Free Cash Flow Calculation From Ebitda - Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

The ultimate cash flow guide ebitda cf fcf fcfe fcff Artofit

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

Free Cash Flow (FCF) Formula, Analysis, Examples Capital City

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

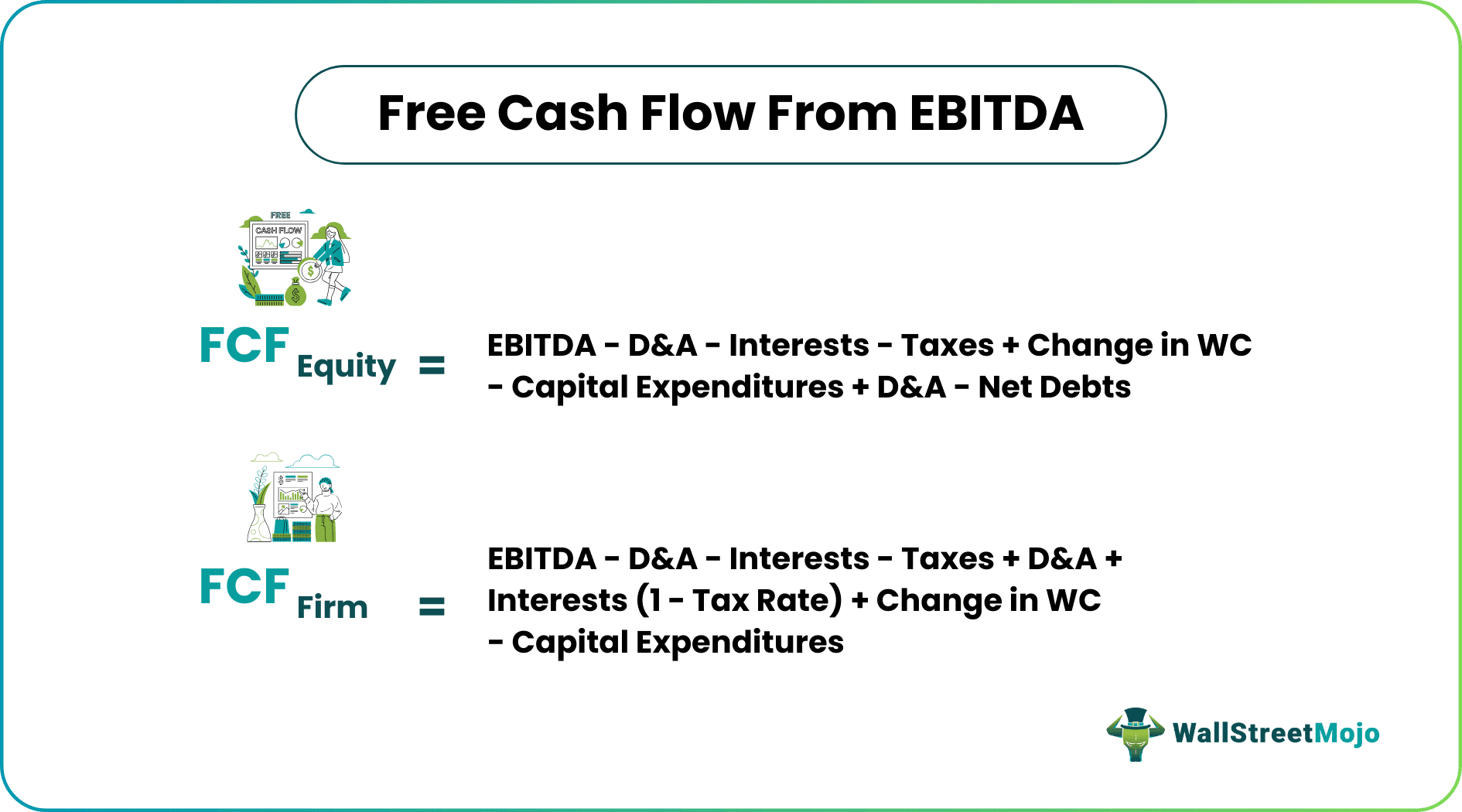

Free Cash Flow from EBITDA How to Calculate?

