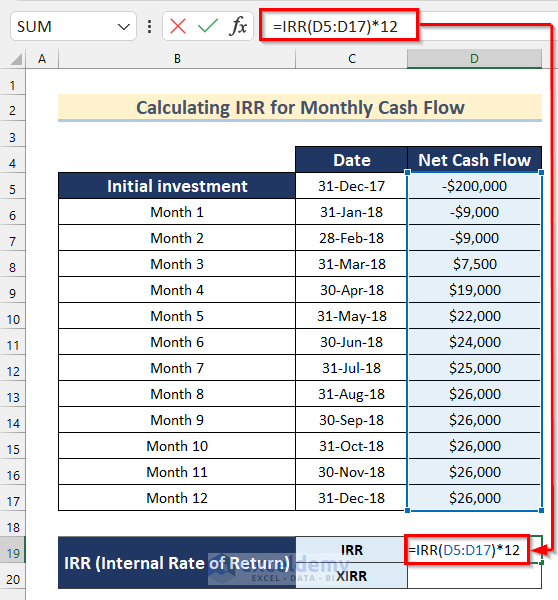

How to Calculate IRR (Internal Rate of Return) in Excel (8 Ways)

Excel has three functions to calculate the irr: Internal rate of return (irr) is a popular tool used to assess potential profitability. It calculates the discount rate that makes all future cash flows. Irr, the modified irr (mirr), and irr for different payment periods (xirr). The tutorial shows how to calculate irr of a project in excel with formulas and.

How to Calculate IRR in Excel 4 Best Methods Technipages

The tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature. Internal rate of return (irr) is a popular tool used to assess potential profitability. You will also learn how to. Irr, the modified irr (mirr), and irr for different payment periods (xirr). It calculates the discount rate that makes all future.

How to Calculate IRR in Excel 4 Best Methods Technipages

Internal rate of return (irr) is a popular tool used to assess potential profitability. The tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature. Irr, the modified irr (mirr), and irr for different payment periods (xirr). It calculates the discount rate that makes all future cash flows. You will also learn.

How to Calculate IRR (Internal Rate of Return) in Excel (8 Ways)

You will also learn how to. Irr, the modified irr (mirr), and irr for different payment periods (xirr). Excel has three functions to calculate the irr: It calculates the discount rate that makes all future cash flows. The tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature.

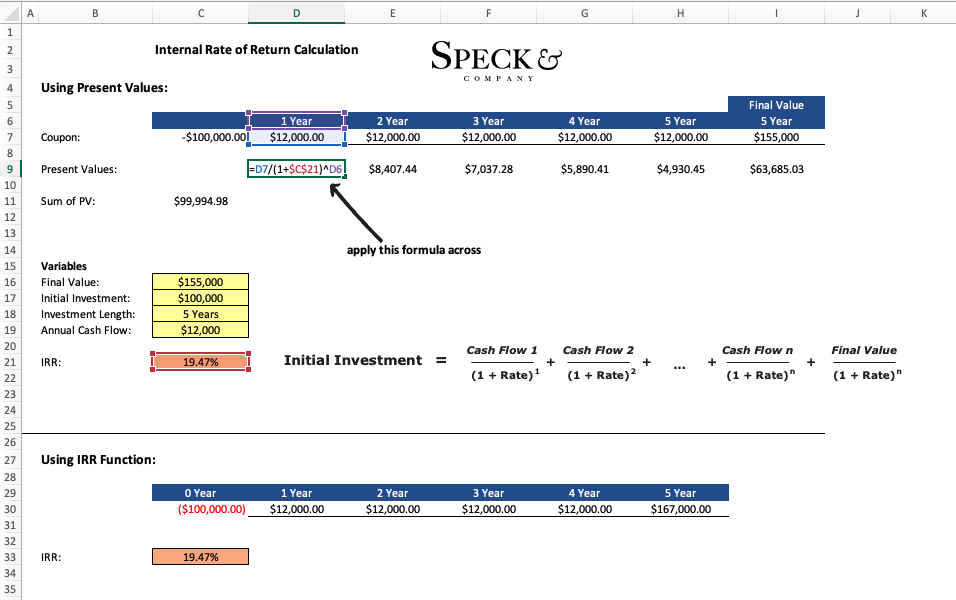

IRR Calculator Excel Template A Comprehensive Guide To Financial

The tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature. You will also learn how to. Irr, the modified irr (mirr), and irr for different payment periods (xirr). It calculates the discount rate that makes all future cash flows. Internal rate of return (irr) is a popular tool used to assess.

