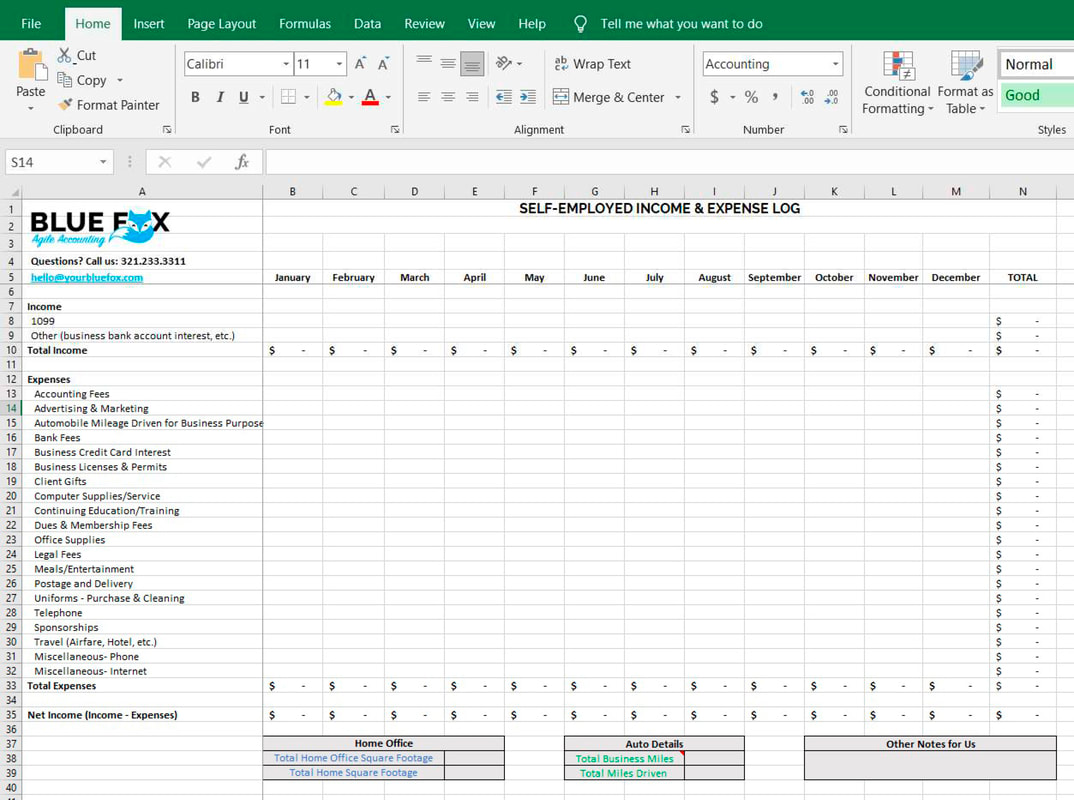

Irs Schedule C Excel Template - “evidence” includes mileage logs, appointment records, calendars, etc. By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer). The best way to reduce you taxable income is track income & expenses for tax form 1040 schedule c. Automate sales and use tax, gst, and vat compliance. Plus irs could ask for odometer readings from oil changes, repair. The first link below opens a.pdf document that outlines the various income and expense categories that are reported on a schedule c.

By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer). The first link below opens a.pdf document that outlines the various income and expense categories that are reported on a schedule c. The best way to reduce you taxable income is track income & expenses for tax form 1040 schedule c. Plus irs could ask for odometer readings from oil changes, repair. Automate sales and use tax, gst, and vat compliance. “evidence” includes mileage logs, appointment records, calendars, etc.

By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer). Automate sales and use tax, gst, and vat compliance. “evidence” includes mileage logs, appointment records, calendars, etc. Plus irs could ask for odometer readings from oil changes, repair. The first link below opens a.pdf document that outlines the various income and expense categories that are reported on a schedule c. The best way to reduce you taxable income is track income & expenses for tax form 1040 schedule c.

