How To Know My Tax Deduction - Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. Learn how it affects your taxable income. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. See how your withholding affects your refund, paycheck.

One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. See how your withholding affects your refund, paycheck. Learn how it affects your taxable income.

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Learn how it affects your taxable income. See how your withholding affects your refund, paycheck. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year.

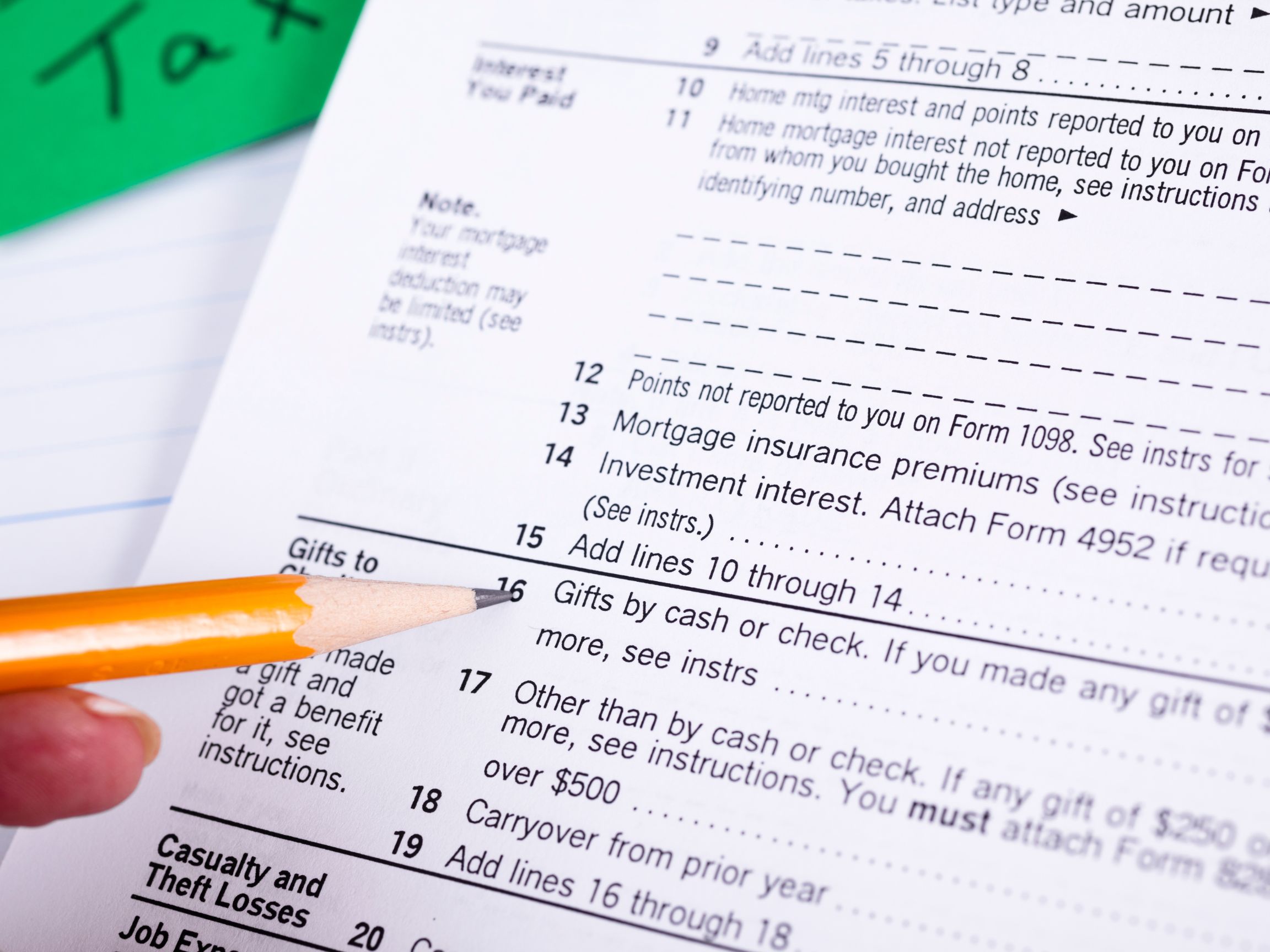

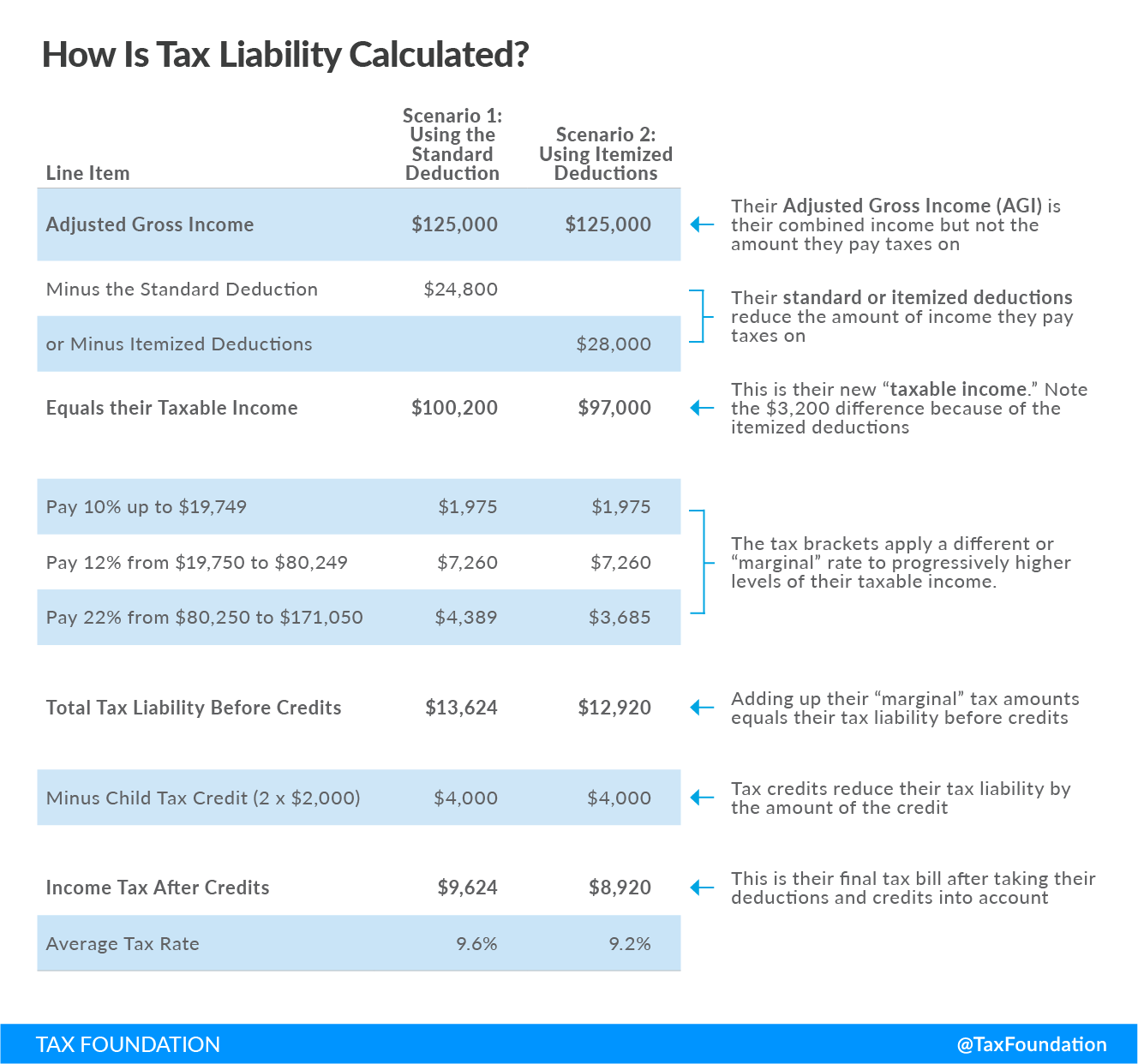

Itemized Deduction Definition TaxEDU Glossary

Learn how it affects your taxable income. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. See how your withholding affects your refund, paycheck. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. Use smartasset's paycheck calculator to calculate.

