How To Calculate Discounted Cash Flow Method - Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected.

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth.

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income.

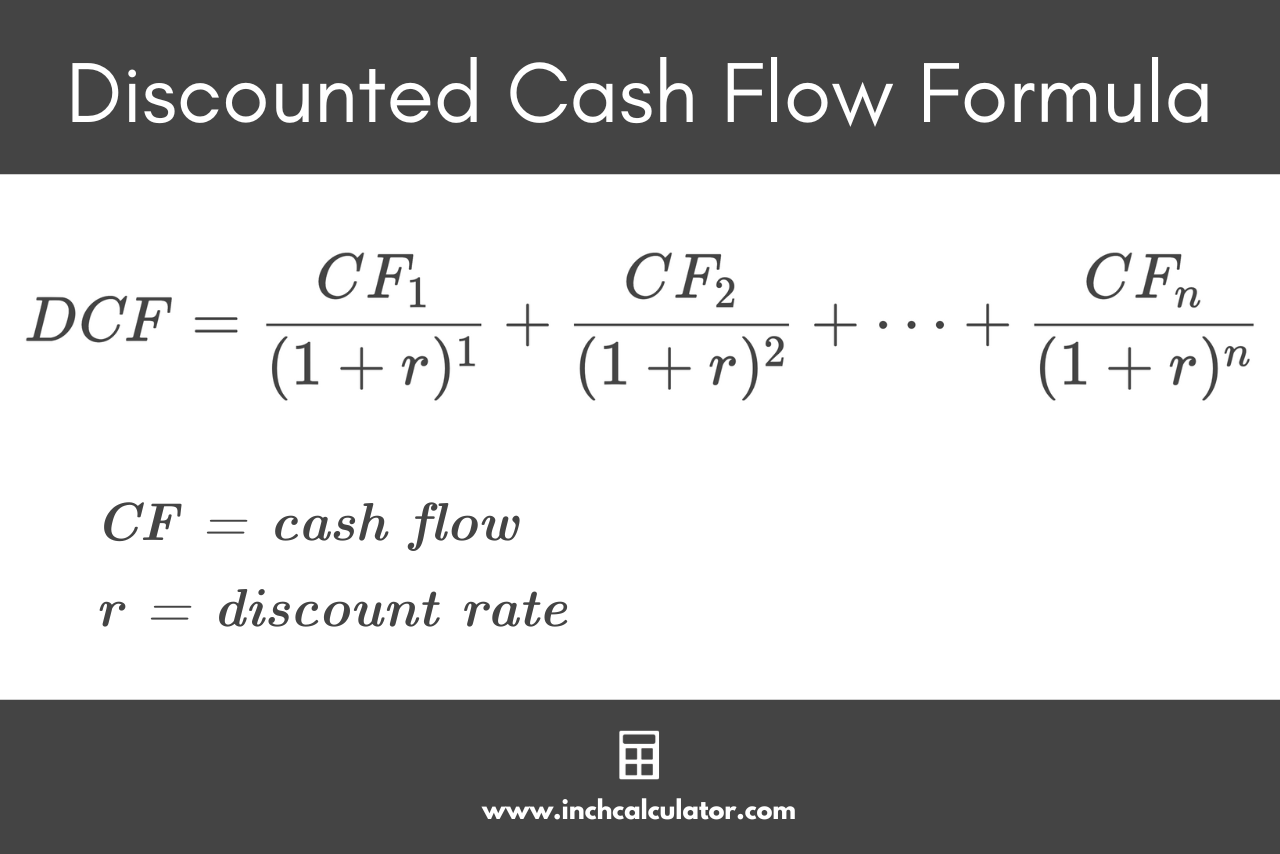

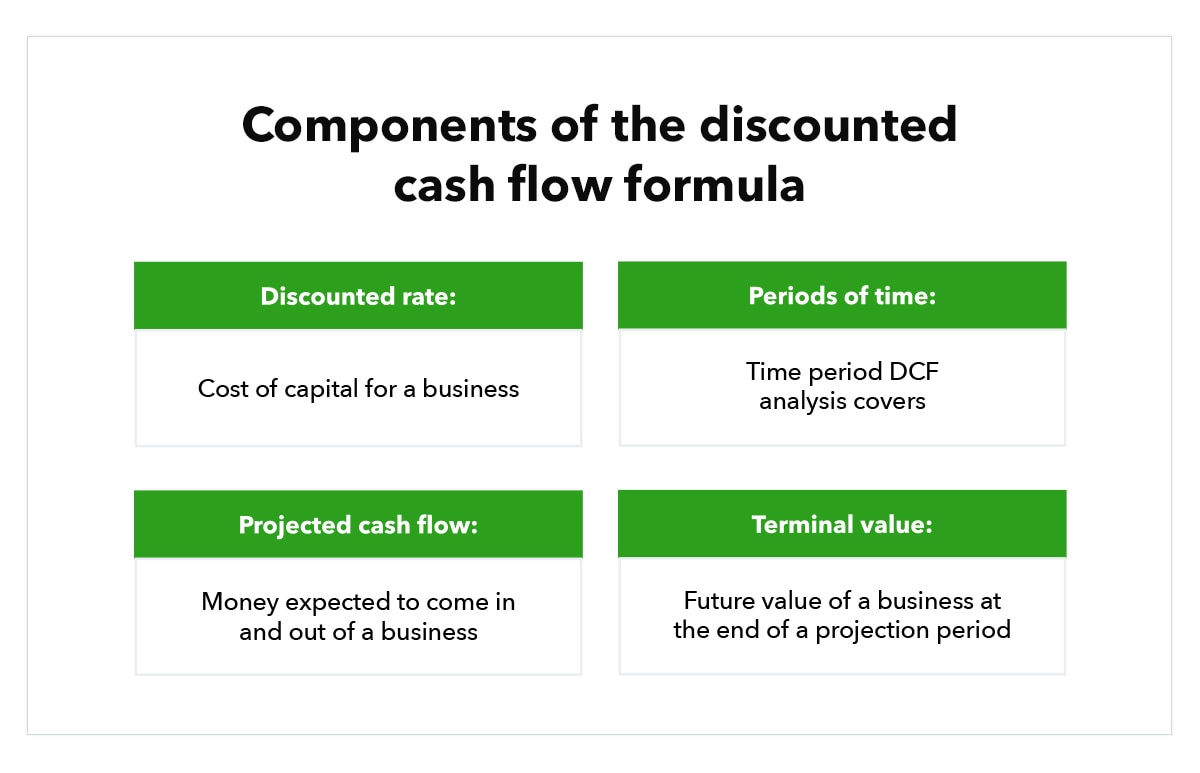

Discounted Cash Flow Calculator Inch Calculator

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value.

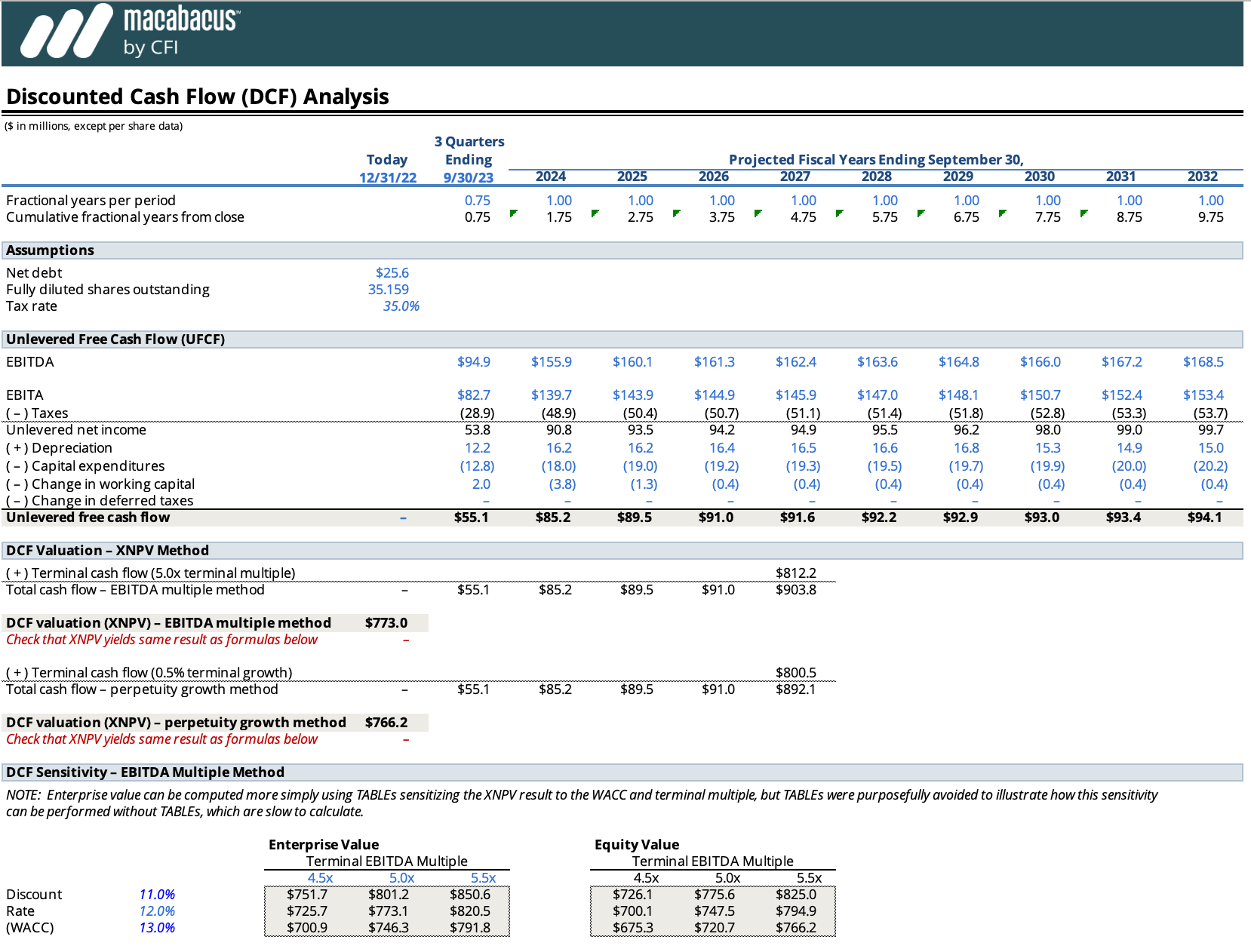

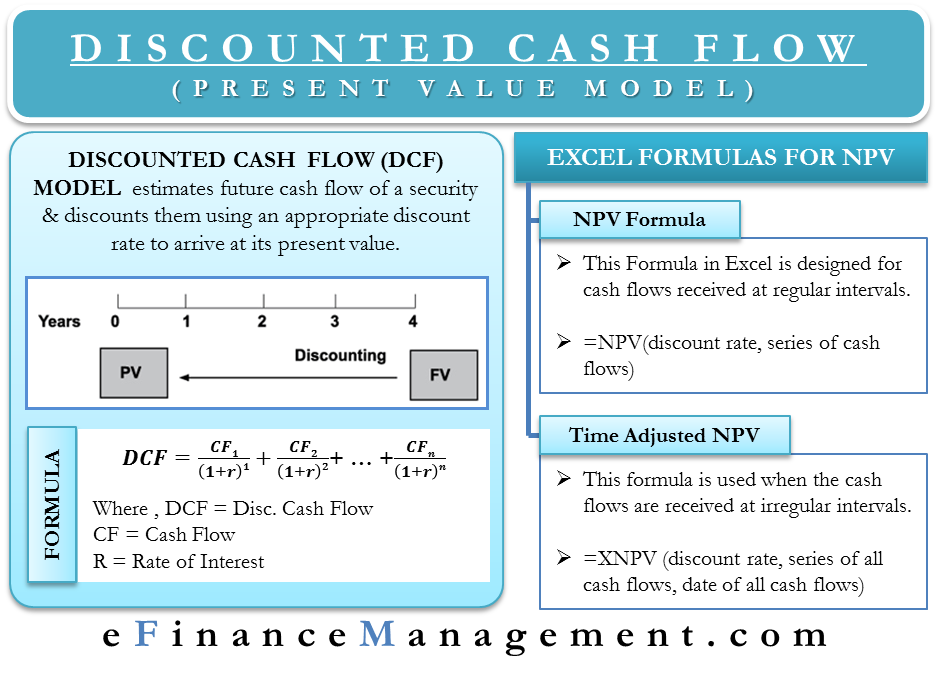

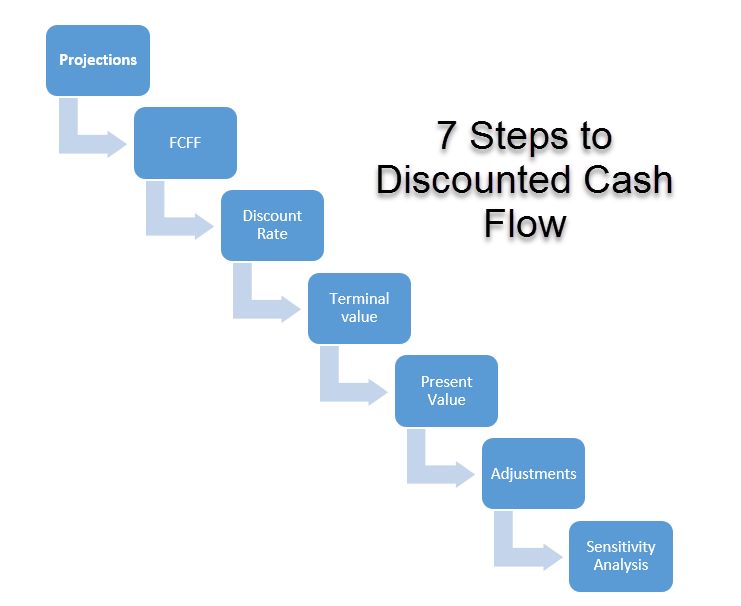

Discounted Cash Flow Method

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value.

