Deductions From Pay Slip - Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.

Understanding Your Pay Stub Canada Part 2 Deductions YouTube

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

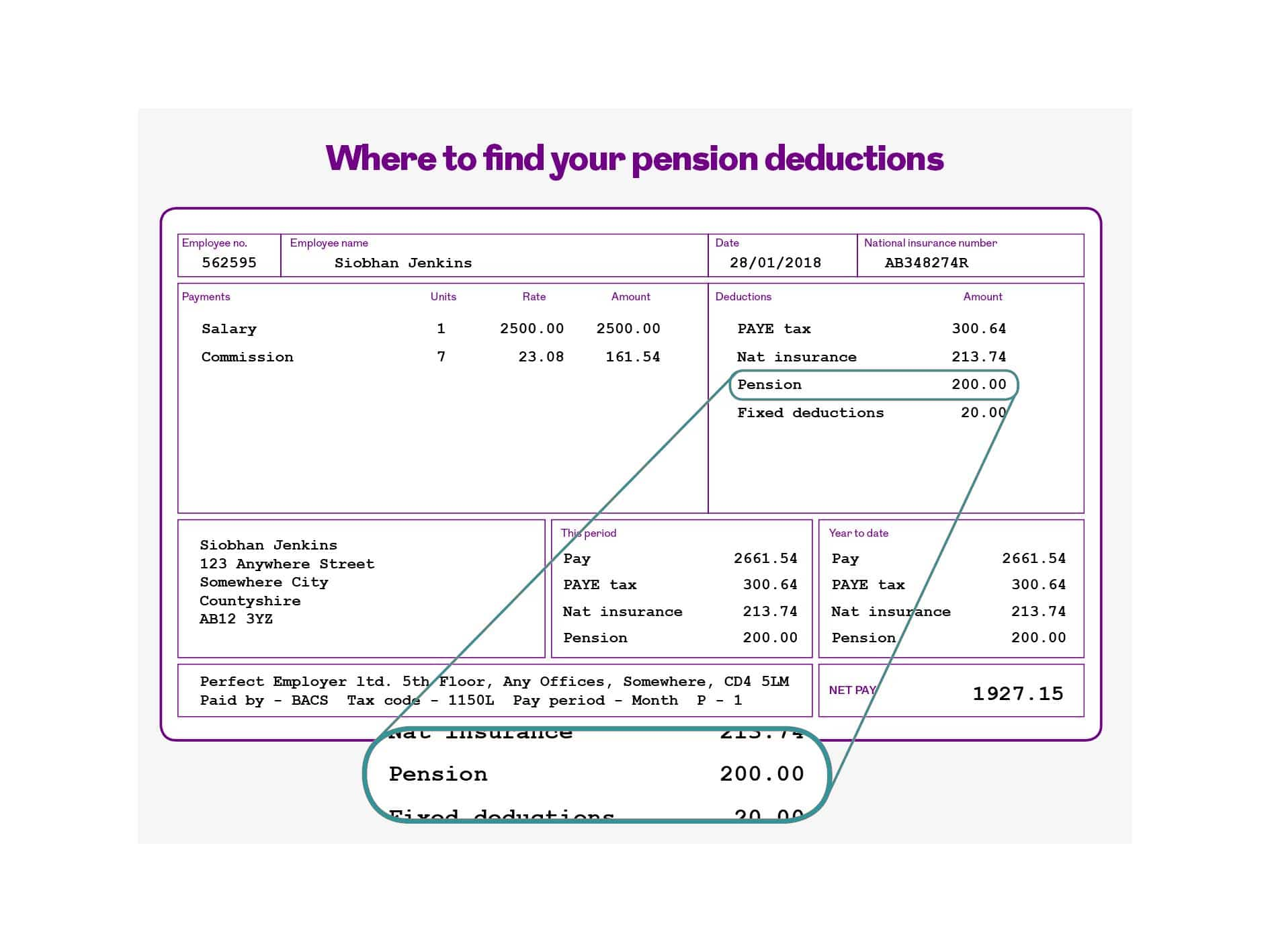

Payslip Deductions Explained Payslipsplus

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

How to read your payslip workplace pension payments Royal London

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

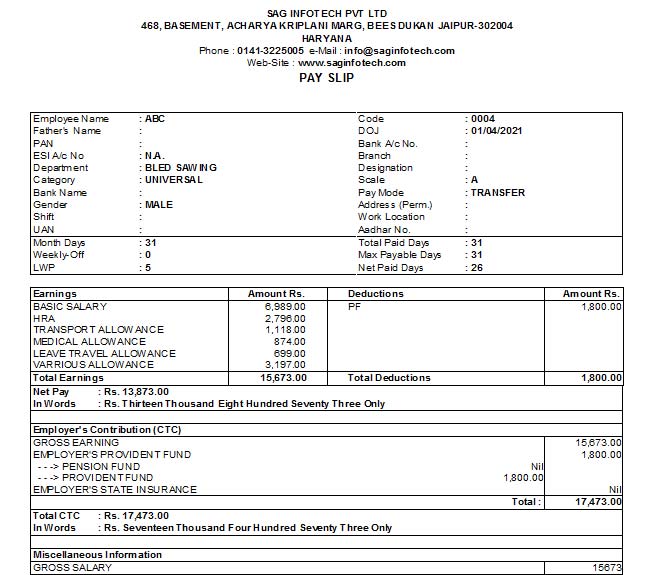

All about Format of Salary SlipOne Should Know BestInvestIndia

Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.