Excel Irr Template

Excel has three functions to calculate the irr: It calculates the discount rate that makes all future cash flows. The tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature. You will also learn how to. Irr, the modified irr (mirr), and irr for different payment periods (xirr).

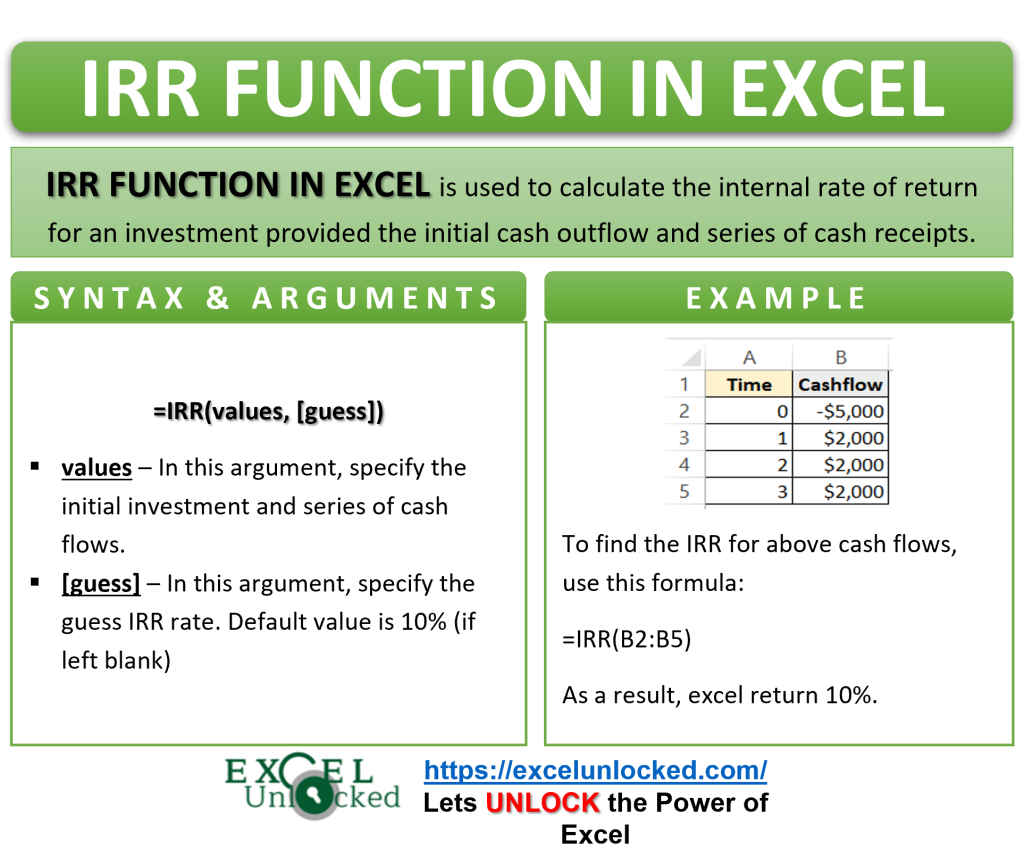

Excel IRR Function Calculating Internal Rate of Return Excel Unlocked

You will also learn how to. Irr, the modified irr (mirr), and irr for different payment periods (xirr). Excel has three functions to calculate the irr: The tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature. It calculates the discount rate that makes all future cash flows.

The Tutorial Shows How To Calculate Irr Of A Project In Excel With Formulas And The Goal Seek Feature.

Excel has three functions to calculate the irr: You will also learn how to. Internal rate of return (irr) is a popular tool used to assess potential profitability. Irr, the modified irr (mirr), and irr for different payment periods (xirr).