E-Invoice Implementation In Malaysia - This guide explains the phased implementation timeline, starting august 2024. Lhdn just released new guidelines again! Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

Lhdn just released new guidelines again! Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024.

This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. Lhdn just released new guidelines again!

eInvoice Malaysia Latest Implementation Updates 2025 YYC taxPOD

This guide explains the phased implementation timeline, starting august 2024. Lhdn just released new guidelines again! Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

Malaysia E Invoicing 2024 Magda Roselle

This guide explains the phased implementation timeline, starting august 2024. Lhdn just released new guidelines again! Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

Understanding Malaysia's EInvoicing Landscape A Comprehensive Guide

Lhdn just released new guidelines again! This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

Adapting to EInvoicing A New Era for Malaysian Businesses SiteGiant

This guide explains the phased implementation timeline, starting august 2024. Lhdn just released new guidelines again! Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

EInvoicing in Malaysia Transformation’s Next Frontier

This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. Lhdn just released new guidelines again!

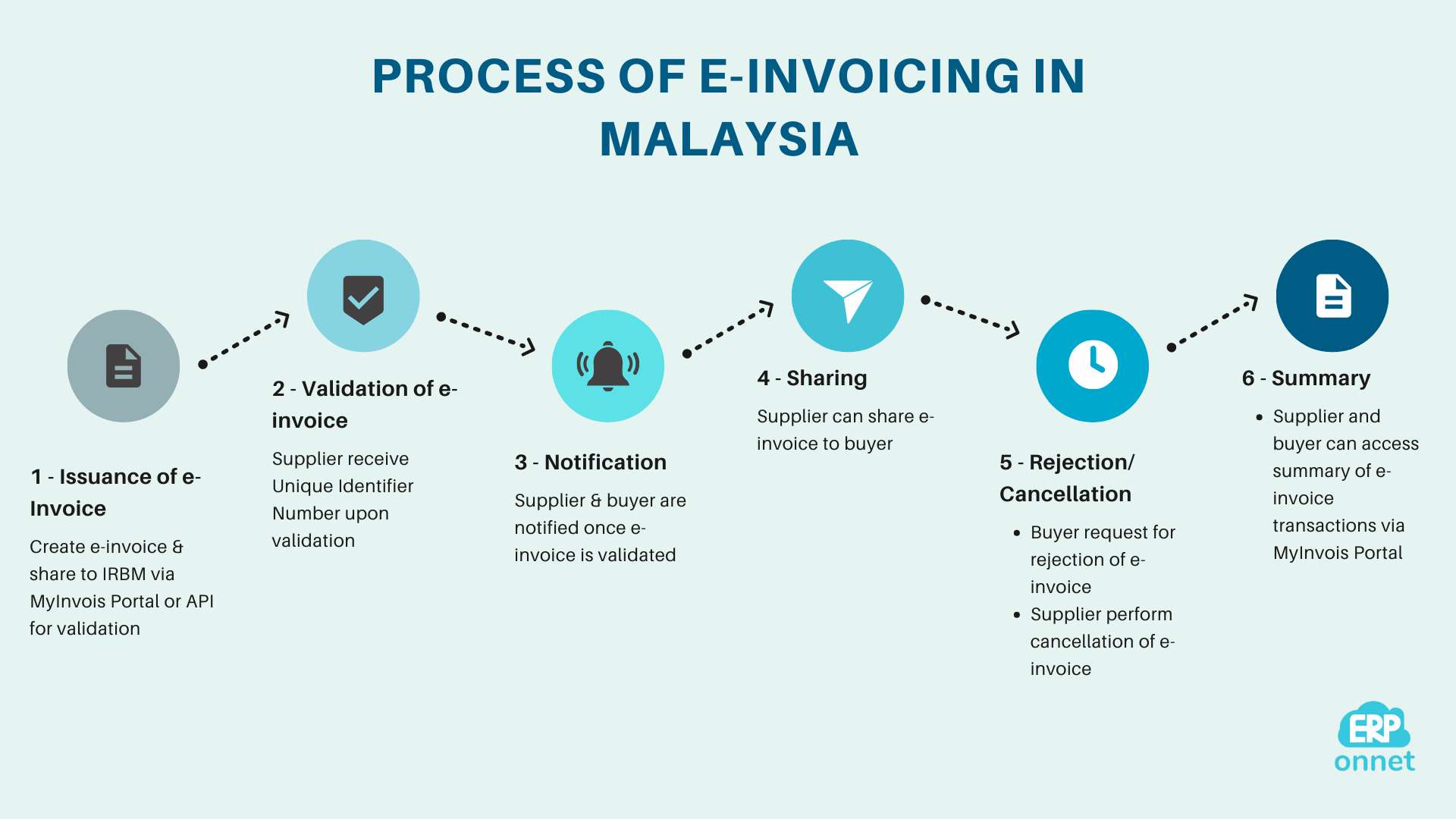

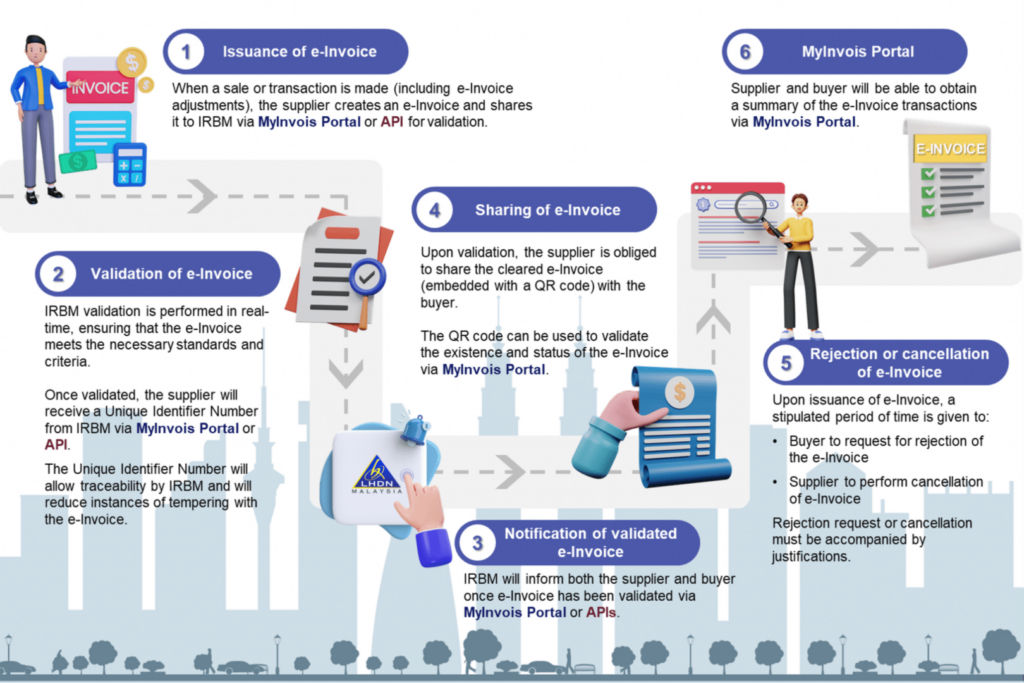

Introduction & Implementation of EInvoicing in Malaysia

Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024. Lhdn just released new guidelines again!

LHDN Announces SixMonth Grace Period for EInvoicing Implementation

This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. Lhdn just released new guidelines again!

2024 LHDN EInvoicing Malaysia How it impact your business

Lhdn just released new guidelines again! Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024.

eInvois HASiL Info Lembaga Hasil Dalam Negeri Malaysia

Lhdn just released new guidelines again! Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024.

The Implementation of EInvoicing in Malaysia A Digital Leap Forward

Lhdn just released new guidelines again! This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

This Guide Explains The Phased Implementation Timeline, Starting August 2024.

Lhdn just released new guidelines again! Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.