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

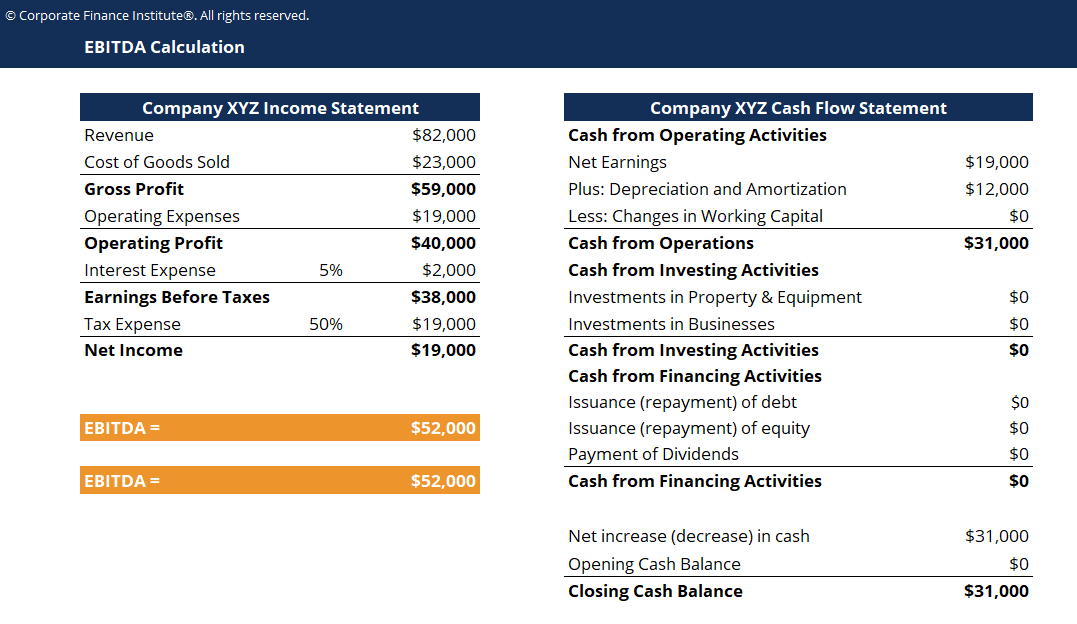

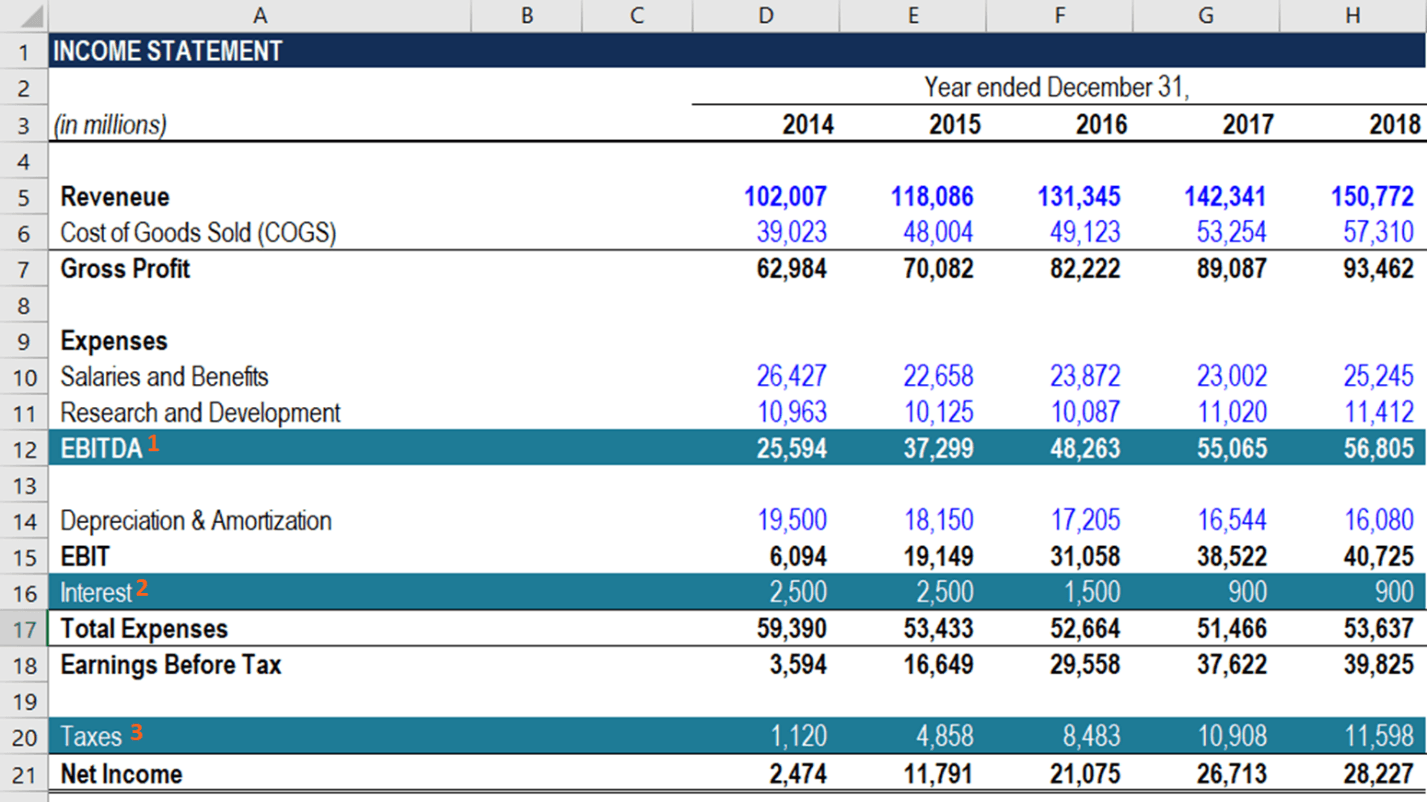

EBITDA Template Download Free Excel Template

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

