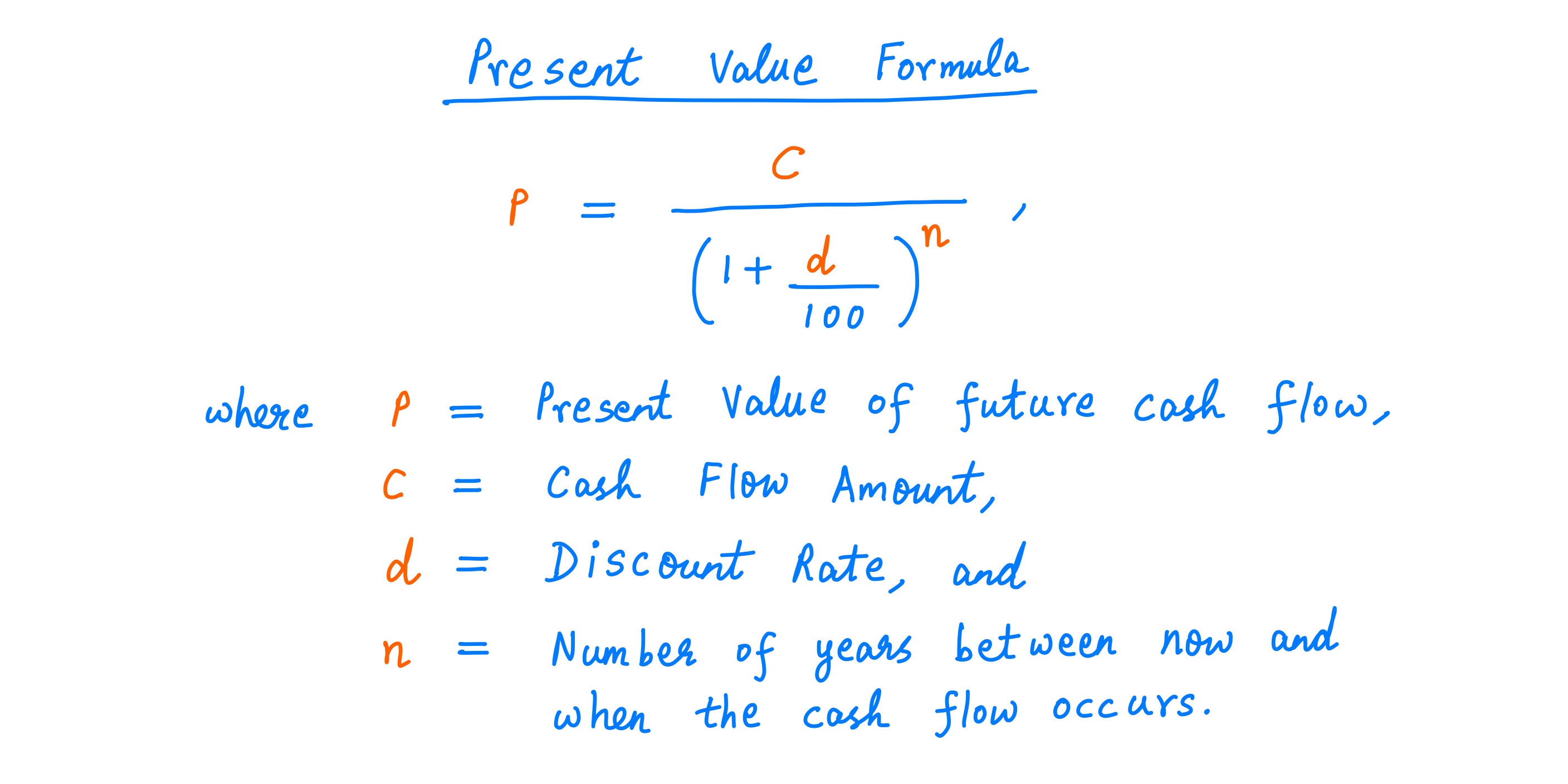

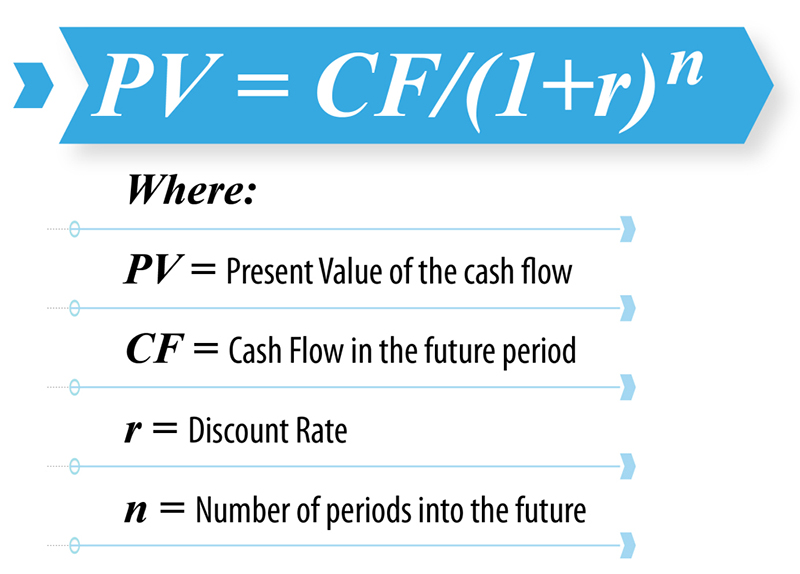

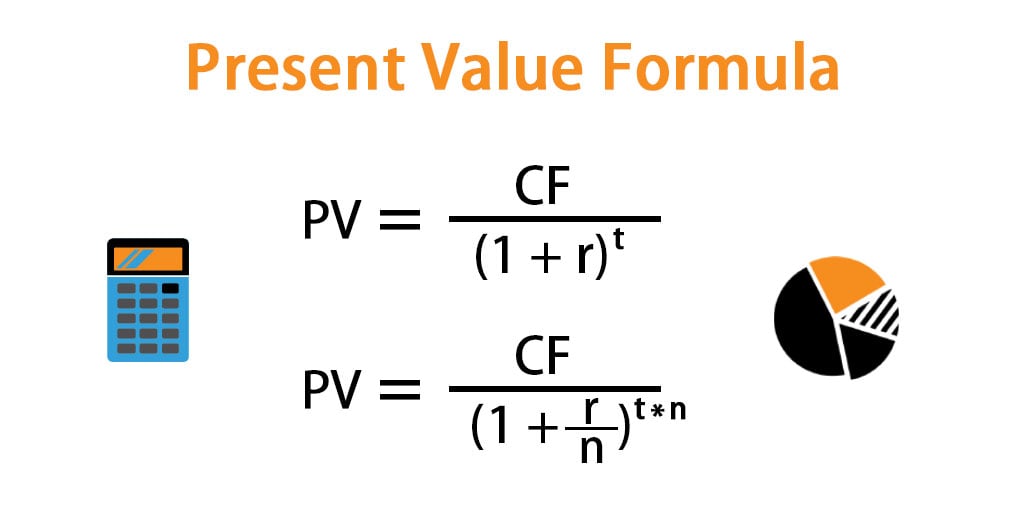

Calculating Present Value Of Future Cash Flow - Using the present value formula, the pv of this future cash flow can be calculated as: The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost. We apply a discount rate (usually the cost of capital or the. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Present value involves discounting future cash flows. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate.

The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost. Present value involves discounting future cash flows. We apply a discount rate (usually the cost of capital or the. Using the present value formula, the pv of this future cash flow can be calculated as: Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate.

Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as: Present value involves discounting future cash flows. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. We apply a discount rate (usually the cost of capital or the. The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost.