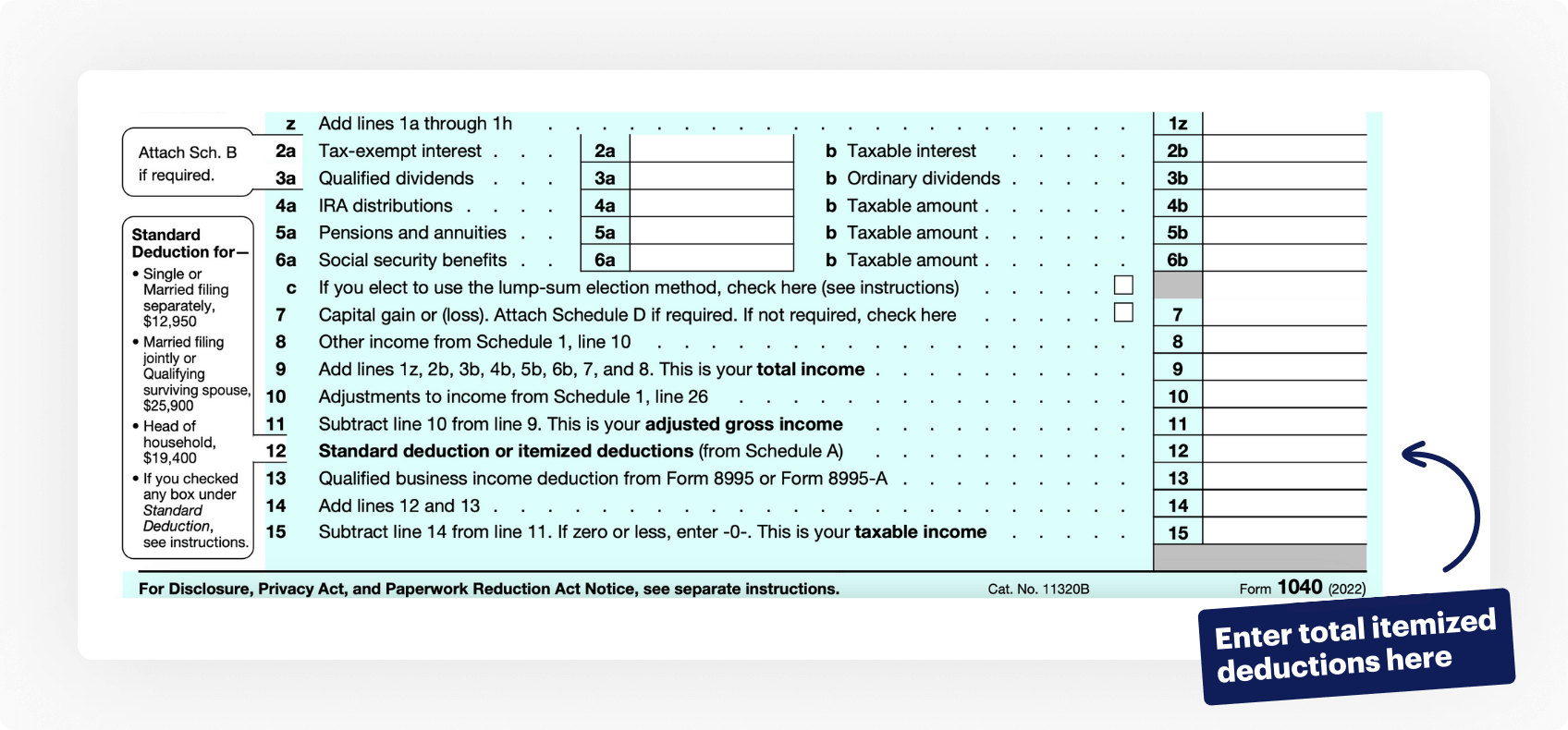

Schedule A (Form 1040) Itemized Deductions For 2025 Lilly S Solorio

One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Learn how it affects your taxable income. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both.

Credit Cards and Itemized Deductions What to Know Before Filing Your

One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into..

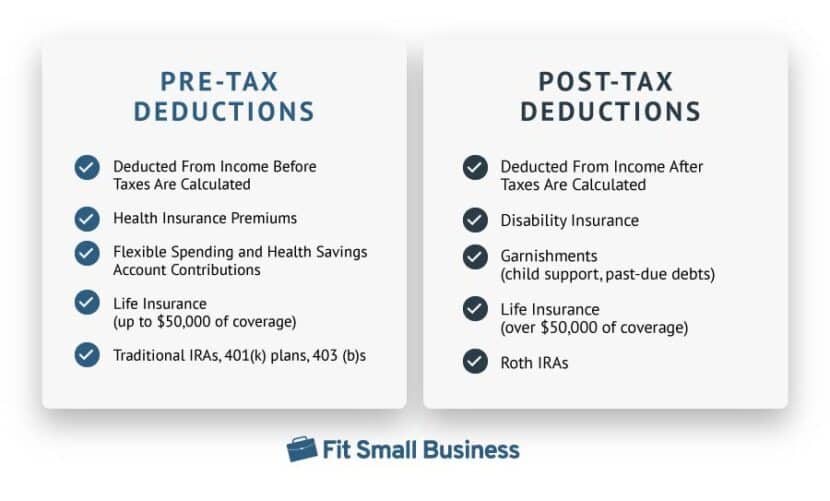

Pretax Deductions & Posttax Deductions An Ultimate Guide

Learn how it affects your taxable income. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. See how your withholding affects your refund, paycheck..

