Irs Leave Donation Guidance - Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,. Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment.

Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment. Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,.

Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment. Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,.

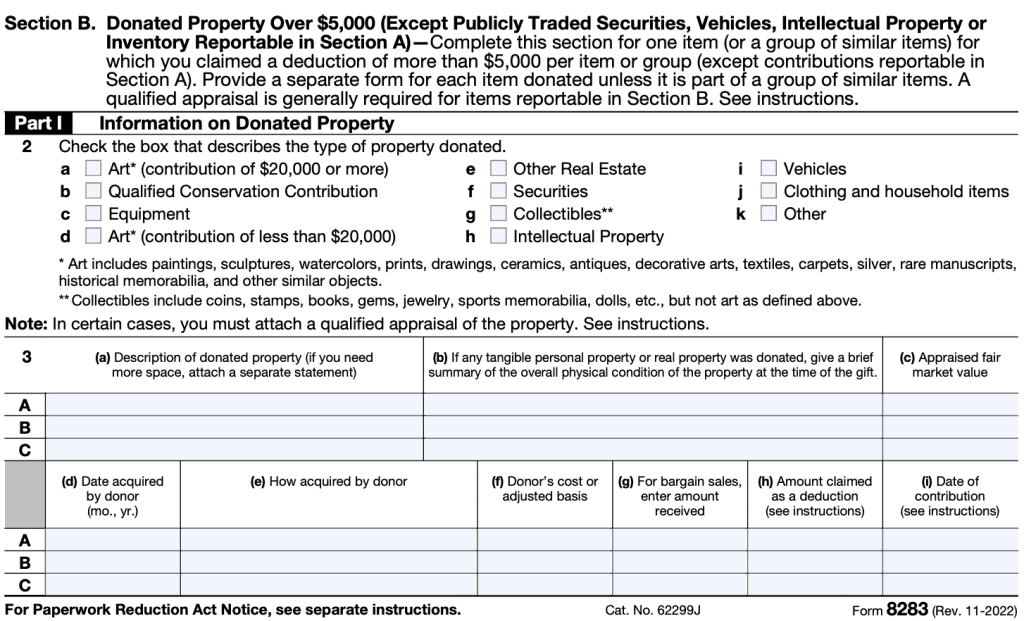

IRS Form 8283 A Guide to Noncash Charitable Contributions

Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,. Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment.

TOP TIP Leave Donation Programs Complying with IRS Requirements

Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,. Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment.

IRS Form 8283 Instructions Noncash Charitable Contributions

Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment. Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,.

Pto Donation IRS Guidelines Essential Information for HR Compliance

Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment. Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,.

Irs Donation Value Guide Fill Online, Printable, Fillable,, 05/10/2024

Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment. Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,.

IRS Form 8283 A Guide to Noncash Charitable Contributions

Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment. Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,.

Irs Donation Value Guide Fill Online, Printable, Fillable,, 05/10/2024

Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,. Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment.

IRS Extends LeaveBased Donation Programs through 2021

Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,. Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment.

IRS approves leave donation programs for coronavirus

Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,. Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment.

IRS Offers Guidance On EmployerSponsored Leave Donation Programs

Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment. Washington — the internal revenue service today provided guidance for employers whose employees forgo sick,.

Washington — The Internal Revenue Service Today Provided Guidance For Employers Whose Employees Forgo Sick,.

Geographic areas).1 this notice provides guidance under the internal revenue code (code) on the federal income and employment tax treatment.