How Much Cash Flow For Rental Property - As a rule of thumb, most rental property investors look for an roi of at least 8%. ** condition as compared to. Other monthly costs enter the monthly cost for each in dollars. Initial monthly cash flow cash flow after loan costs. How much cash flow is good for a rental property depends on the location, property type, investment strategy, and purchase price. Rental property cash flow is the net income remaining after all expenses related to the property are paid. However, depending on the investment strategy.

Rental property cash flow is the net income remaining after all expenses related to the property are paid. Other monthly costs enter the monthly cost for each in dollars. Initial monthly cash flow cash flow after loan costs. ** condition as compared to. However, depending on the investment strategy. As a rule of thumb, most rental property investors look for an roi of at least 8%. How much cash flow is good for a rental property depends on the location, property type, investment strategy, and purchase price.

Rental property cash flow is the net income remaining after all expenses related to the property are paid. Other monthly costs enter the monthly cost for each in dollars. As a rule of thumb, most rental property investors look for an roi of at least 8%. ** condition as compared to. Initial monthly cash flow cash flow after loan costs. How much cash flow is good for a rental property depends on the location, property type, investment strategy, and purchase price. However, depending on the investment strategy.

Rental Property Cash Flow, ROI and Cap Rate Investment Analysis

As a rule of thumb, most rental property investors look for an roi of at least 8%. However, depending on the investment strategy. How much cash flow is good for a rental property depends on the location, property type, investment strategy, and purchase price. Rental property cash flow is the net income remaining after all expenses related to the property.

Ultimate Guide to Calculate Cash Flow for a Rental Property! Investyle

Rental property cash flow is the net income remaining after all expenses related to the property are paid. However, depending on the investment strategy. How much cash flow is good for a rental property depends on the location, property type, investment strategy, and purchase price. Other monthly costs enter the monthly cost for each in dollars. ** condition as compared.

Rental Property Cash Flow Analysis Why It is Important?

As a rule of thumb, most rental property investors look for an roi of at least 8%. Initial monthly cash flow cash flow after loan costs. Rental property cash flow is the net income remaining after all expenses related to the property are paid. How much cash flow is good for a rental property depends on the location, property type,.

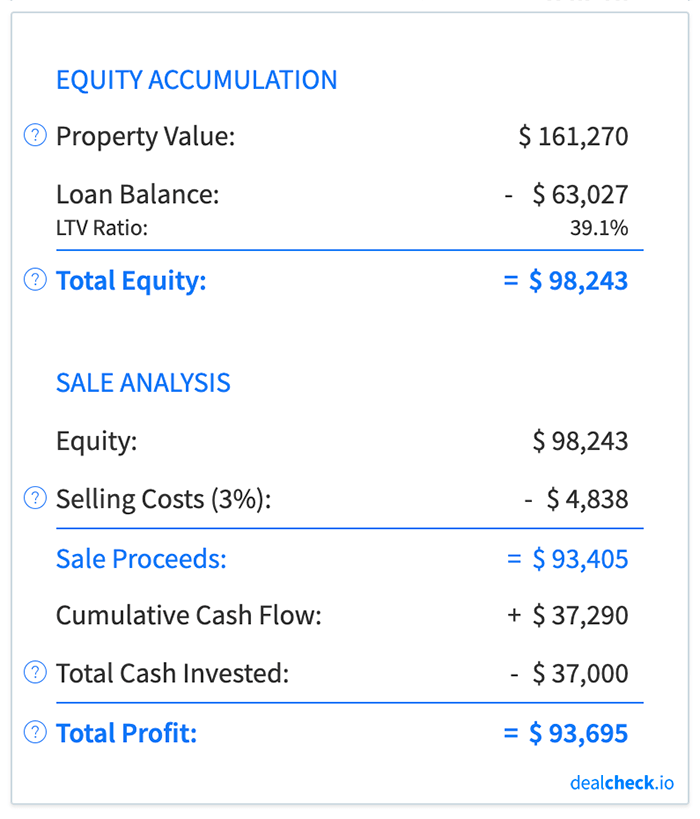

How To Make Money from Rental Properties in 2022 (Hint Appreciation)

Other monthly costs enter the monthly cost for each in dollars. Rental property cash flow is the net income remaining after all expenses related to the property are paid. How much cash flow is good for a rental property depends on the location, property type, investment strategy, and purchase price. However, depending on the investment strategy. ** condition as compared.

Rental Property Cash Flow Analysis at Ethan Fuhrman blog

How much cash flow is good for a rental property depends on the location, property type, investment strategy, and purchase price. Rental property cash flow is the net income remaining after all expenses related to the property are paid. ** condition as compared to. Initial monthly cash flow cash flow after loan costs. However, depending on the investment strategy.

