How To Calculate Free Cash Flow From Ebitda - You add change in working capital if working capital. The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand. Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into a company’s financials, moving beyond. To get from ebitda to fcf, the wso community provides the following answer:

To get from ebitda to fcf, the wso community provides the following answer: You add change in working capital if working capital. The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand. Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into a company’s financials, moving beyond.

You add change in working capital if working capital. To get from ebitda to fcf, the wso community provides the following answer: Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into a company’s financials, moving beyond. The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand.

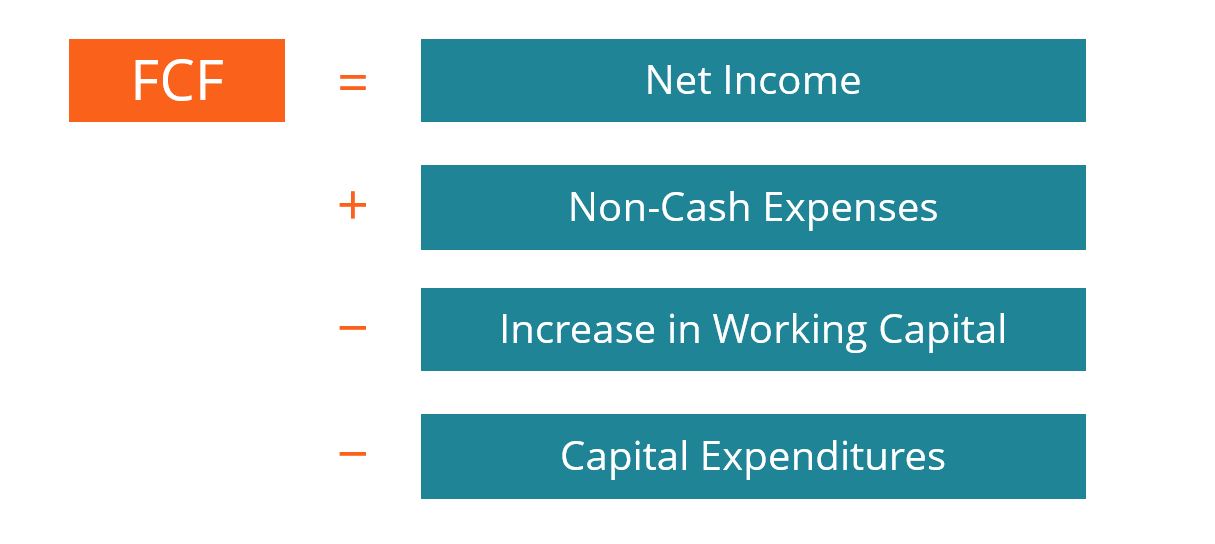

Free Cash Flow (FCF) Formula

Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into a company’s financials, moving beyond. The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand. To get from ebitda to fcf, the wso community provides the following answer: You add change in.

