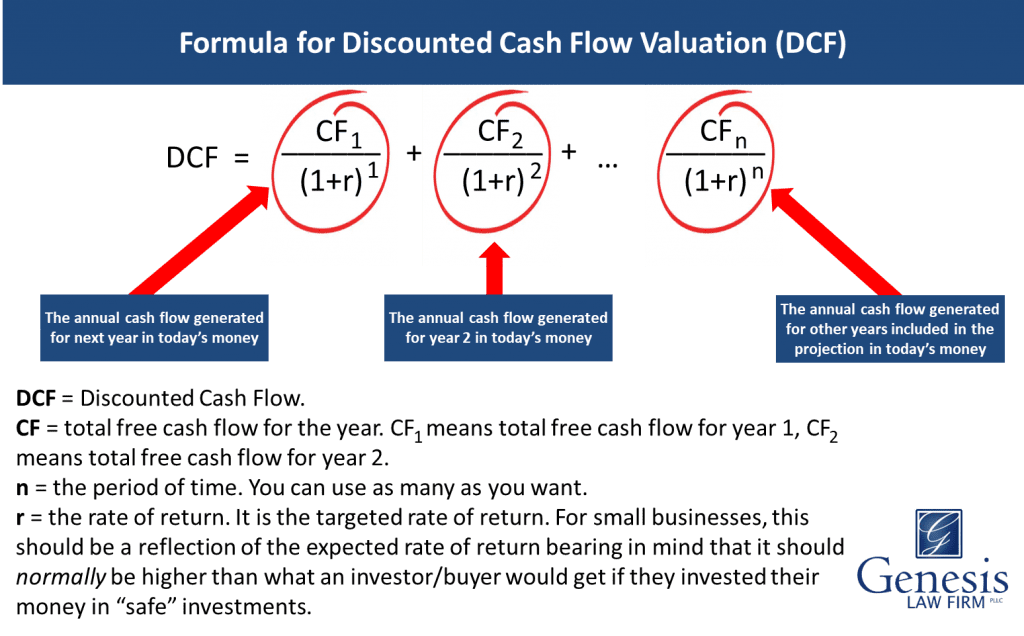

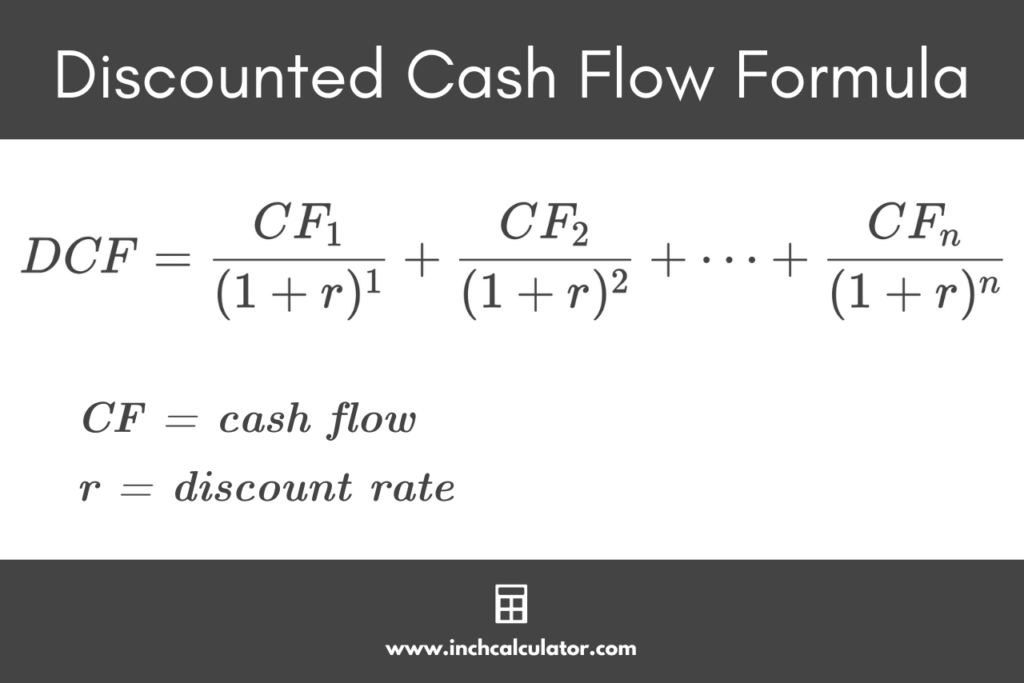

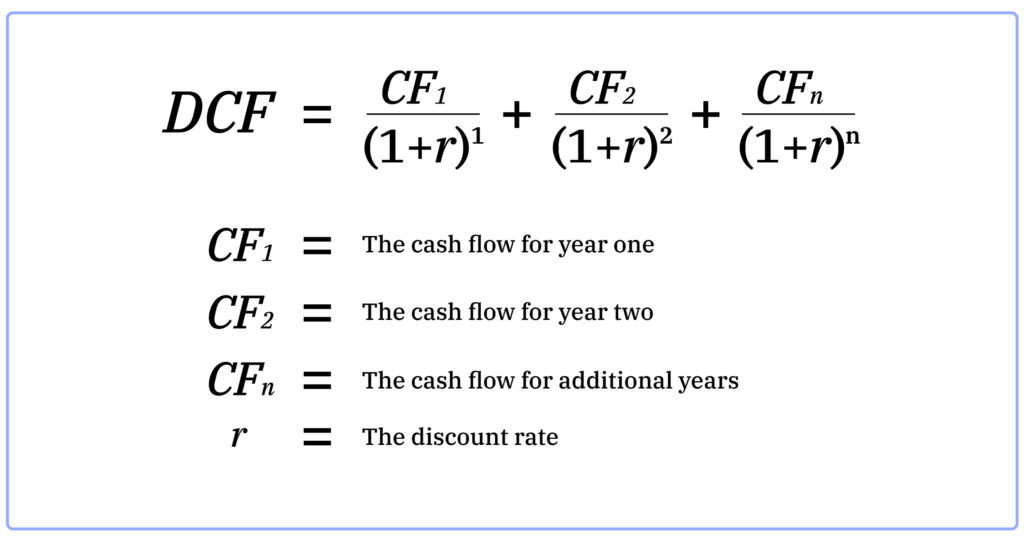

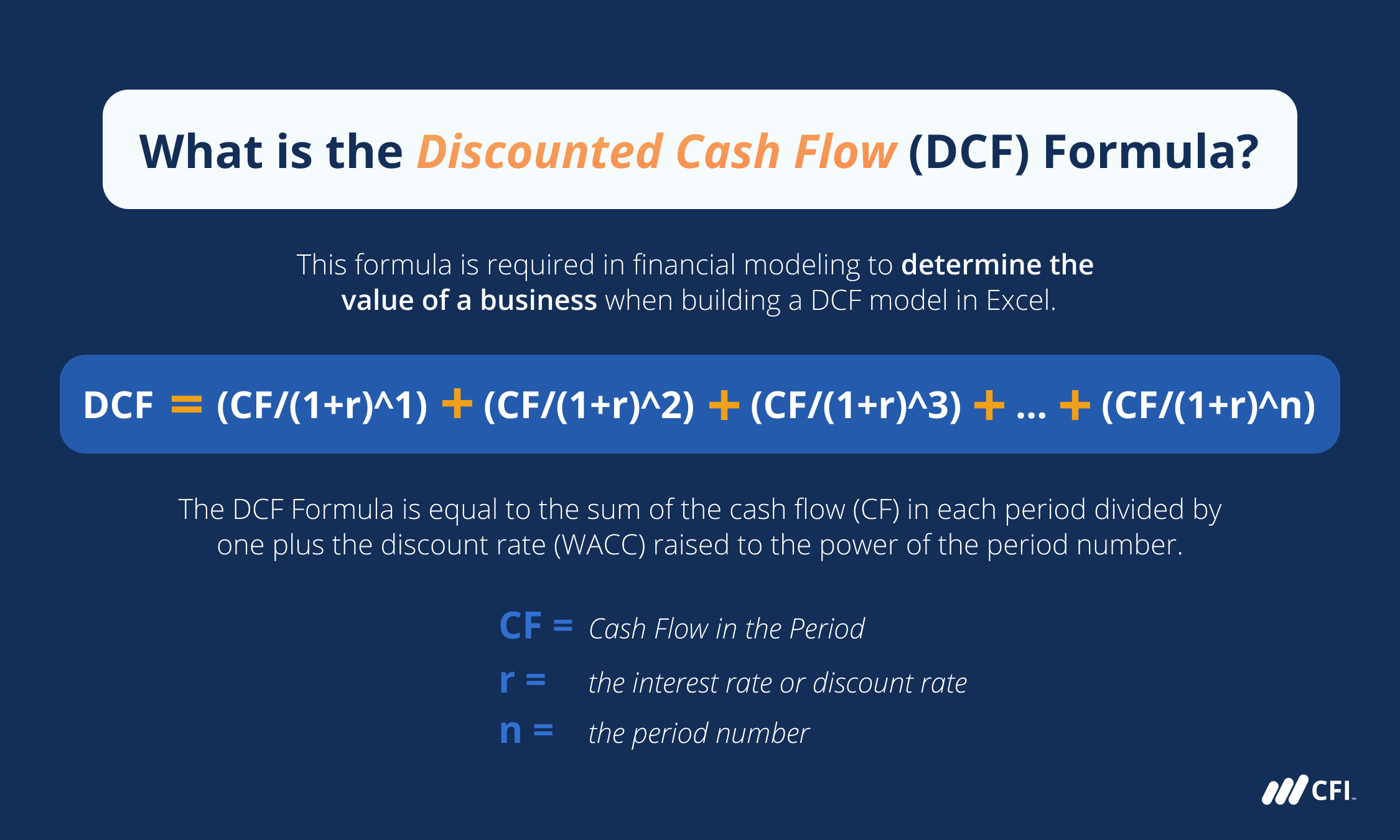

How Do You Calculate Discounted Cash Flow - What is dcf formula (discounted cash flow)? Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future cash flow. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows.

Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. What is dcf formula (discounted cash flow)? Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future cash flow.

Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future cash flow. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. What is dcf formula (discounted cash flow)?

Discounted Cash Flow QuickBooks Global

Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future cash flow. What is dcf formula (discounted cash flow)? Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment.

How to Apply Discounted Cash Flow Formula in Excel ExcelDemy

Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future cash flow. Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. What is dcf formula (discounted cash flow)? Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment.

Discounted Cash Flow Method Discounted Cash Flow PowerPoint Templates,

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. What is dcf formula (discounted cash flow)? Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future.

Discounted Cash Flow Calculator Inch Calculator

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future cash flow. What is dcf formula (discounted.