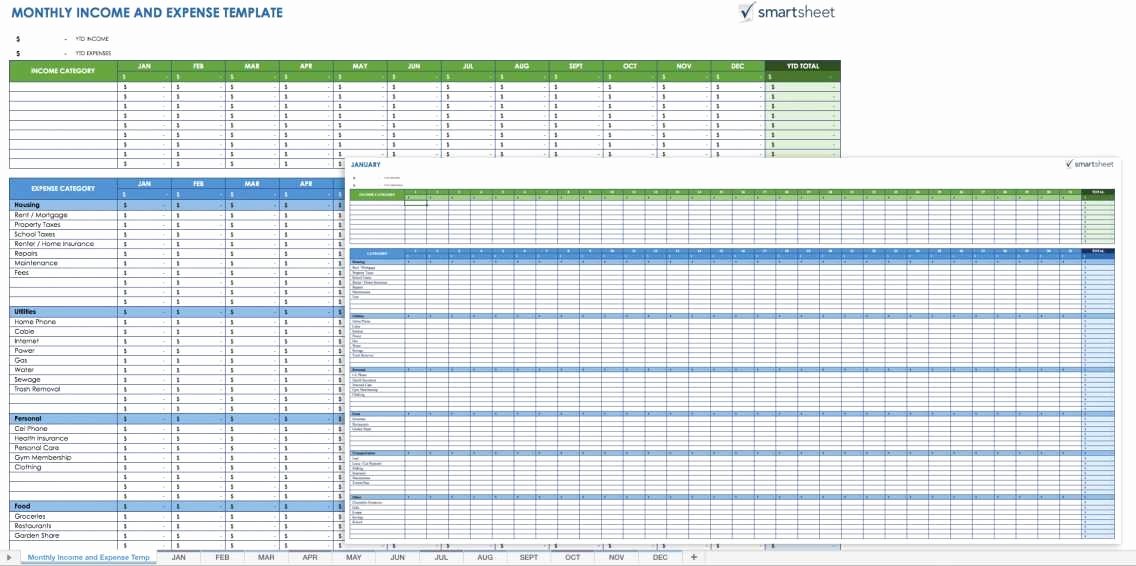

Schedule C In Excel Format

By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer). The best way to reduce you taxable income is track income & expenses for tax form 1040 schedule c. Automate sales and use tax, gst, and vat compliance. “evidence” includes mileage logs, appointment records, calendars,.

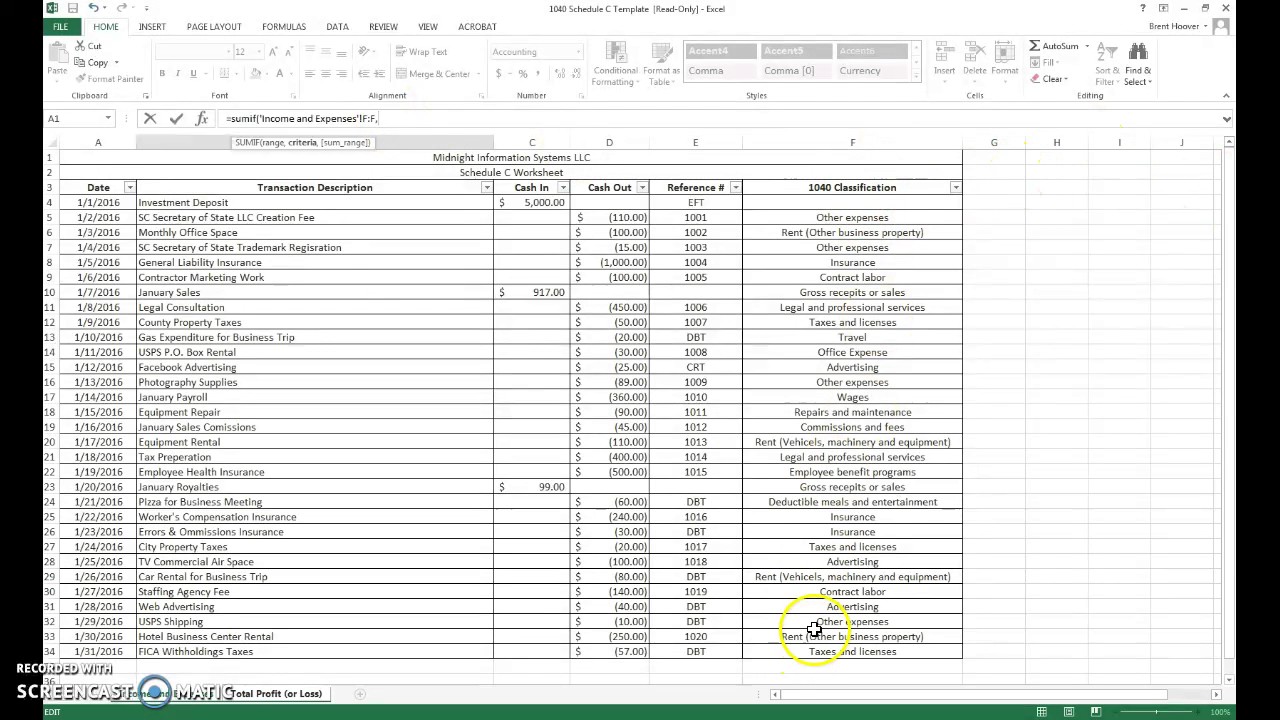

Schedule C IRS Form 1040 Spreadsheet Excel Google Sheets Etsy

Automate sales and use tax, gst, and vat compliance. The first link below opens a.pdf document that outlines the various income and expense categories that are reported on a schedule c. The best way to reduce you taxable income is track income & expenses for tax form 1040 schedule c. By using this spreadsheet to track your income and expenses.