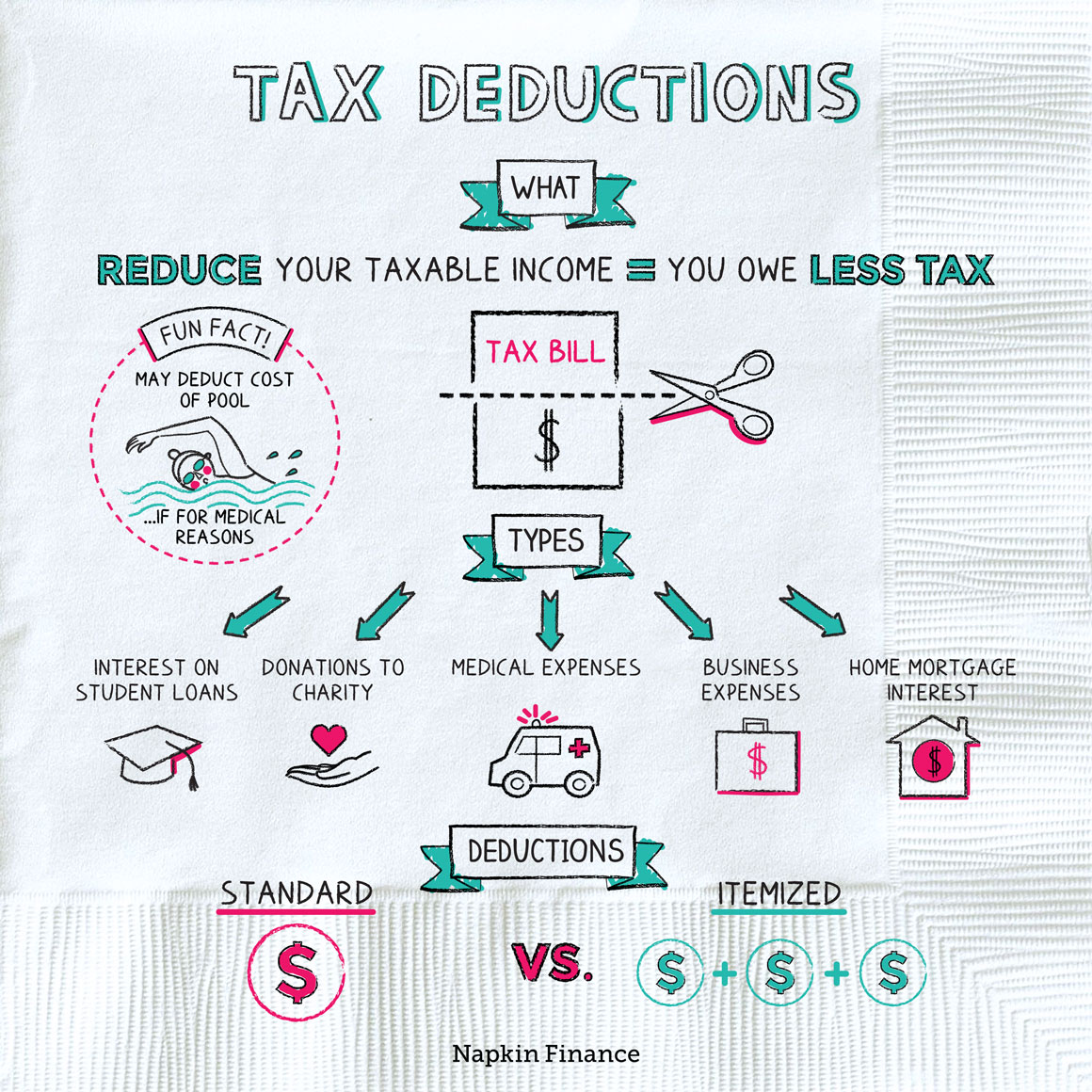

Understanding Tax Deductions Itemized vs. Standard Deduction

Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. See how your withholding affects your refund, paycheck. One way to be sure whether you took the standard or itemized deduction is to look.

