How Is Free Cash Flow Calculated - Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. To determine fcf, subtract capital. Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and capital. Free cash flow is calculated using several items from a company's cash flow statement.

To determine fcf, subtract capital. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Free cash flow is calculated using several items from a company's cash flow statement. Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and capital.

To determine fcf, subtract capital. Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and capital. Free cash flow is calculated using several items from a company's cash flow statement. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after.

Calculate Free Cash Flow Example and Formula QuickBooks

Free cash flow is calculated using several items from a company's cash flow statement. To determine fcf, subtract capital. Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and capital. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates.

Free Cash Flow (FCF) How to Calculate and Interpret It

Free cash flow is calculated using several items from a company's cash flow statement. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. To determine fcf, subtract capital. Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and.

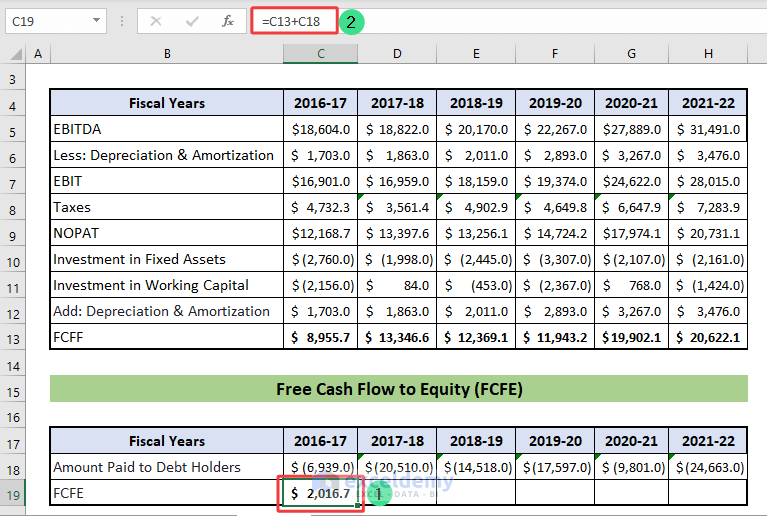

Free Cash Flow Excel Template

Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and capital. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. To determine fcf, subtract capital. Free cash flow is calculated using several items from a company's cash flow.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

To determine fcf, subtract capital. Free cash flow is calculated using several items from a company's cash flow statement. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and.

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

To determine fcf, subtract capital. Free cash flow is calculated using several items from a company's cash flow statement. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and.

How to Calculate Free Cash Flow in Excel (to Firm and Equity)

To determine fcf, subtract capital. Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and capital. Free cash flow is calculated using several items from a company's cash flow statement. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates.

Free Cash Flow (FCF) Formula

Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and capital. Free cash flow is calculated using several items from a company's cash flow statement. To determine fcf, subtract capital. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates.

Free Cash Flow Plan Projections

Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and capital. Free cash flow is calculated using several items from a company's cash flow statement. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. To determine fcf, subtract.

(FCF) Free Cash Flow Formula and Calculation Financial

Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and capital. Free cash flow is calculated using several items from a company's cash flow statement. To determine fcf, subtract capital. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates.

Free Cash Flow What it is and how to calculate it Example and

Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Free cash flow is calculated using several items from a company's cash flow statement. Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and capital. To determine fcf, subtract.

To Determine Fcf, Subtract Capital.

Free cash flow is calculated using several items from a company's cash flow statement. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Free cash flow (fcf) measures a company’s financial health by showing how much cash is available after expenses and capital.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)