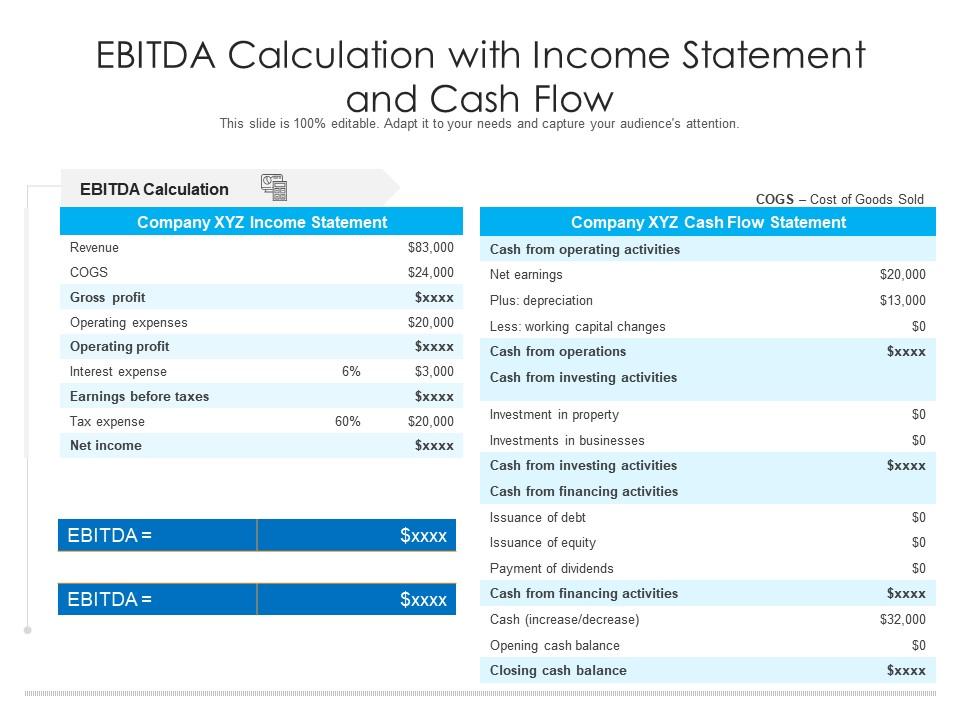

EBITDA Calculation With Statement And Cash Flow Presentation

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

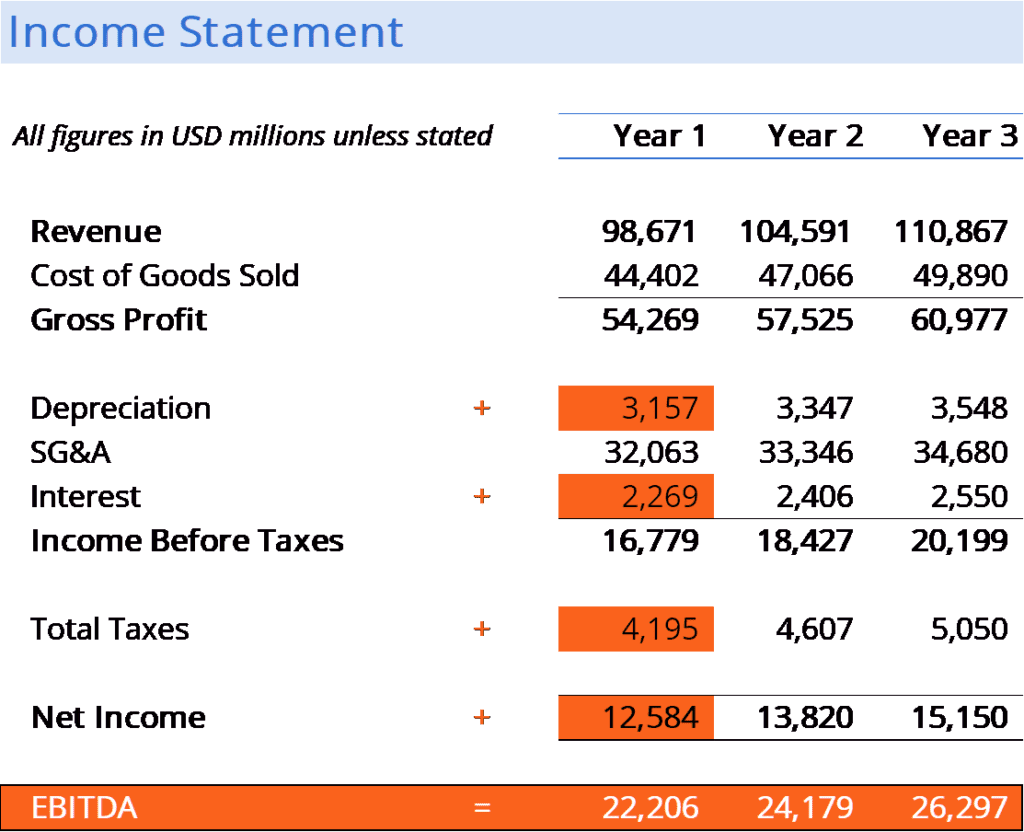

What is EBITDA Formula, Definition and Explanation

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

Cash Conversion Ebitda at Abbey Takasuka blog

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf

Two key metrics often used in this evaluation are ebitda (earnings before interest, taxes, depreciation, and amortization) and free.