Using Rental Property Cash Flow Calculator Excel Mashvisor

** condition as compared to. However, depending on the investment strategy. As a rule of thumb, most rental property investors look for an roi of at least 8%. Rental property cash flow is the net income remaining after all expenses related to the property are paid. How much cash flow is good for a rental property depends on the location,.

How Much Cash Flow Do You Need on Rental Properties?

Other monthly costs enter the monthly cost for each in dollars. Initial monthly cash flow cash flow after loan costs. ** condition as compared to. However, depending on the investment strategy. As a rule of thumb, most rental property investors look for an roi of at least 8%.

How to Calculate the Return on Investment (ROI) for Rental Properties

However, depending on the investment strategy. Rental property cash flow is the net income remaining after all expenses related to the property are paid. ** condition as compared to. Other monthly costs enter the monthly cost for each in dollars. As a rule of thumb, most rental property investors look for an roi of at least 8%.

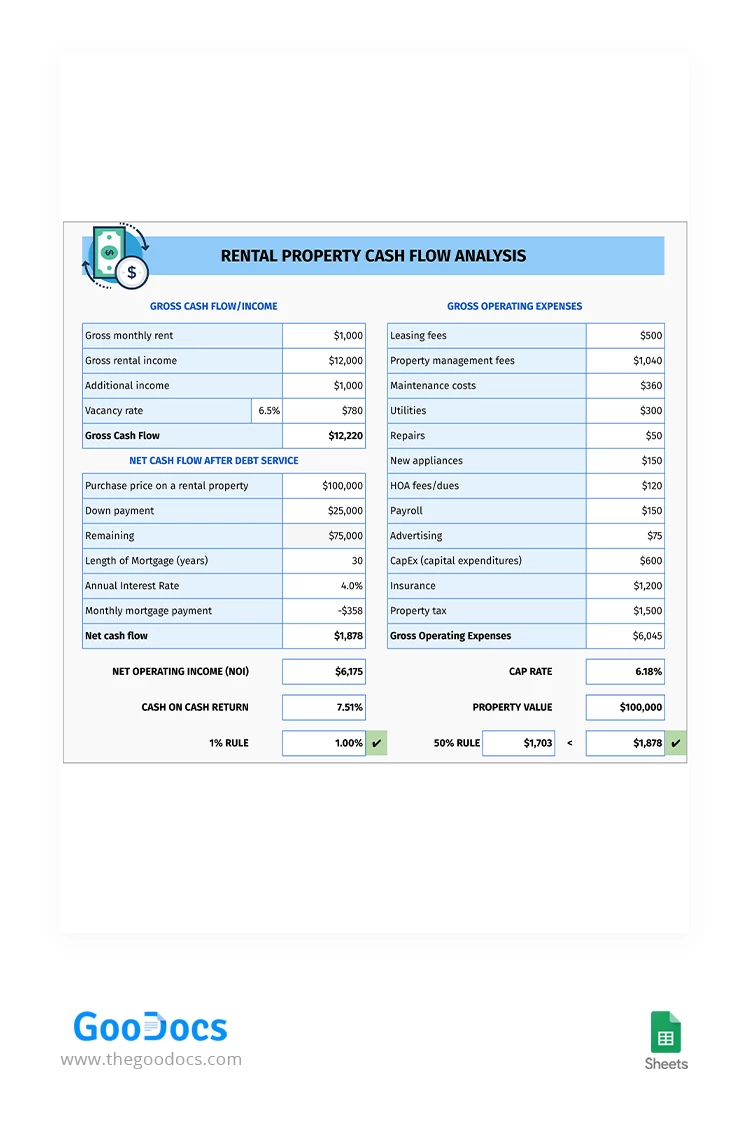

Free Rental Property Cash Flow Analysis Template In Google Sheets

As a rule of thumb, most rental property investors look for an roi of at least 8%. ** condition as compared to. Other monthly costs enter the monthly cost for each in dollars. Rental property cash flow is the net income remaining after all expenses related to the property are paid. Initial monthly cash flow cash flow after loan costs.

Rental Property Cash Flow Analysis at Ethan Fuhrman blog

How much cash flow is good for a rental property depends on the location, property type, investment strategy, and purchase price. Other monthly costs enter the monthly cost for each in dollars. Initial monthly cash flow cash flow after loan costs. As a rule of thumb, most rental property investors look for an roi of at least 8%. ** condition.

As A Rule Of Thumb, Most Rental Property Investors Look For An Roi Of At Least 8%.

Initial monthly cash flow cash flow after loan costs. Other monthly costs enter the monthly cost for each in dollars. However, depending on the investment strategy. ** condition as compared to.

How Much Cash Flow Is Good For A Rental Property Depends On The Location, Property Type, Investment Strategy, And Purchase Price.

Rental property cash flow is the net income remaining after all expenses related to the property are paid.