How To Calculate Free Cash Flow In Excel - Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and. Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and.

Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and. Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and.

Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and. Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and.

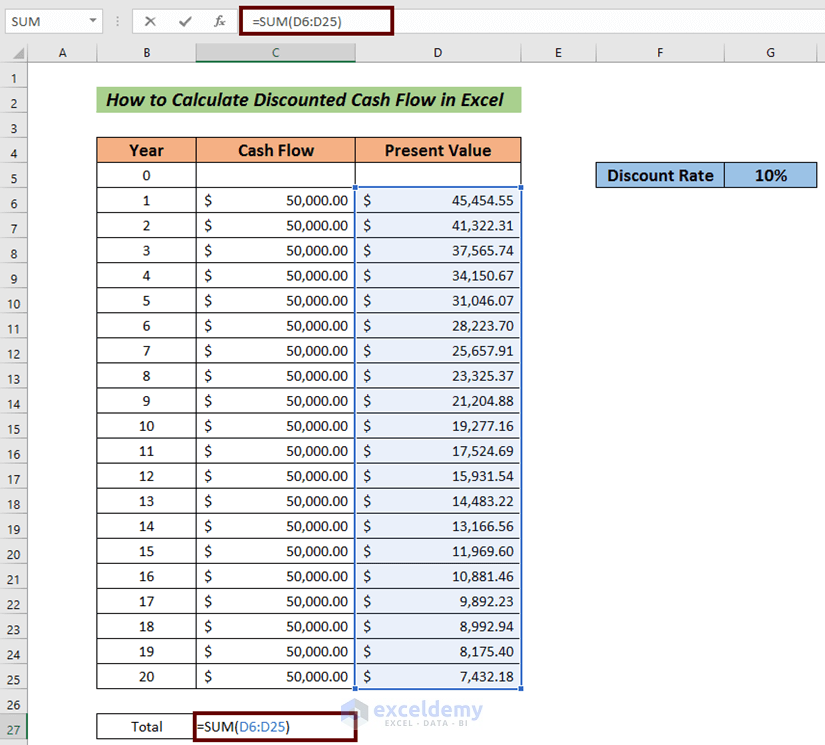

How to Calculate Free Cash Flow + Excel Examples

Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and. Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and.

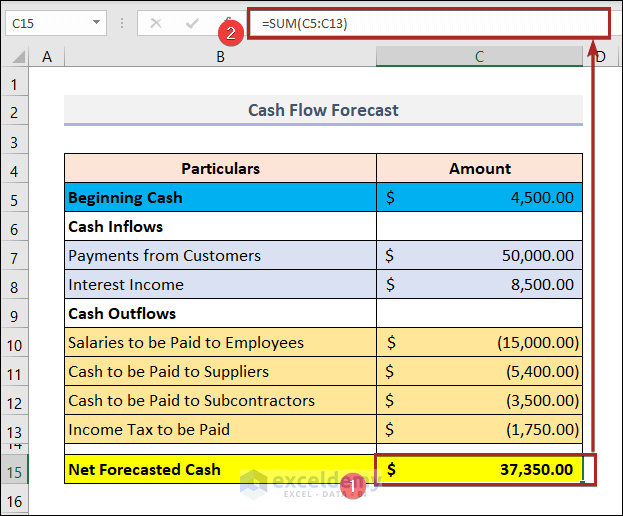

Cash Flow In Excel Formula at Isaac Soundy blog

Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and. Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and.

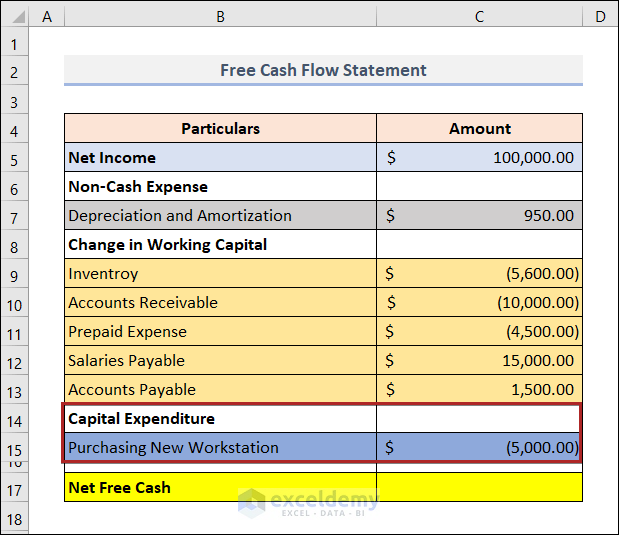

Free Cash Flow Formula

Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and. Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and.

Cash Flow In Excel Formula at Isaac Soundy blog

Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and. Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and.

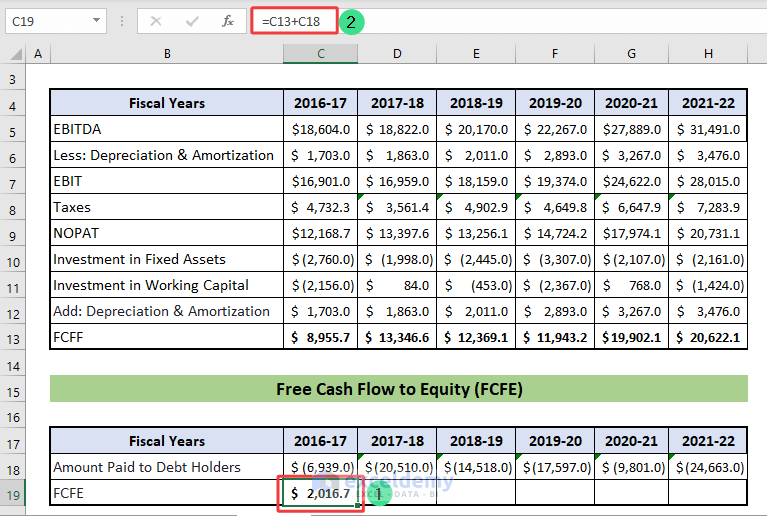

How to Calculate Free Cash Flow in Excel (to Firm and Equity)

Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and. Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and.

How to Calculate the Operating Cash Flow in Excel 2 Methods

Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and. Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and.

Excel Tutorial How To Calculate Free Cash Flow In Excel

Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and. Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and.

Free Cash Flow Excel Template

Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and. Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and.

Free Cash Flow Template Excel

Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and. Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and.

How to Calculate Free Cash Flow + Excel Examples

Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and. Free cash flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and.

Free Cash Flow Can Be Defined As The Cash Flow Available To The Firm Net Of Any Funds Invested In Capital Expenditure And.

Download cfi's free free cash flow (fcf) excel template to measure cash available after capital expenditures—essential for valuation and.