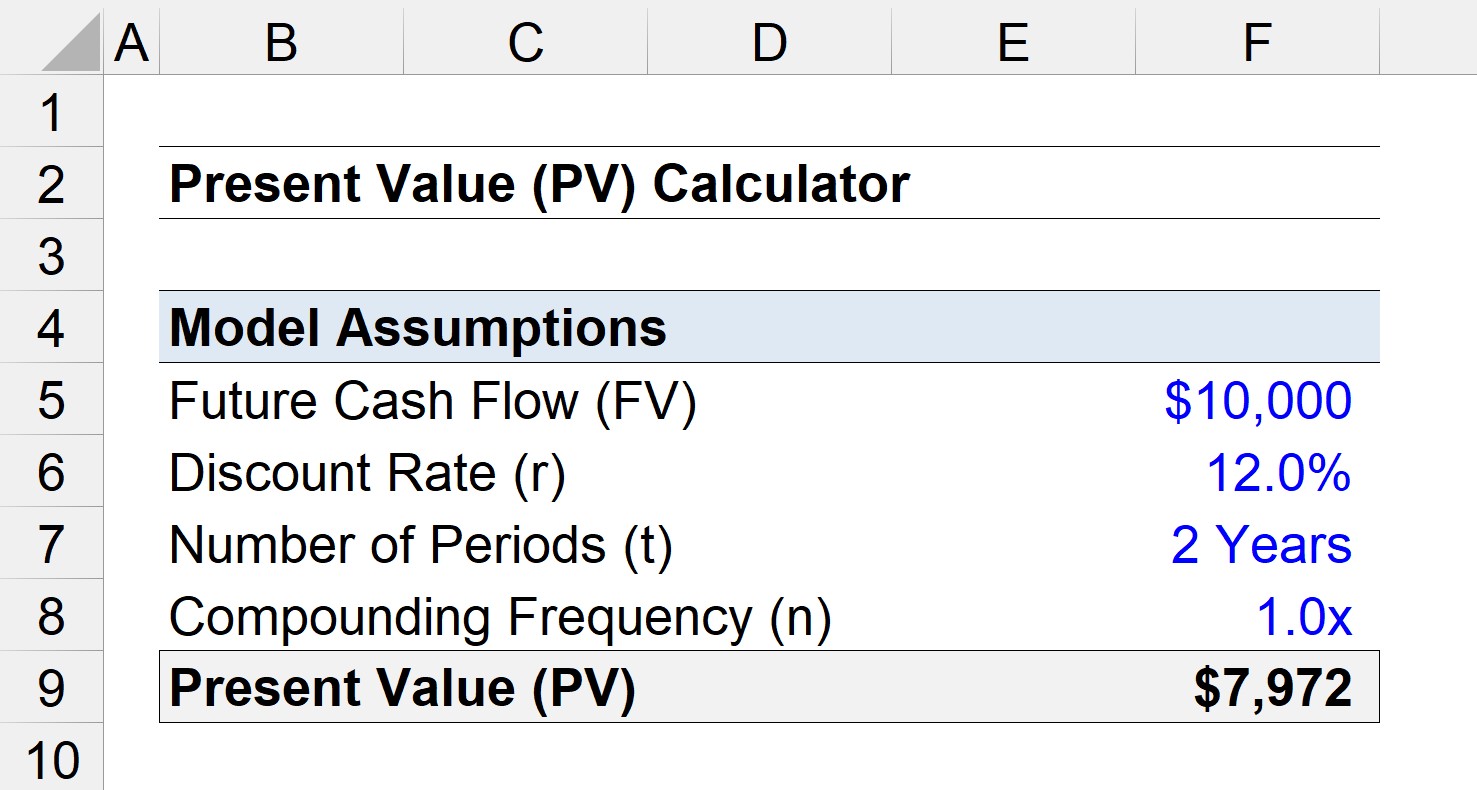

How to Use NPV in Excel to Calculate the Present Value of Future Cash

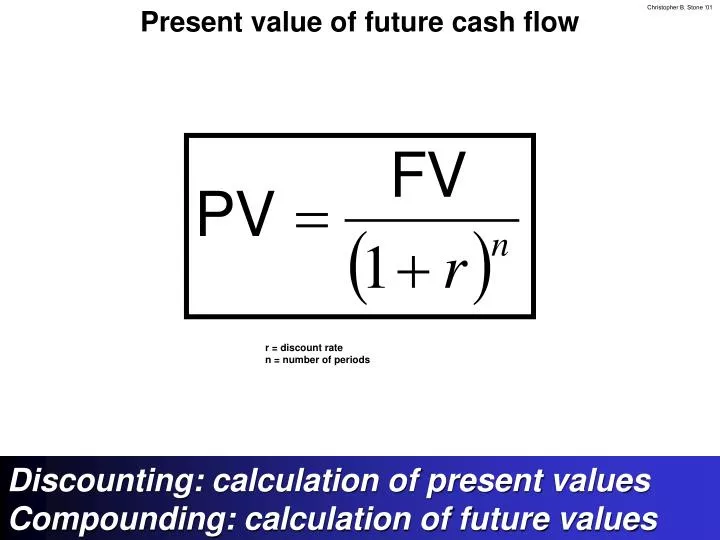

We apply a discount rate (usually the cost of capital or the. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost. Pv =.

Pv of future cash flows calculator SophieRylie

The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Present value involves discounting future cash flows. Using the present value formula, the pv.

How to Calculate Present Value of Future Cash Flows in Excel

The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. We apply a discount rate (usually the cost of capital or the. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated.

Pv of future cash flows calculator SophieRylie

We apply a discount rate (usually the cost of capital or the. Using the present value formula, the pv of this future cash flow can be calculated as: The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Present.

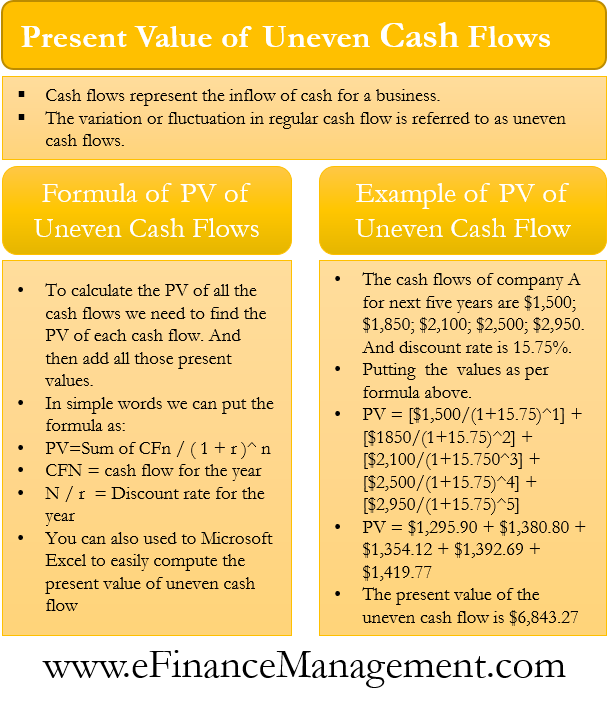

How to Calculate Future Value of Uneven Cash Flows in Excel

Using the present value formula, the pv of this future cash flow can be calculated as: The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the.

Present Value Formula

We apply a discount rate (usually the cost of capital or the. Present value involves discounting future cash flows. Using the present value formula, the pv of this future cash flow can be calculated as: The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost. Pv = $10,000.

How to Calculate Present Value of Future Cash Flows in Excel

The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost. We apply a discount rate (usually the cost of capital or the. Present value involves discounting future cash flows. The formula used to calculate the present value (pv) divides the future value of a future cash flow by.

PPT Present value of future cash flow PowerPoint Presentation, free

Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. We apply a discount rate (usually the cost of capital or the. Present value involves discounting future cash flows. The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost. The formula used to calculate the present value (pv) divides.

Discounted Cash Flow Analysis Formula, Use, Types & Benefits IBCA

The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost. Using the present value formula, the pv of this future cash flow can be calculated as: We apply a discount rate (usually the cost of capital or the. The formula used to calculate the present value (pv) divides.

Continuous Money Flow Total and Present Value Wilson Whamess

Using the present value formula, the pv of this future cash flow can be calculated as: Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. We apply a discount rate (usually the cost of capital or the. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount.

Using The Present Value Formula, The Pv Of This Future Cash Flow Can Be Calculated As:

Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Present value involves discounting future cash flows. The calculation for npv is the sum of the present values of all expected future cash flows minus the initial investment cost.