Schedule C Excel Template

Automate sales and use tax, gst, and vat compliance. The best way to reduce you taxable income is track income & expenses for tax form 1040 schedule c. The first link below opens a.pdf document that outlines the various income and expense categories that are reported on a schedule c. “evidence” includes mileage logs, appointment records, calendars, etc. By using.

Excel Schedule C Template

Plus irs could ask for odometer readings from oil changes, repair. “evidence” includes mileage logs, appointment records, calendars, etc. By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer). The best way to reduce you taxable income is track income & expenses for tax form.

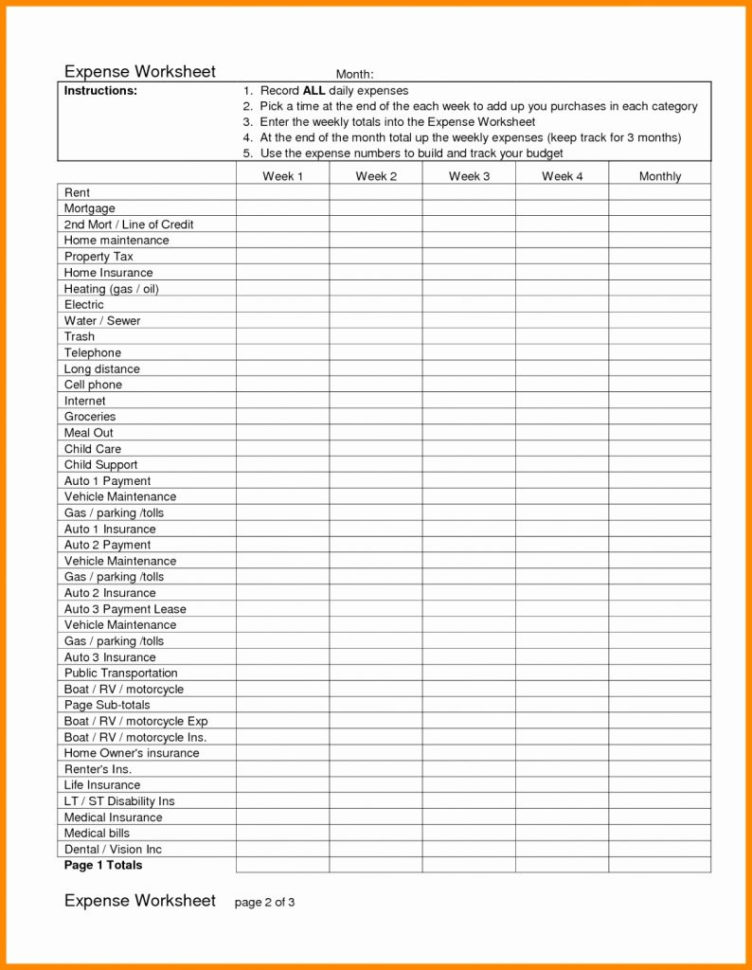

Schedule C Worksheet Excel

By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer). Automate sales and use tax, gst, and vat compliance. The first link below opens a.pdf document that outlines the various income and expense categories that are reported on a schedule c. Plus irs could ask.

