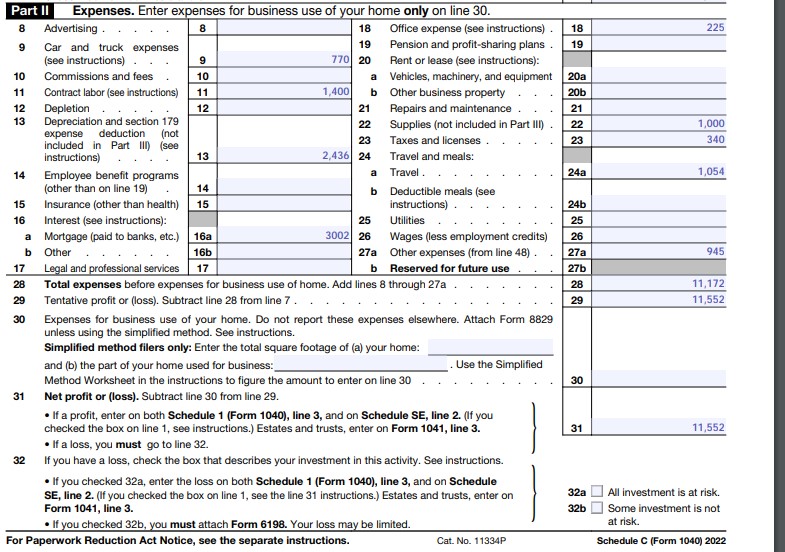

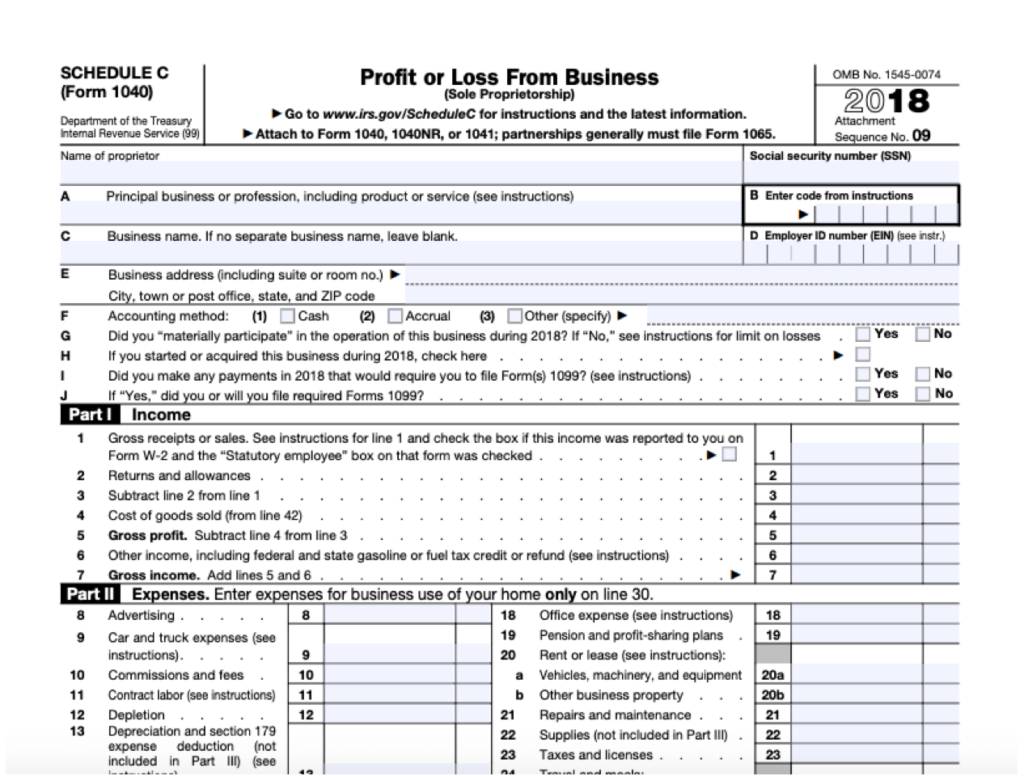

Instructions For 2024 Schedule C - • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. What is irs schedule c (form 1040)? Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. (if you checked the box on. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to.

(if you checked the box on. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. What is irs schedule c (form 1040)? Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. What is irs schedule c (form 1040)? (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to.