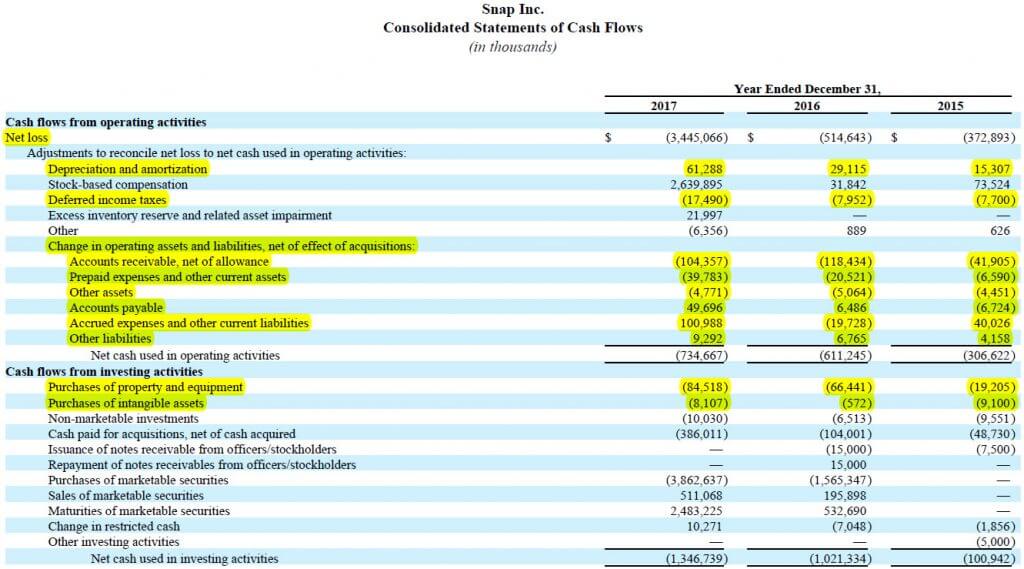

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf

Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into a company’s financials, moving beyond. To get from ebitda to fcf, the wso community provides the following answer: You add change in working capital if working capital. The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in.