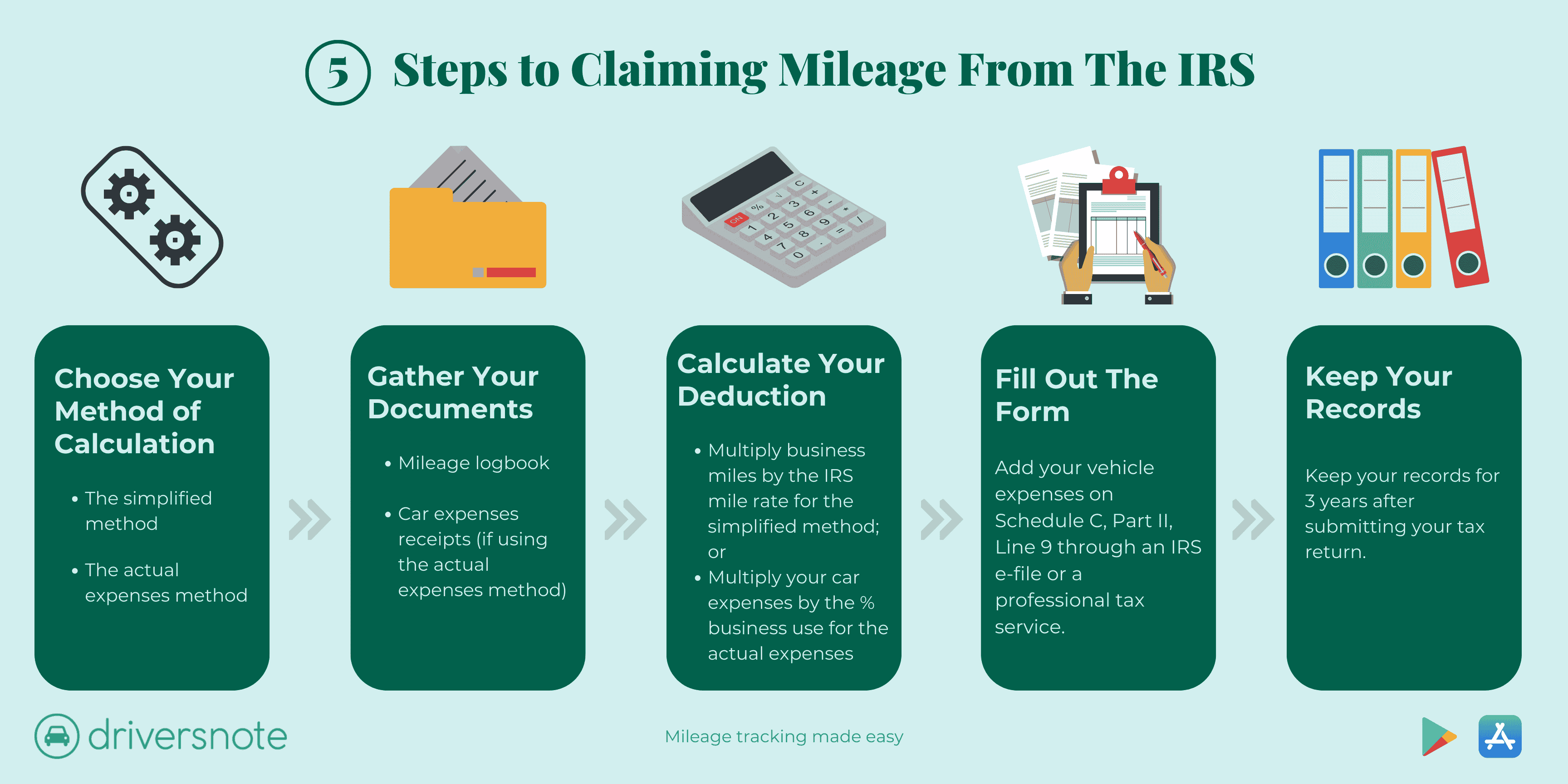

Tax Act Where Can You Claim Tax Deductions?

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. Learn how it affects your taxable income. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. See how your withholding affects your refund, paycheck..