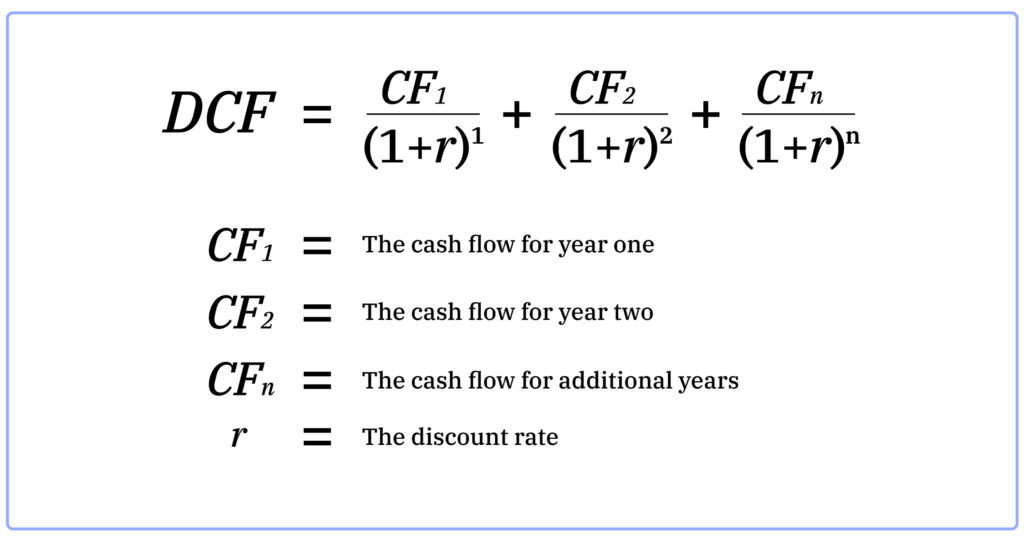

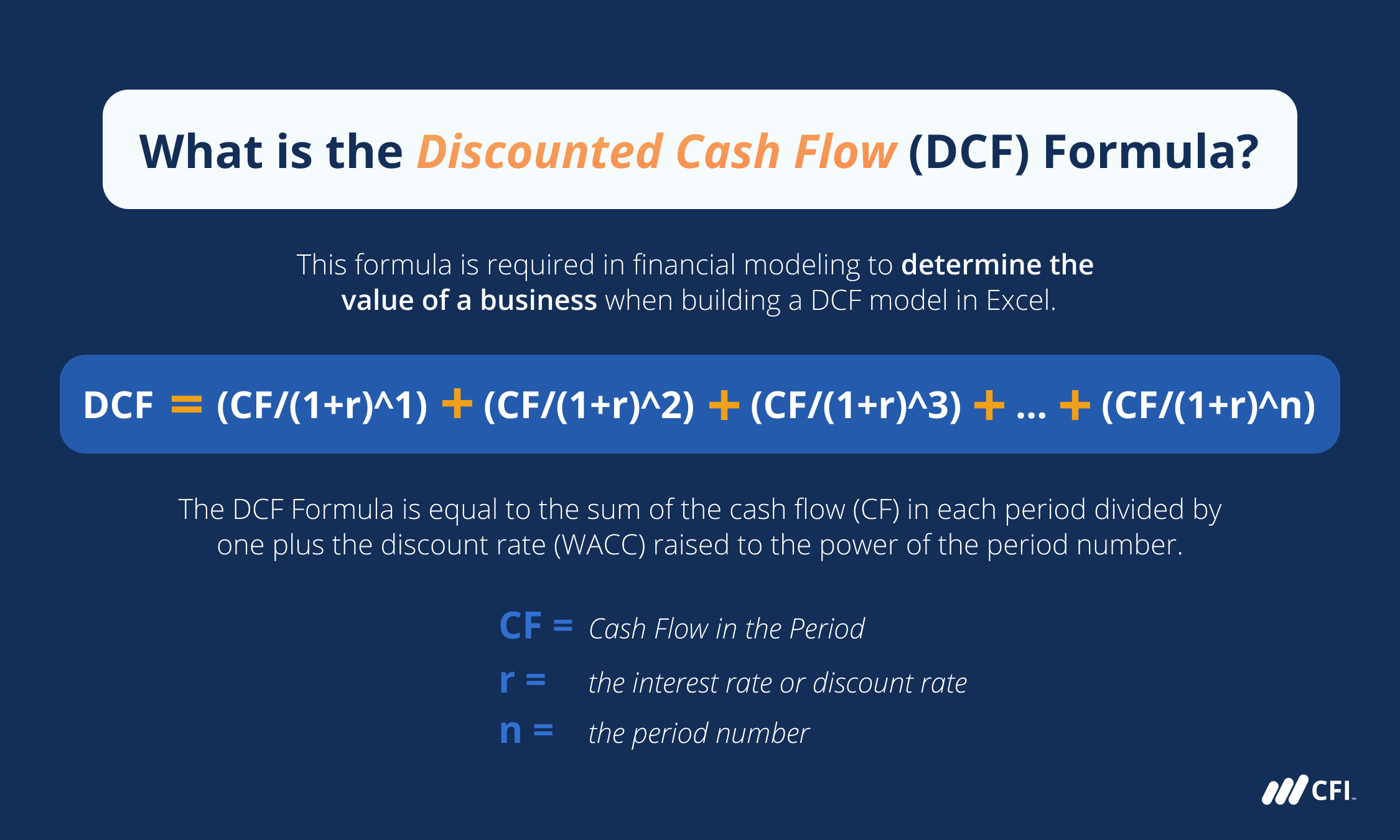

Discounted Cash Flow Formula

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value.

Discounted Cash Flow DCF Formula

Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Calculating the sum of future discounted cash flows is the gold standard to determine how much.

Discounted Cash Flow Method

Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment.

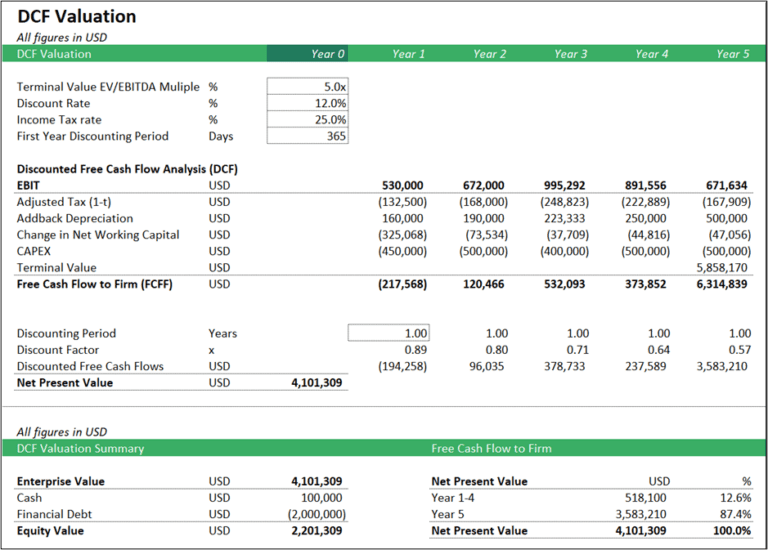

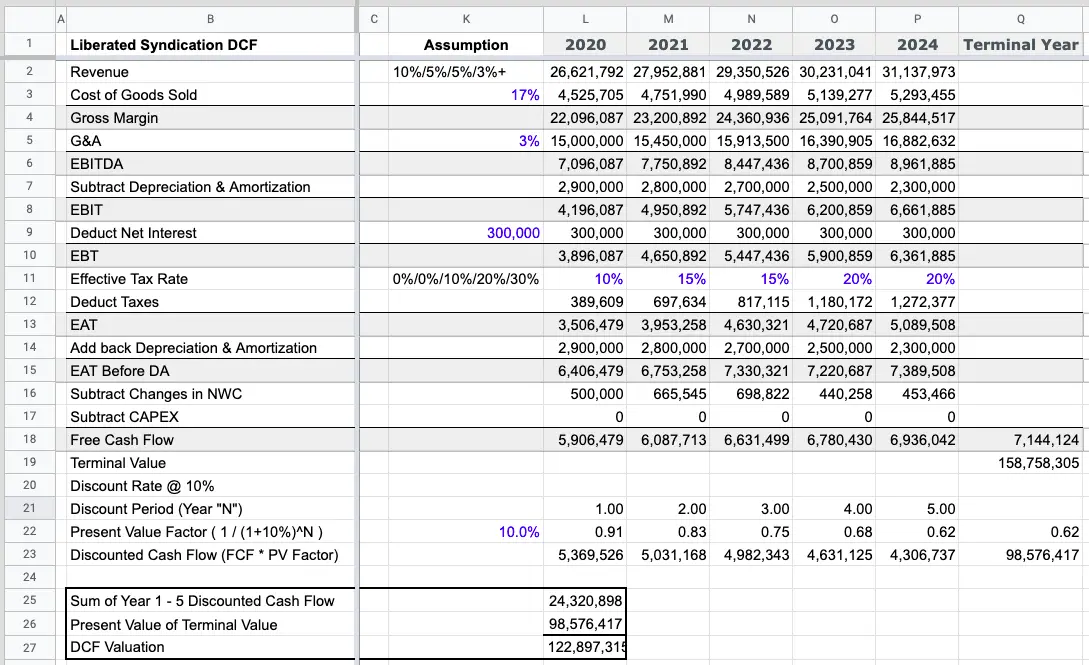

Discounted Cash Flow Model in Excel Solving Finance

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment.

Discounted Cash Flow Method

Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Calculating the sum of future discounted cash flows is the gold standard to determine how much.

Discounted Cash Flow Formula

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value.

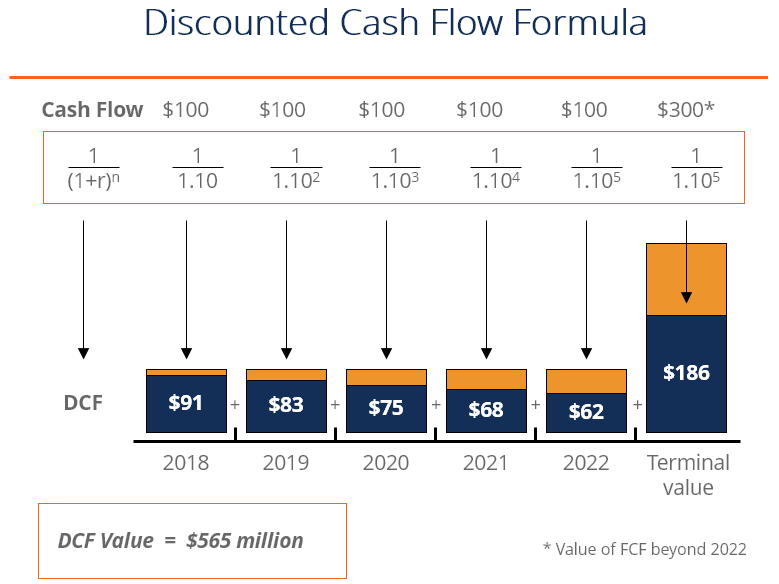

Discounted Cash Flow Formula Intrinsic Value Stock Analysis Method

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Calculating the sum of future discounted cash flows is the gold standard to determine how much.

Discounted Cash Flow Method

Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Calculating the sum of future discounted cash flows is the gold standard to determine how much.

Calculating The Sum Of Future Discounted Cash Flows Is The Gold Standard To Determine How Much An Investment Is Worth.

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income.