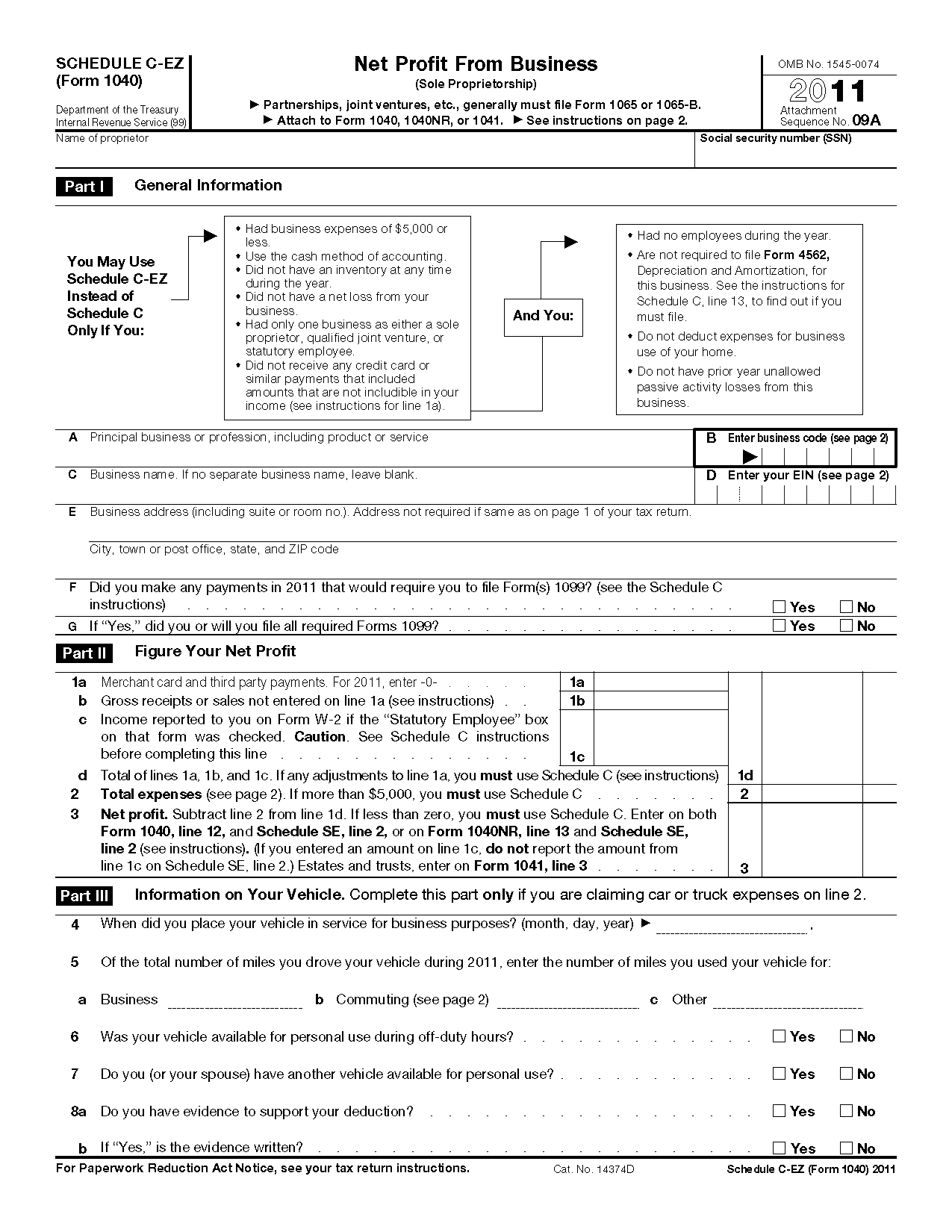

Schedule C Form Fillable Free

“evidence” includes mileage logs, appointment records, calendars, etc. Plus irs could ask for odometer readings from oil changes, repair. Automate sales and use tax, gst, and vat compliance. By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer). The best way to reduce you taxable.

Schedule C Worksheet Excel

“evidence” includes mileage logs, appointment records, calendars, etc. Plus irs could ask for odometer readings from oil changes, repair. The best way to reduce you taxable income is track income & expenses for tax form 1040 schedule c. The first link below opens a.pdf document that outlines the various income and expense categories that are reported on a schedule c..

Schedule C Expenses Worksheet 2023

Plus irs could ask for odometer readings from oil changes, repair. “evidence” includes mileage logs, appointment records, calendars, etc. Automate sales and use tax, gst, and vat compliance. By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer). The first link below opens a.pdf document.

Schedule C Instructions How to Fill Out Form 1040 Excel Capital

By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer). The first link below opens a.pdf document that outlines the various income and expense categories that are reported on a schedule c. Plus irs could ask for odometer readings from oil changes, repair. Automate sales.

Schedule C Worksheet Fillable

“evidence” includes mileage logs, appointment records, calendars, etc. By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer). Automate sales and use tax, gst, and vat compliance. Plus irs could ask for odometer readings from oil changes, repair. The best way to reduce you taxable.

The Best Way To Reduce You Taxable Income Is Track Income & Expenses For Tax Form 1040 Schedule C.

“evidence” includes mileage logs, appointment records, calendars, etc. The first link below opens a.pdf document that outlines the various income and expense categories that are reported on a schedule c. Plus irs could ask for odometer readings from oil changes, repair. By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer).