Free Cash Flow To Equity Calculation - Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. Free cash flow to equity (fcfe) is the amount of cash a business generates that is available to be potentially distributed to shareholders. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. This article will show you how to calculate and interpret free cash flow to equity (fcfe), also known as levered free cash flow.

This article will show you how to calculate and interpret free cash flow to equity (fcfe), also known as levered free cash flow. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow to equity (fcfe) is the amount of cash a business generates that is available to be potentially distributed to shareholders. Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair.

Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. This article will show you how to calculate and interpret free cash flow to equity (fcfe), also known as levered free cash flow. Free cash flow to equity (fcfe) is the amount of cash a business generates that is available to be potentially distributed to shareholders.

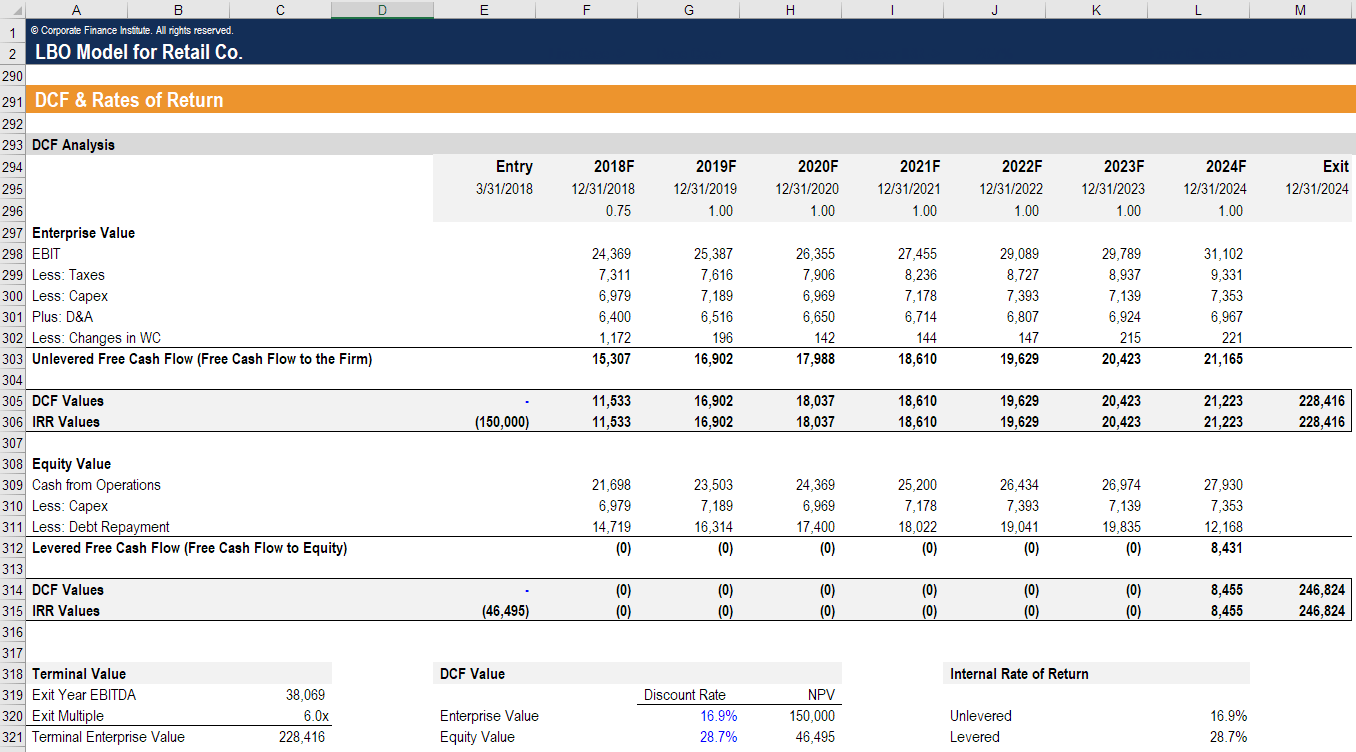

Free Cash Flow to Equity (FCFE) Formula and Example

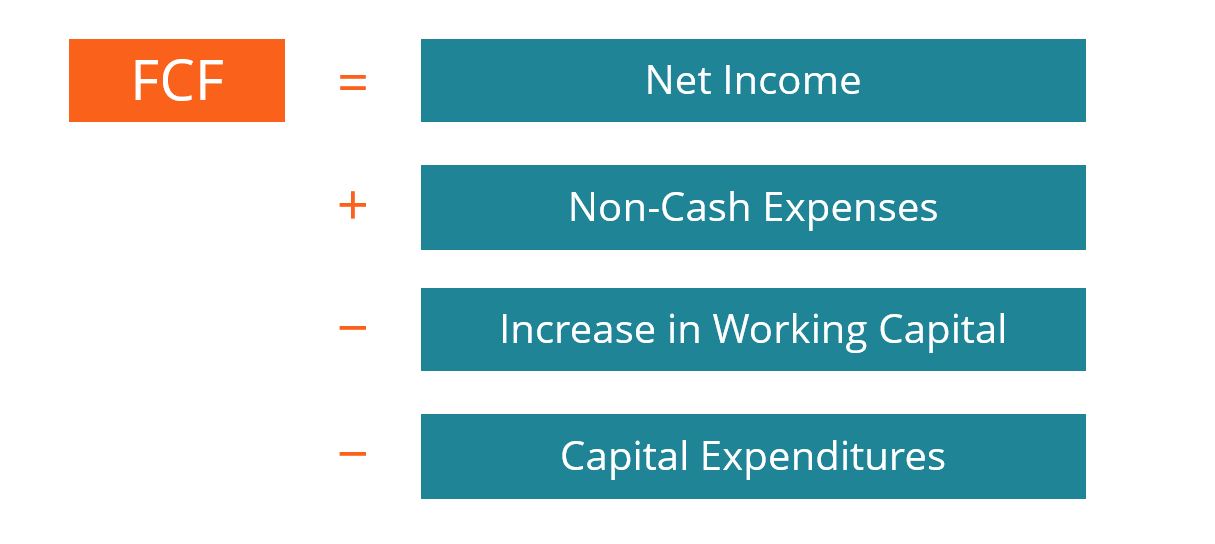

Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. Free cash flow to equity (fcfe) is the amount of cash a business generates that is available to be potentially distributed to shareholders. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital.

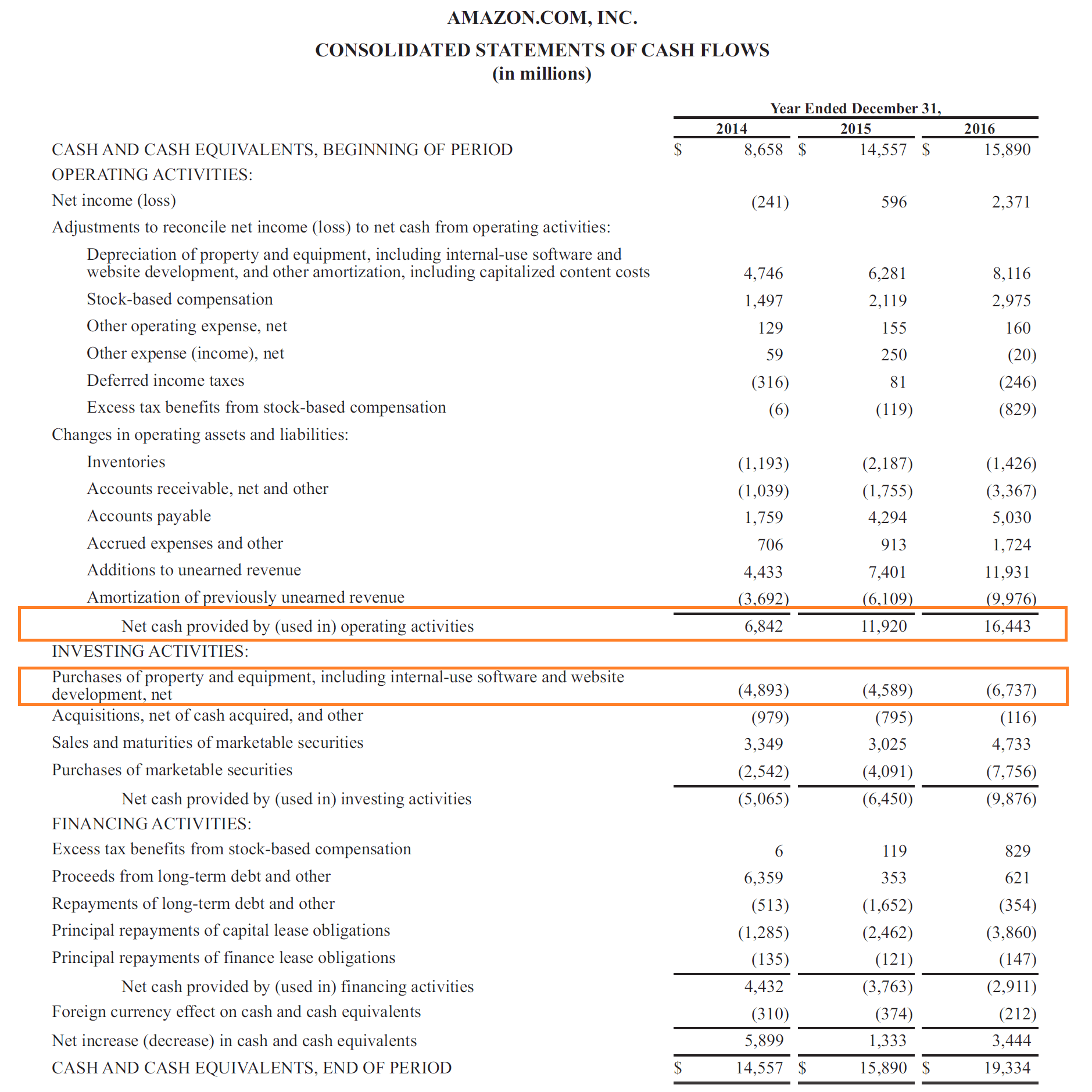

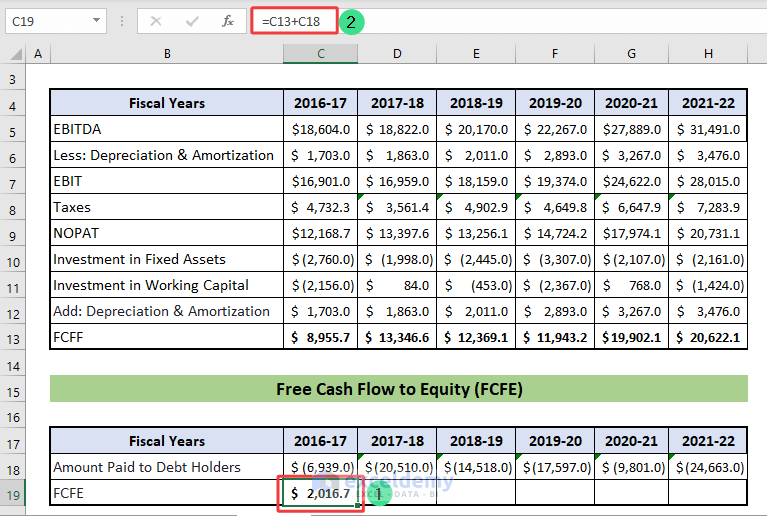

How to Calculate Free Cash Flow in Excel (to Firm and Equity)

Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. Free cash flow to equity (fcfe) is the amount of cash a business generates that is available to be potentially distributed to shareholders. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital.