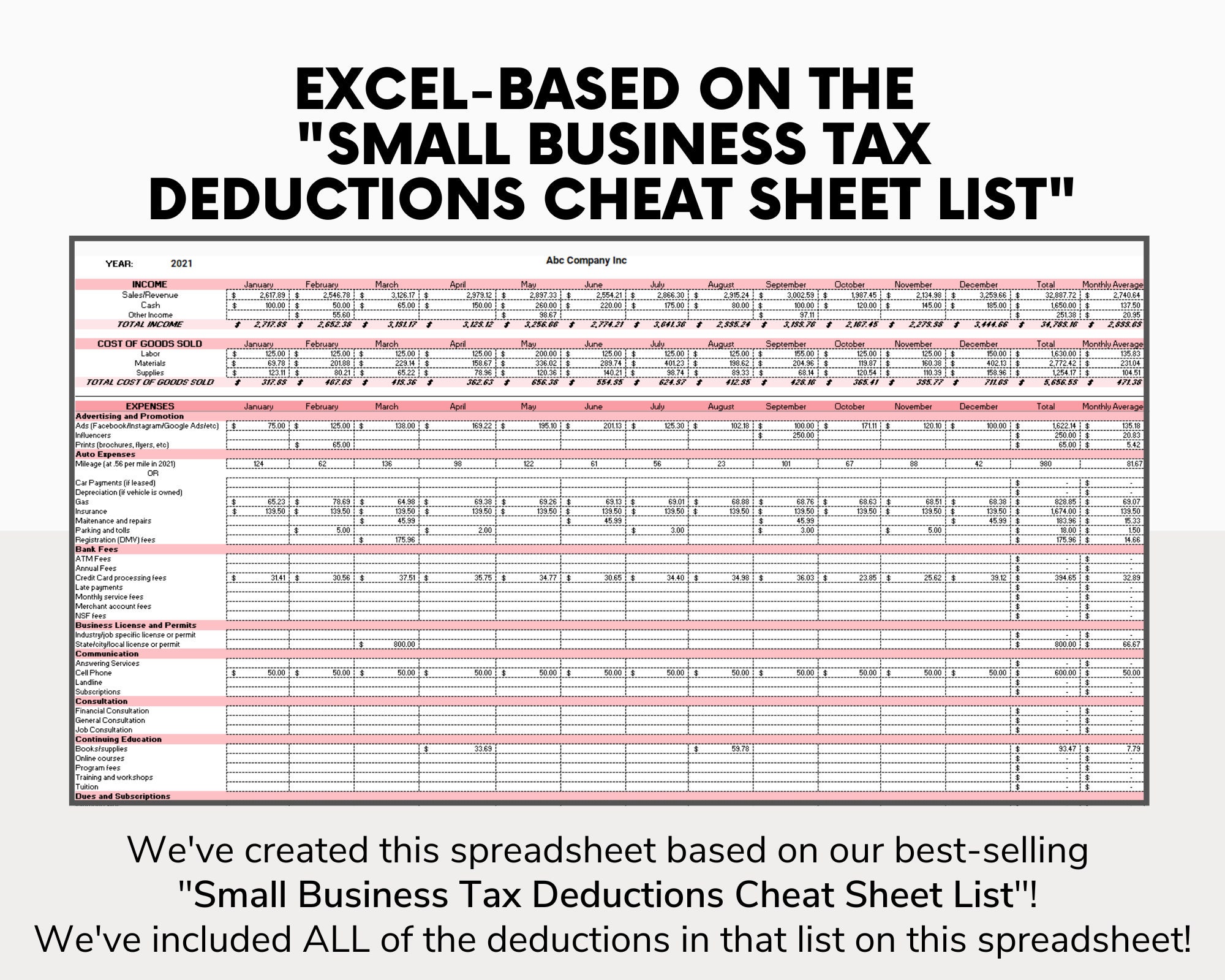

Business Tax Deductions Cheat Sheet Excel in PINK Tax Etsy Australia

Learn how it affects your taxable income. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. One way to be sure whether you took the standard or itemized deduction is to look at.

Tax basics Understanding the difference between standard and itemized

See how your withholding affects your refund, paycheck. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. One way to be sure whether you took the standard or itemized deduction is to look.

The master list of all types of tax deductions infographic Artofit

Learn how it affects your taxable income. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. See how your withholding affects your refund, paycheck..

What are the 5 different tax deductions? Leia aqui What are 5 types of

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. Learn how it affects your taxable income. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. One way to be sure whether you took the standard or itemized deduction is to look at.

Use Smartasset's Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into.

Learn how it affects your taxable income. See how your withholding affects your refund, paycheck. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year.

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)