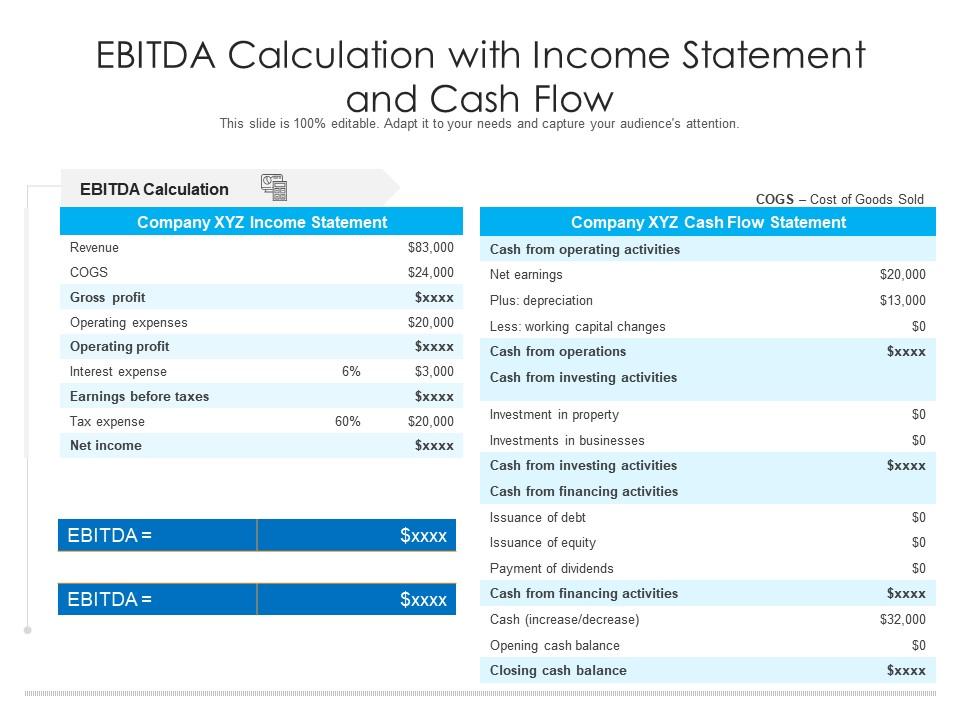

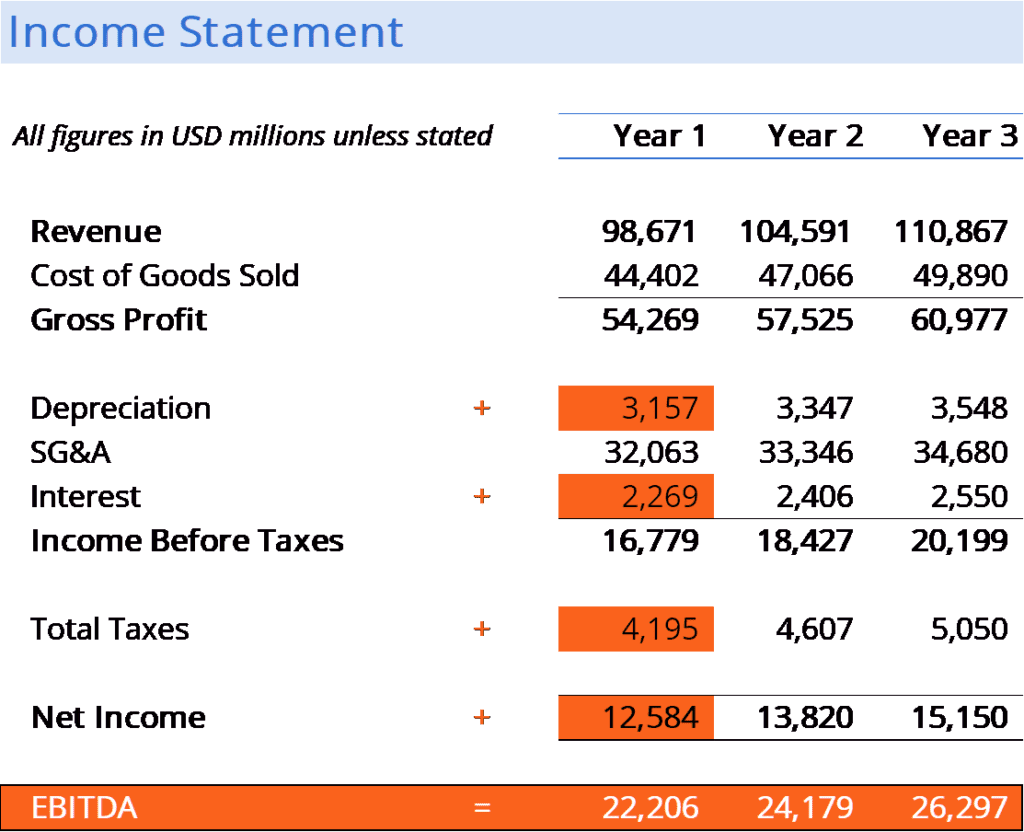

EBITDA Calculation With Statement And Cash Flow Presentation

The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand. Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into a company’s financials, moving beyond. You add change in working capital if working capital. To get from ebitda to fcf, the wso.