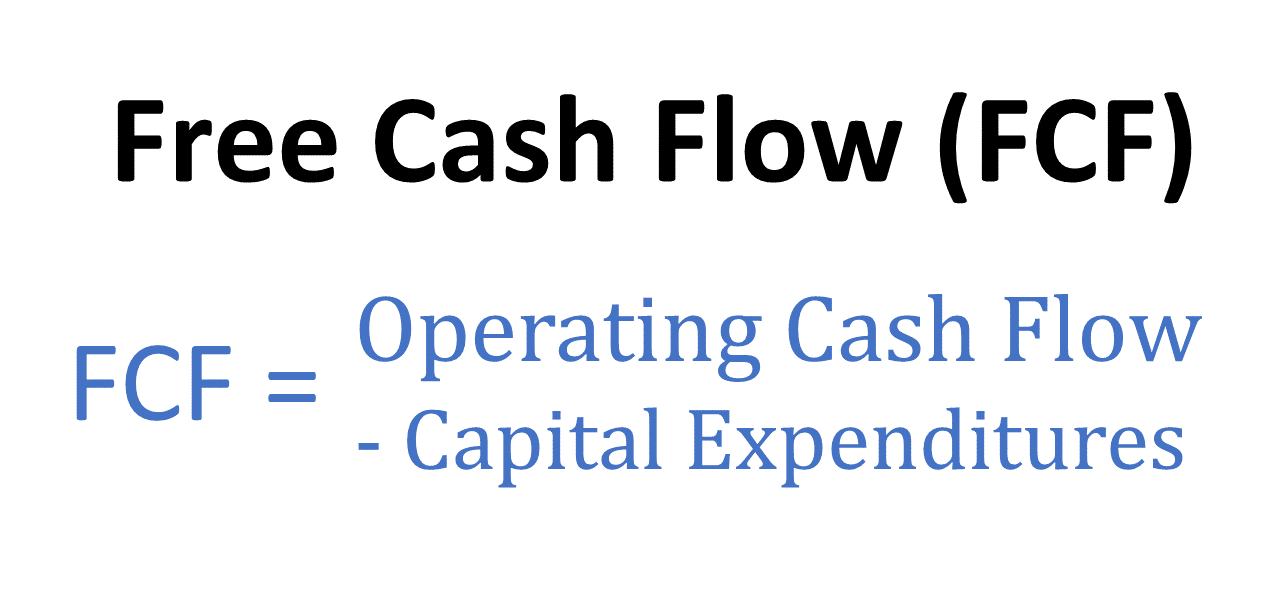

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. Free cash flow to equity (fcfe) is the amount of cash a business generates that is available to be potentially distributed to shareholders. The formula for free cash flow to equity is net income minus capital expenditures.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Free cash flow to equity (fcfe) is the amount of cash a business generates that is available to be potentially distributed to shareholders. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to.

Free Cash Flow To Equity What Is It, Formula, How To Calculate?

Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. Free cash flow to equity (fcfe) is the amount of cash a business generates that is available to be potentially distributed to shareholders. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital.

[Solved] Calculate the Free Cash Flow to Equity (FCFE) for year 2000

This article will show you how to calculate and interpret free cash flow to equity (fcfe), also known as levered free cash flow. Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. The formula for free cash flow to equity is net income minus capital expenditures.

Free Cash Flow (FCF) Formula

The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. This article will show you how to calculate and interpret free cash flow to equity (fcfe), also known as levered free cash flow. Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches.

Free Cash Flow to Equity (FCFE) Learn How to Calculate FCFE

Free cash flow to equity (fcfe) is the amount of cash a business generates that is available to be potentially distributed to shareholders. Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. The formula for free cash flow to equity is net income minus capital expenditures.

Free Cash Flow to Equity (FCFE) Learn How to Calculate FCFE

Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow to equity (fcfe) is the amount of cash a business generates that is available to be potentially.

PPT Valuation PowerPoint Presentation, free download ID3072616

The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. This article will show you how to calculate and interpret free cash flow to equity (fcfe), also known as levered free cash flow. Free cash flow to equity (fcfe) is the amount of cash a business generates that.

Free Cash Flow To Equity (Fcfe) Is The Amount Of Cash A Business Generates That Is Available To Be Potentially Distributed To Shareholders.

Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. This article will show you how to calculate and interpret free cash flow to equity (fcfe), also known as levered free cash flow.

:max_bytes(150000):strip_icc()/FCFE_Final-d9ef0104bab14a9a8b622a6a9a60a3bb.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)