Payslip Explained Planday Images

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

Employees Pay Slip Jan 2024 10114831 PDF Taxes Tax Deduction

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

All About Salary Slip with Format and Its Important Parts

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

Simple salary slip format pdf msaeb

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

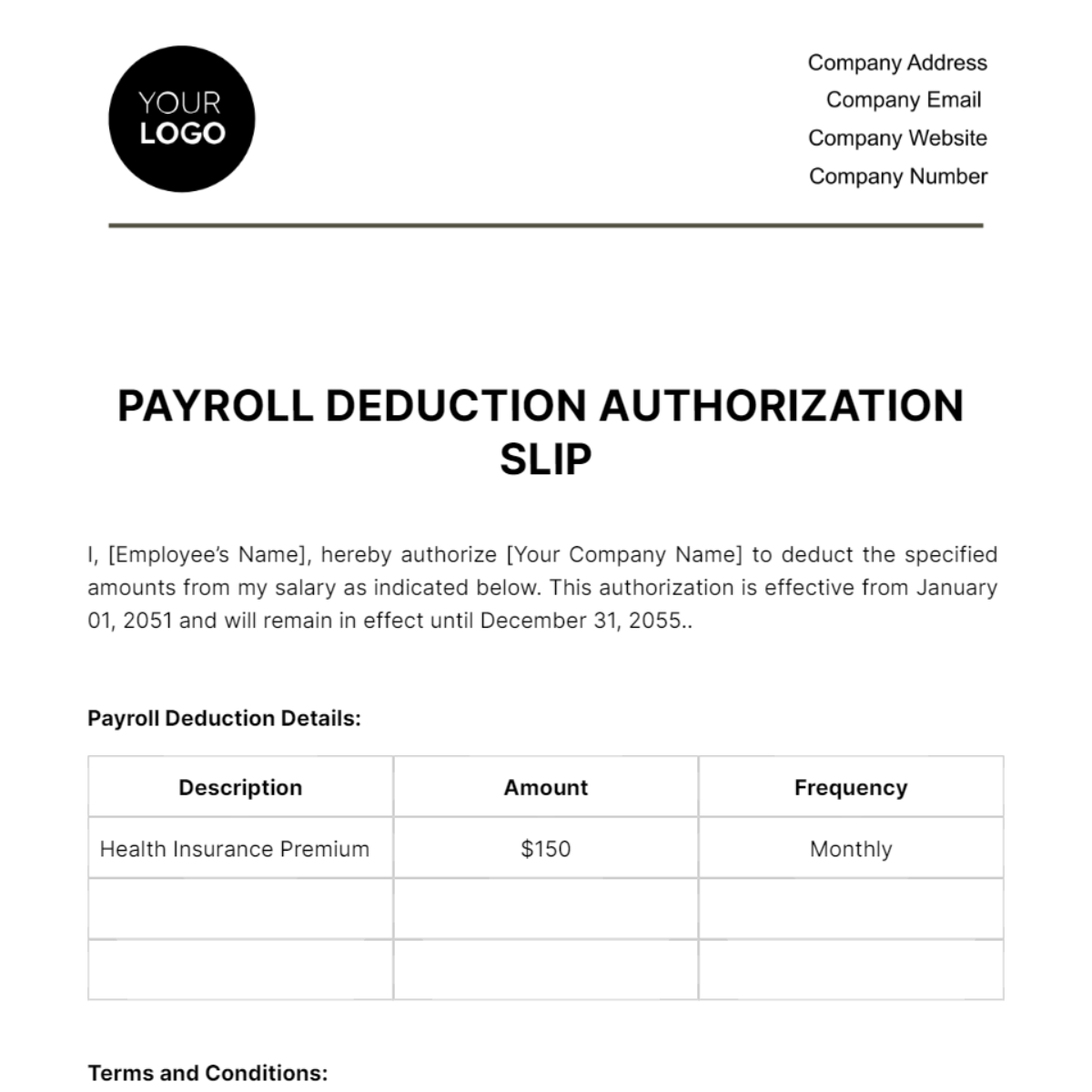

Free Payroll Deduction Authorization Slip HR Template to Edit Online

Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.

Salary Slip Meaning, Format and Components

Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.

Payroll Deductions Are Wages Withheld From An Employee’s Total Earnings For The Purpose Of Paying Taxes, Garnishments And Benefits, Like.

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.