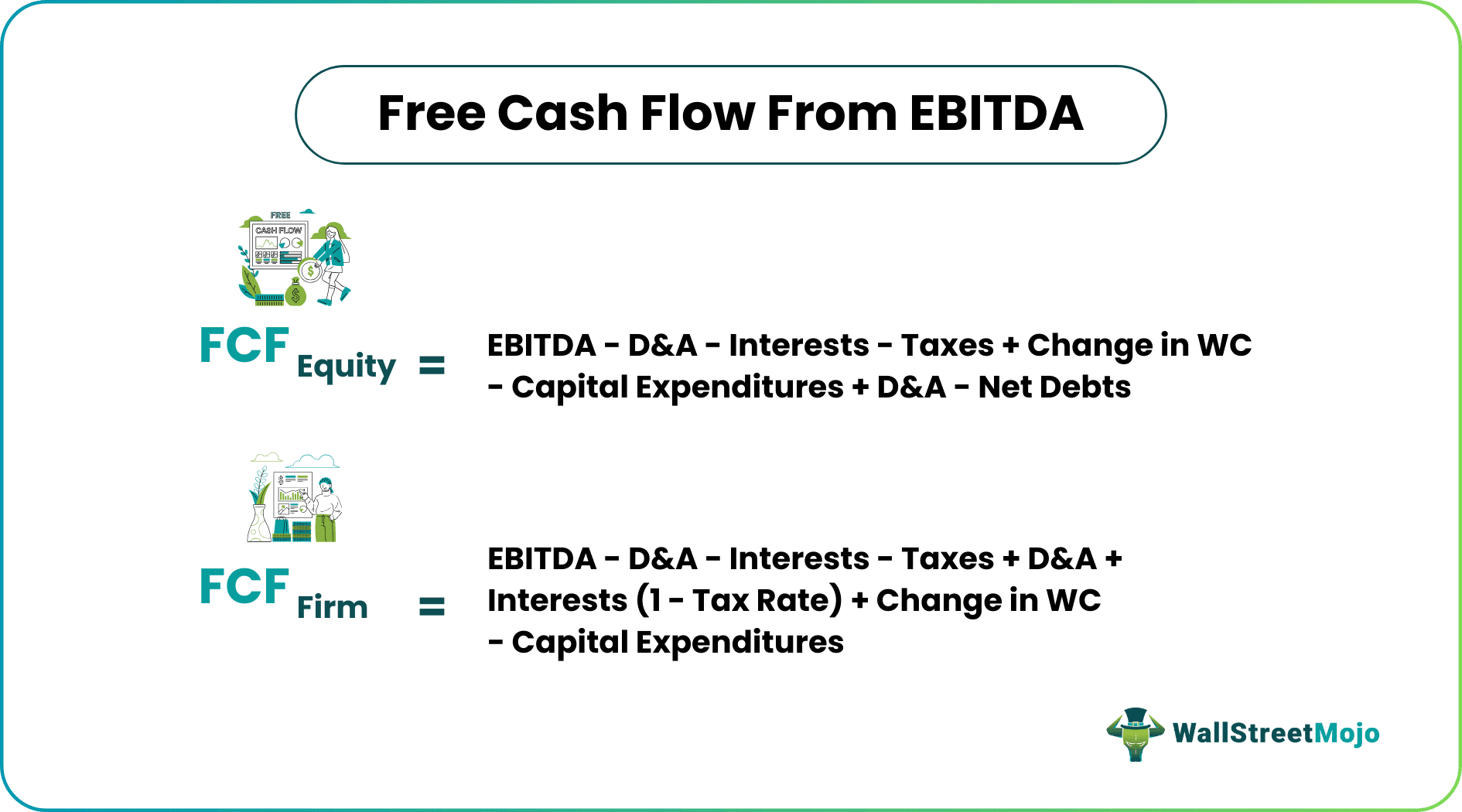

Free Cash Flow from EBITDA How to Calculate?

To get from ebitda to fcf, the wso community provides the following answer: Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into a company’s financials, moving beyond. The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand. You add change in.

How to Calculate FCFE from EBITDA Overview, Formula, Example

Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into a company’s financials, moving beyond. To get from ebitda to fcf, the wso community provides the following answer: The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand. You add change in.

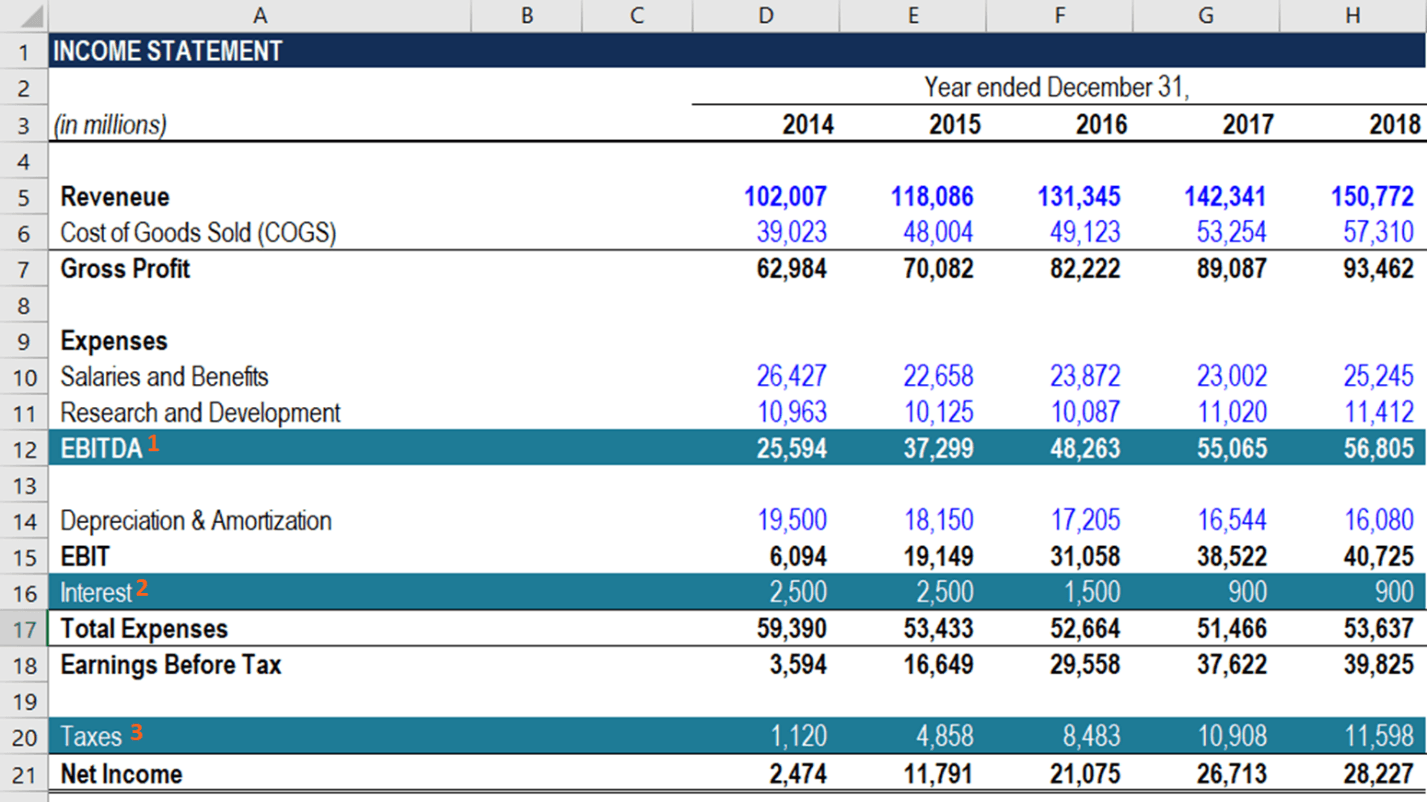

EBITDA Meaning and Example Calculations

You add change in working capital if working capital. To get from ebitda to fcf, the wso community provides the following answer: Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into a company’s financials, moving beyond. The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in.

What is EBITDA Formula, Definition and Explanation

To get from ebitda to fcf, the wso community provides the following answer: Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into a company’s financials, moving beyond. The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand. You add change in.

Cash flow from ebitda instadun

The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand. You add change in working capital if working capital. To get from ebitda to fcf, the wso community provides the following answer: Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into.

Free Cash Flow (FCF) Formula, Analysis, Examples Capital City

To get from ebitda to fcf, the wso community provides the following answer: You add change in working capital if working capital. The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand. Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into.

The Ultimate Cash Flow Guide (EBITDA, CF, FCF, FCFE, FCFF)

The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand. Transitioning from ebitda to free cash flow (fcf) involves a deeper dive into a company’s financials, moving beyond. You add change in working capital if working capital. To get from ebitda to fcf, the wso.

Transitioning From Ebitda To Free Cash Flow (Fcf) Involves A Deeper Dive Into A Company’s Financials, Moving Beyond.

You add change in working capital if working capital. The objective here is to compare a company’s free cash flow (fcf) in a given period to its ebitda, in an effort to better understand. To get from ebitda to fcf, the wso community provides the following answer: