Discounted Cash Flow Excel - The dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic. Learn how to use the dcf formula to calculate the fair value of an investment by discounting future cash flows. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear.

Learn how to use the dcf formula to calculate the fair value of an investment by discounting future cash flows. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting.

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to use the dcf formula to calculate the fair value of an investment by discounting future cash flows. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic.

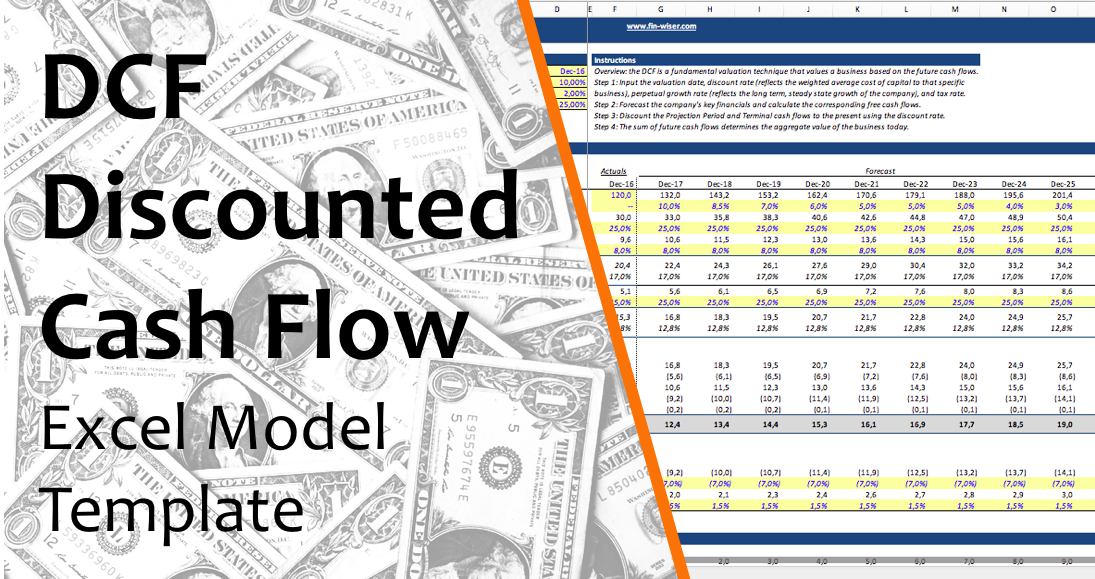

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. The dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. Learn how.

Discounted cash flow calculator online SachaSorcha

Learn how to use the dcf formula to calculate the fair value of an investment by discounting future cash flows. The dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple,.

Discounted Cash Flow Template Free Excel Download

Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how.

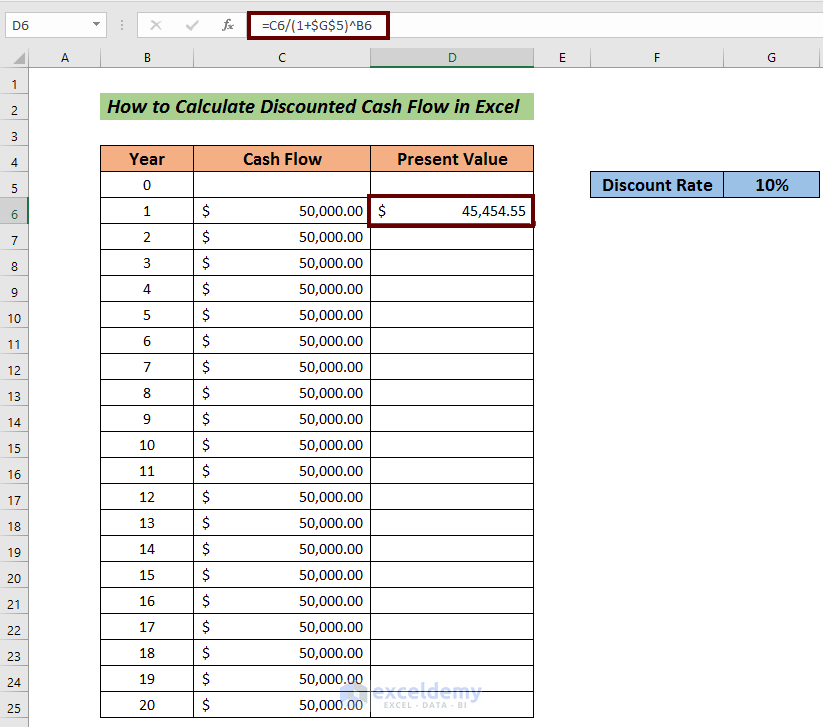

Navigate Your Success How to Calculate a DCF in Excel

Learn how to use the dcf formula to calculate the fair value of an investment by discounting future cash flows. The dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to.

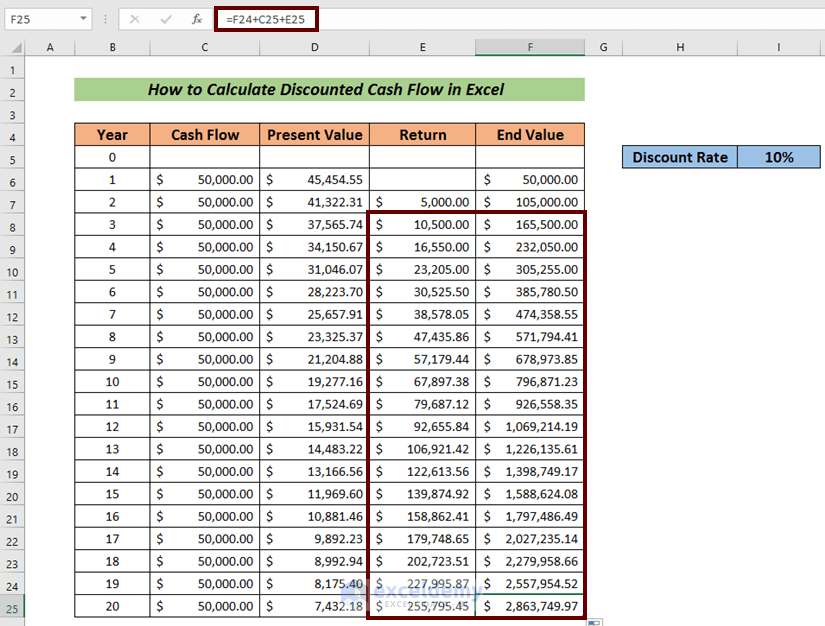

How to Apply Discounted Cash Flow Formula in Excel ExcelDemy

Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to use the dcf formula to calculate the fair value of an investment by discounting future cash flows. The dcf.

How to Calculate the Discounted Cash Flow in Excel 3 Easy Steps

Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how.

DCF Model Excel Free Template Macabacus

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to use the dcf formula to calculate the fair value of an investment by discounting future cash flows. The dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic. Learn how to.

Discounted Cash Flow Excel Template

Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. The dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic. Learn how.

How to Apply Discounted Cash Flow Formula in Excel ExcelDemy

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to use the dcf formula to calculate the fair value of an investment by discounting future cash flows. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The dcf.

Discounted Cash Flow Model in Excel Solving Finance

Learn how to use the dcf formula to calculate the fair value of an investment by discounting future cash flows. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. The dcf.

The Dcf Template Is An Excel Spreadsheet That Allows You To Input Data And Perform Calculations To Determine The Intrinsic.

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to use the dcf formula to calculate the fair value of an investment by discounting future cash flows. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear.