Keeping Records For Tax Deductions - Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Talk to an experttax pros

Talk to an experttax pros Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

Talk to an experttax pros Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

3 Tips For Keeping Tax Records For Your Business National Insurance

Talk to an experttax pros Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

9 Tax Records You Should Keep In Your Business To Avoid IRS Audit

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Talk to an experttax pros

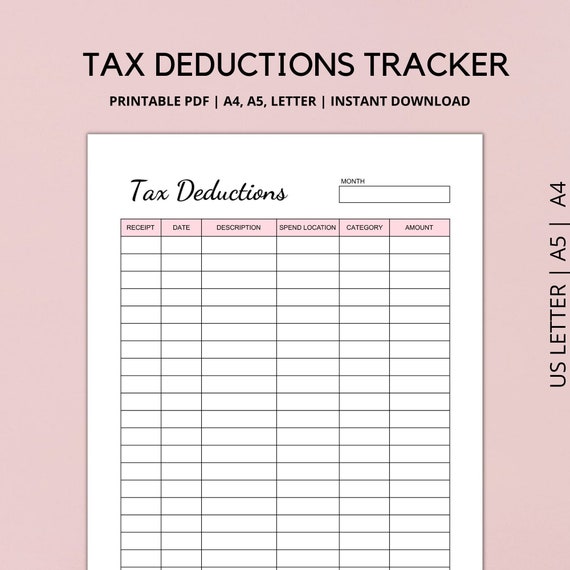

Tax Deduction Tracker Printable Business Tax Log Expenses Etsy

Talk to an experttax pros Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

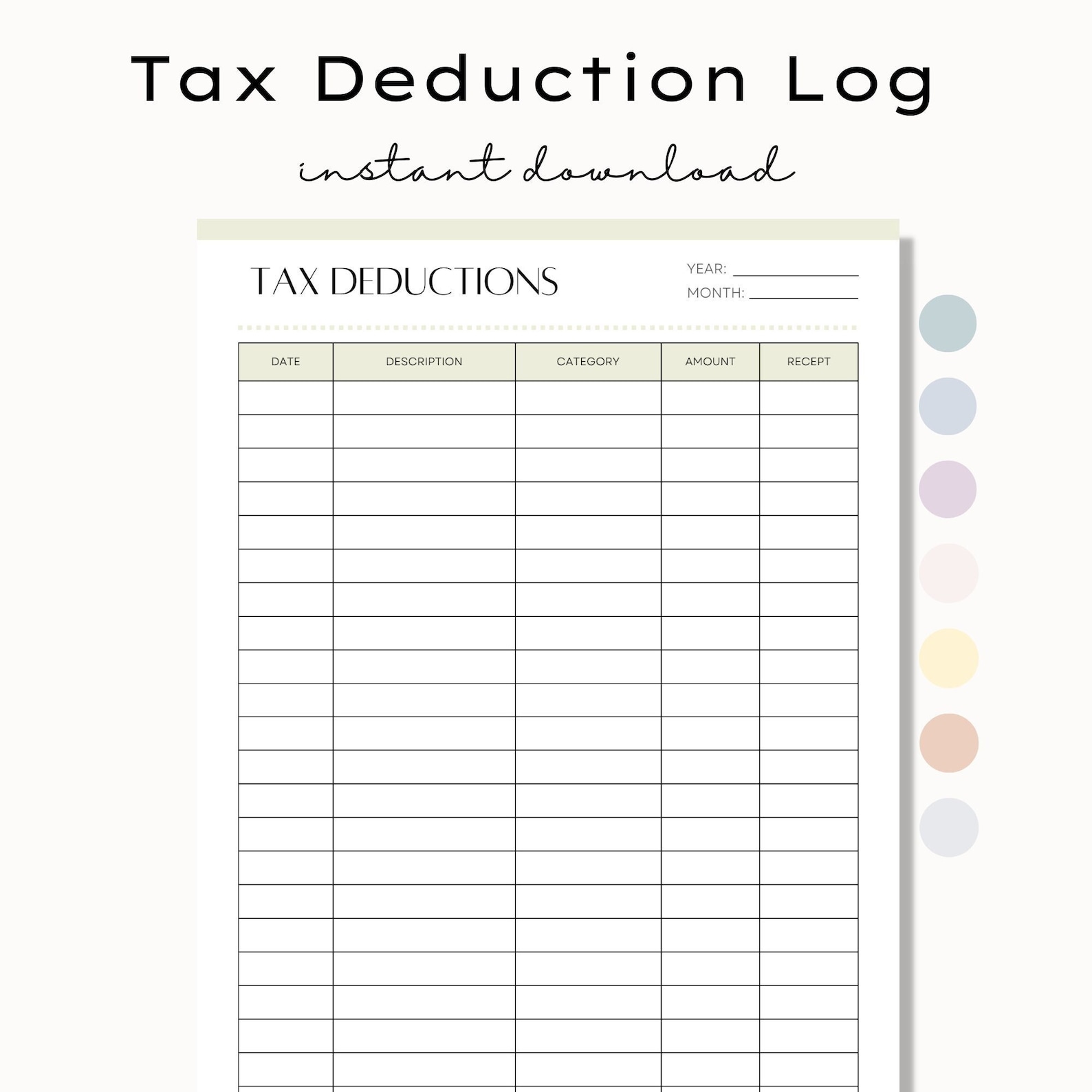

Download Printable Simple Tax Deductions Tracker Template PDF

Talk to an experttax pros Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

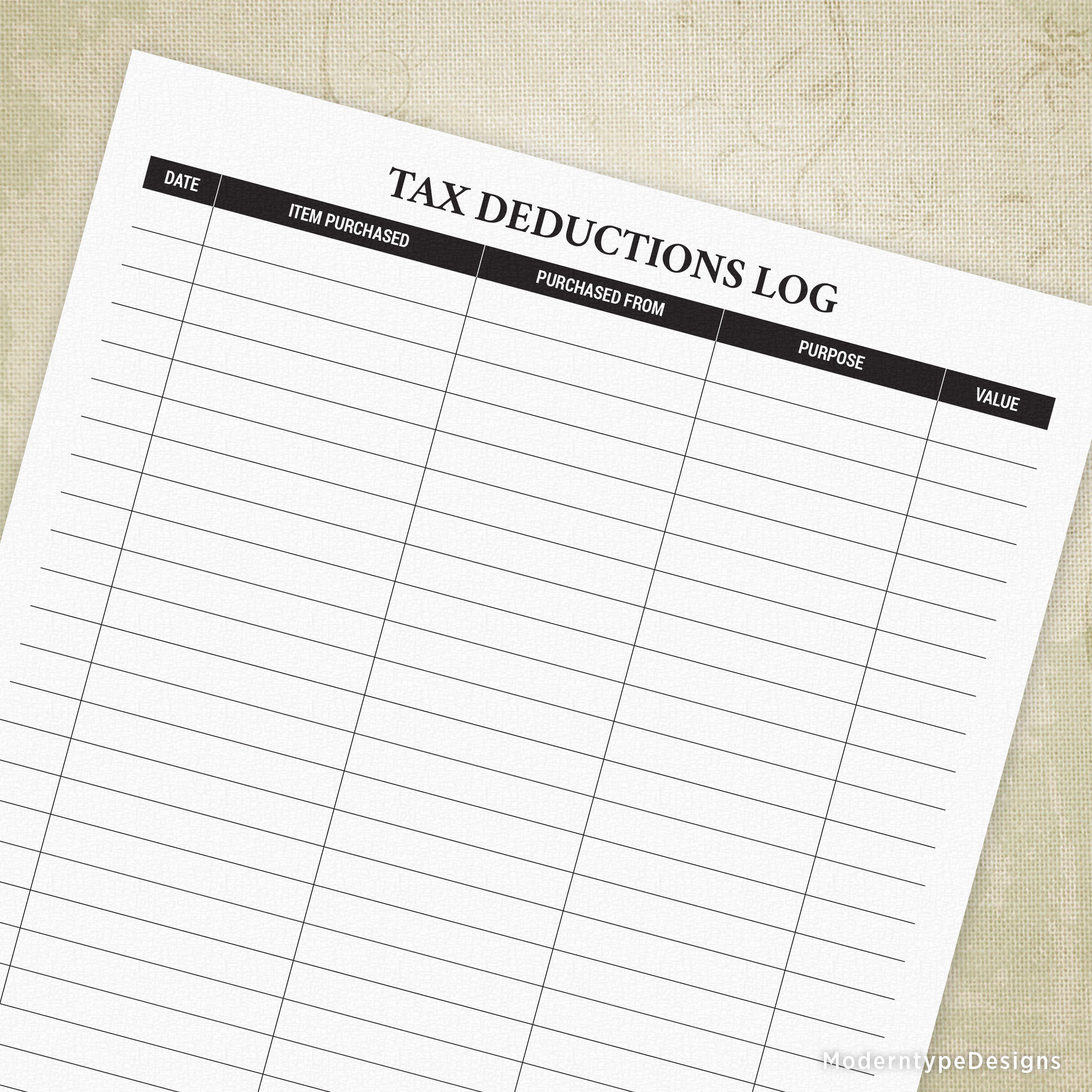

Tax Deductions Log Printable, Expenses Tracker, Purchase Records

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Talk to an experttax pros

Printable Tax Deduction Tracker, Tax Deduction Log, Business Tax Log

Talk to an experttax pros Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

Keeping Meticulous Records Is the Key to Tax Deductions and Painless

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Talk to an experttax pros

Tax Deduction Log Book Notebook Organizer For Simple Tax

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Talk to an experttax pros

The Importance of Accurate Record Keeping for Tax Purposes Lighthouse

Talk to an experttax pros Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

Find Out The Kinds Of Records You Should Keep For Your Business To Show Income And Expenses For Federal Tax Purposes.

Talk to an experttax pros