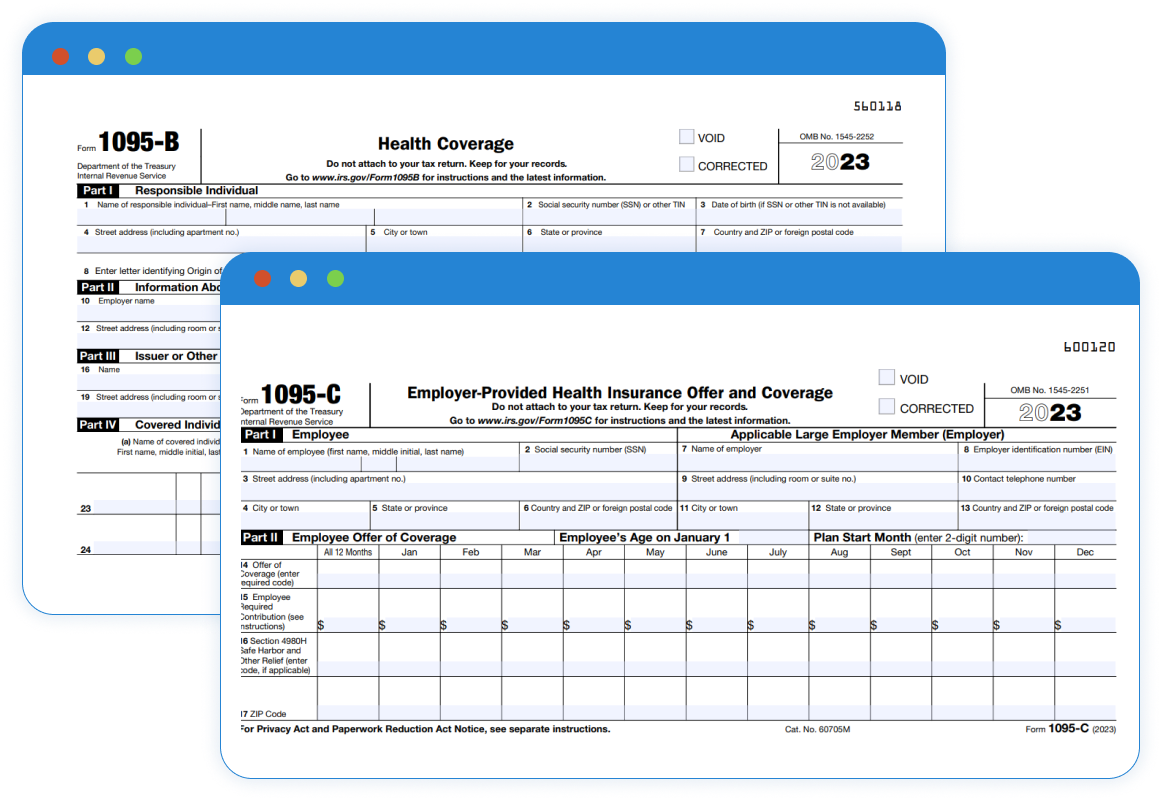

2024 Instructions For Forms 2024C And 2024C Csc Kitti Lindsay

In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. (if you checked the box on. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. • if you checked 32a,.

Schedule C Instructions 2024 Instructions Ivett Letisha

In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business,.

2024 Instructions For Forms 2024C And 2024C C Corp Cathie Doralyn

What is irs schedule c (form 1040)? (if you checked the box on. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. In this.

2024 Instructions Schedule C domino's pizza carte

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. What is irs schedule c (form 1040)? Use schedule.

2024 Schedule C Alia Louise

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Information about schedule c (form 1040), profit or loss from business, used to report.

2024 Form 1040 Schedule C Instructions Meaning Lydia Rochell

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. What is irs schedule c (form 1040)? Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. In this article, we’ll walk you.

Instructions For Schedule C 2024 Retha Hyacinthia

In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. What is irs schedule c (form 1040)? Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. • if you checked 32a, enter the loss on both schedule 1.

Schedule C Instructions 2024 Pdf Download Roxy Catarina

What is irs schedule c (form 1040)? In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040).

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. (if you checked the box on. • if you checked 32a,.

(If You Checked The Box On.

What is irs schedule c (form 1040)? Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)