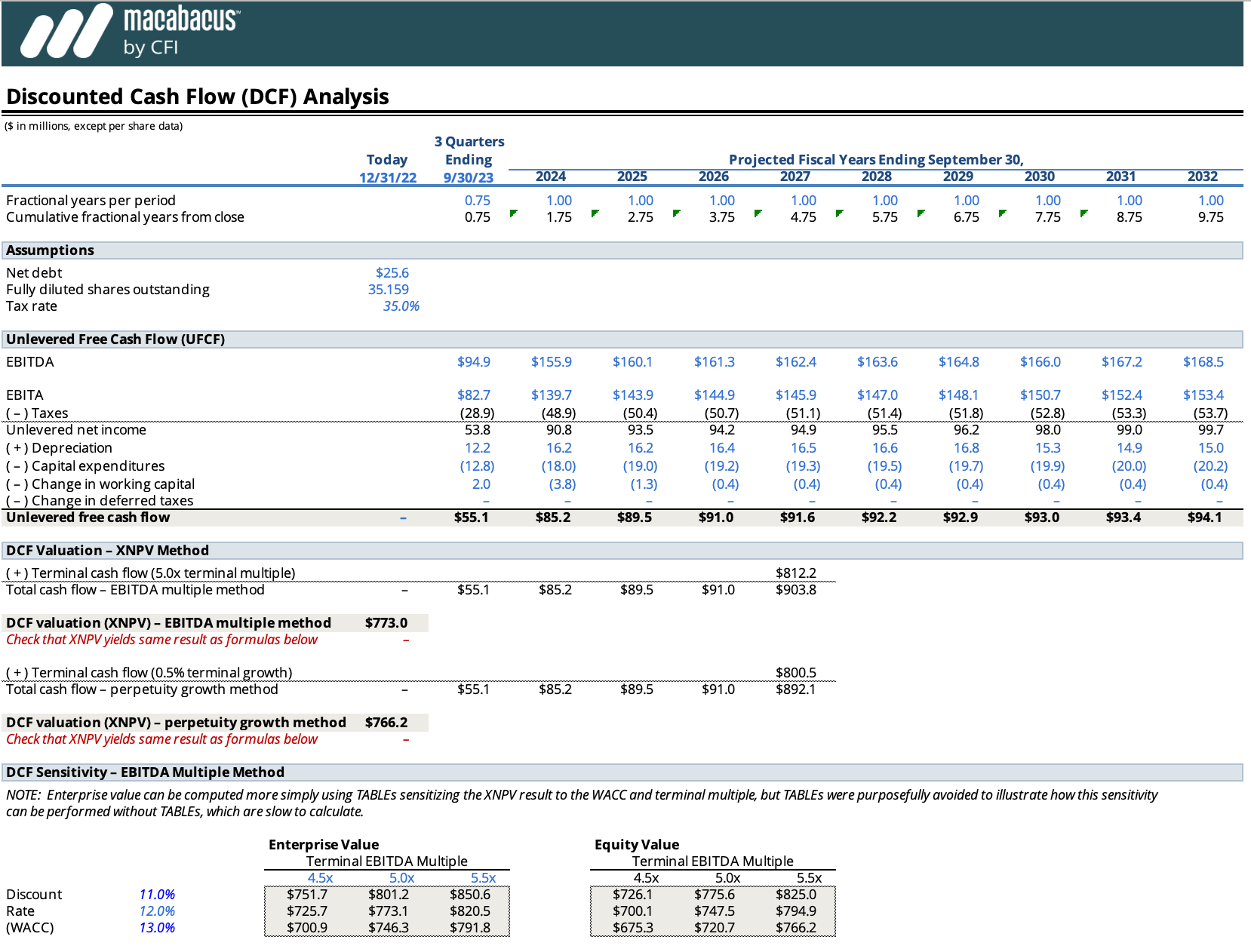

Discounted Cash Flow Model in Excel Solving Finance

What is dcf formula (discounted cash flow)? Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future cash flow. Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment.

Calculate Discount Cash Flow at Matilda Chomley blog

What is dcf formula (discounted cash flow)? Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future.

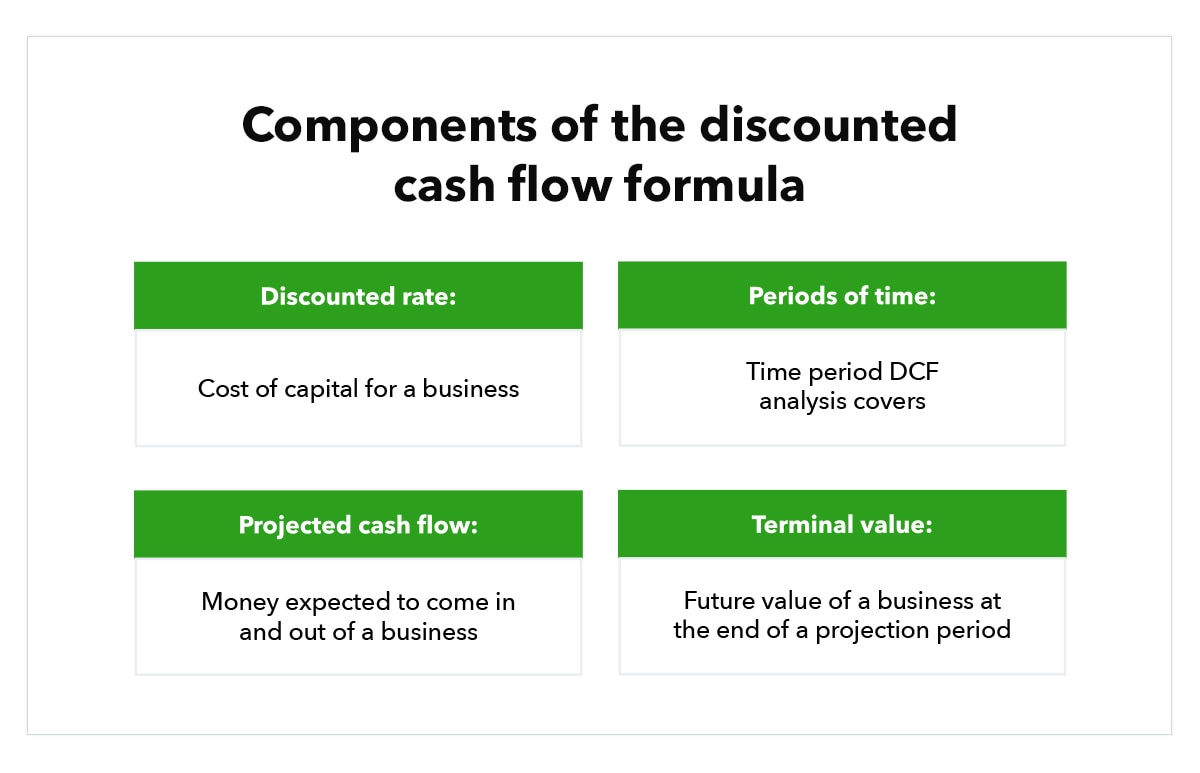

Discounted Cash Flow DCF Formula

Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future cash flow. What is dcf formula (discounted cash flow)? Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment.

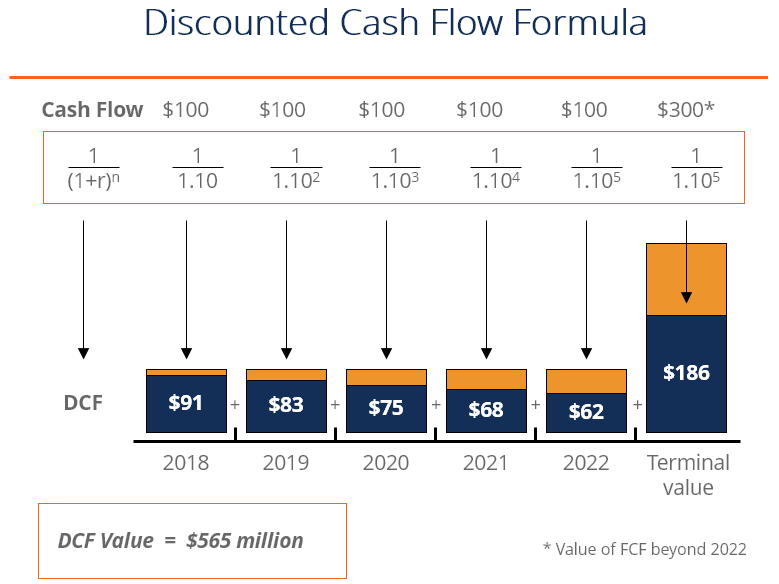

Discounted Cash Flow Formula

Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future cash flow. What is dcf formula (discounted cash flow)? Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment.

Discounted Cash Flow Formula

Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. What is dcf formula (discounted cash flow)? Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future.

Discounted Cash Flow Formula Intrinsic Value Stock Analysis Method

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is predominantly used to value a company today by forecasting its future cash flow. Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows. What is dcf formula (discounted.

Discounted Cash Flow (Dcf) Is Predominantly Used To Value A Company Today By Forecasting Its Future Cash Flow.

What is dcf formula (discounted cash flow)? Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) works by estimating the present value of an investment's expected future cash flows.