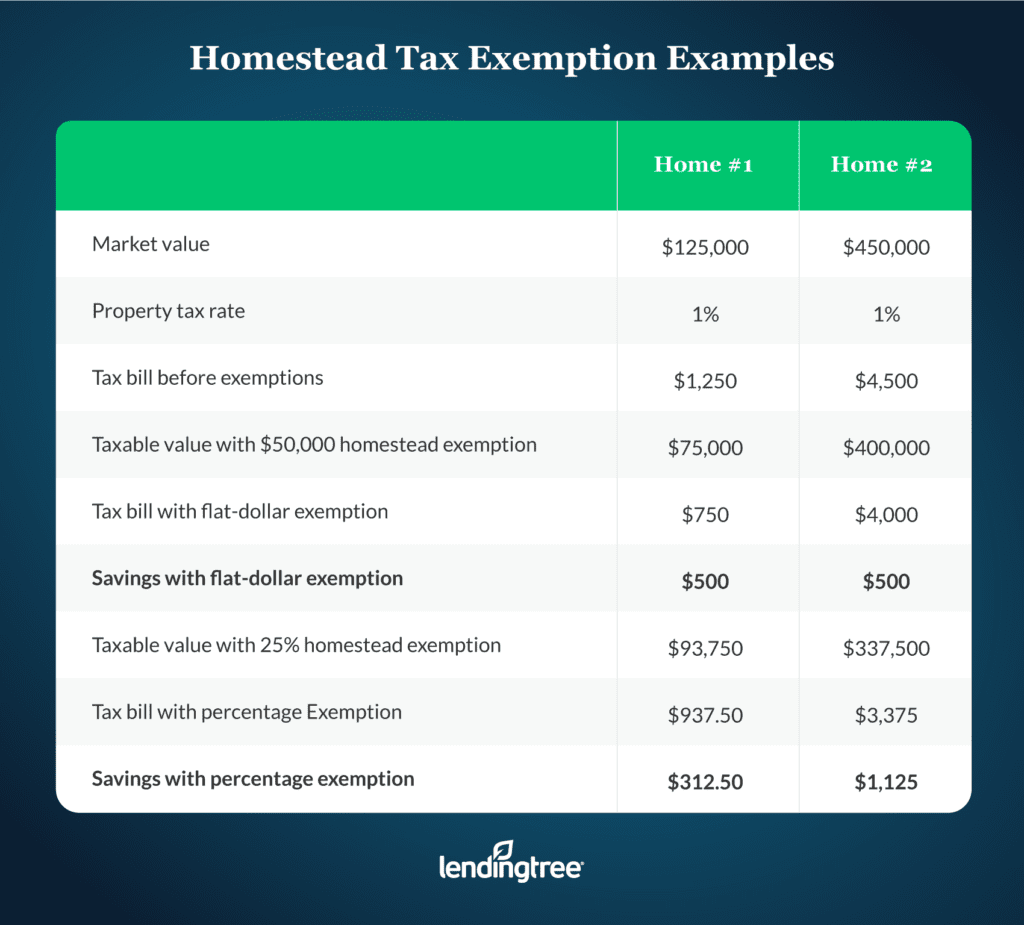

King County Property Tax Exempt Form - State law provides 2 tax benefit programs for senior citizens and persons with disabilities. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. Click here to apply online, or apply. Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. They include property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income.

Click here to apply online, or apply. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. They include property tax exemptions and property. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or.

Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. They include property tax exemptions and property. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Click here to apply online, or apply.

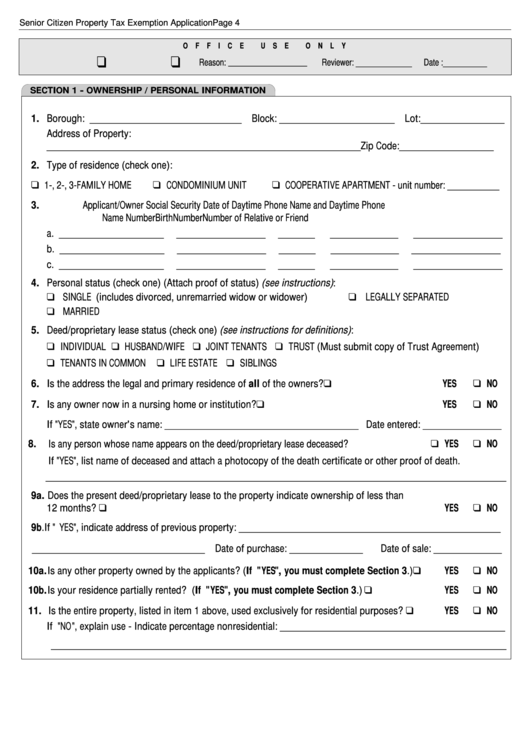

Fillable Online short form property tax exemption for seniors

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors.

King County Property Tax Exemption 2025 Stephen E. Stanley

To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. They include property tax exemptions and property. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. Launching in may, monthly workshops will take place where eligible king county residents will meet with.

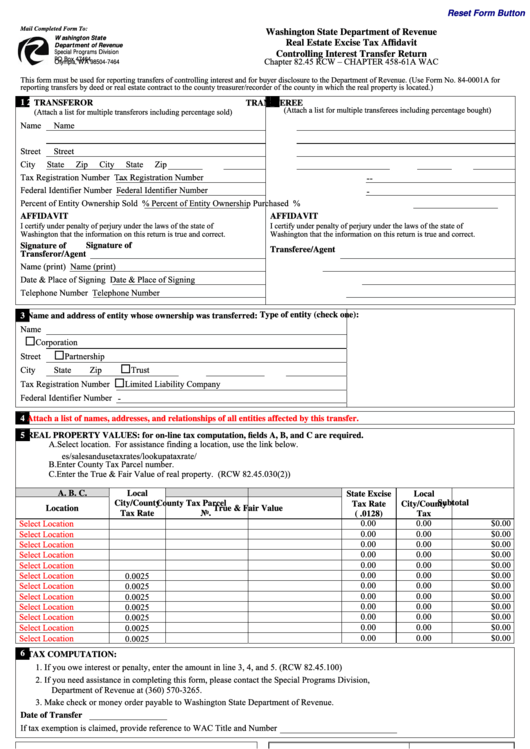

King County Real Estate Excise Tax Affidavit Form 2024

Click here to apply online, or apply. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property.

King County Audit Property Tax Exemptions YouTube

State law provides 2 tax benefit programs for senior citizens and persons with disabilities. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. They include property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction.

Property Tax Exemption for Seniors Form Larimer County

Click here to apply online, or apply. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. Exempt from regular property taxes on $60,000 or 60% of the.

King County Senior Property Tax Exemption 2025 Lark Aurelia

They include property tax exemptions and property. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. State law provides 2 tax benefit programs for senior citizens.

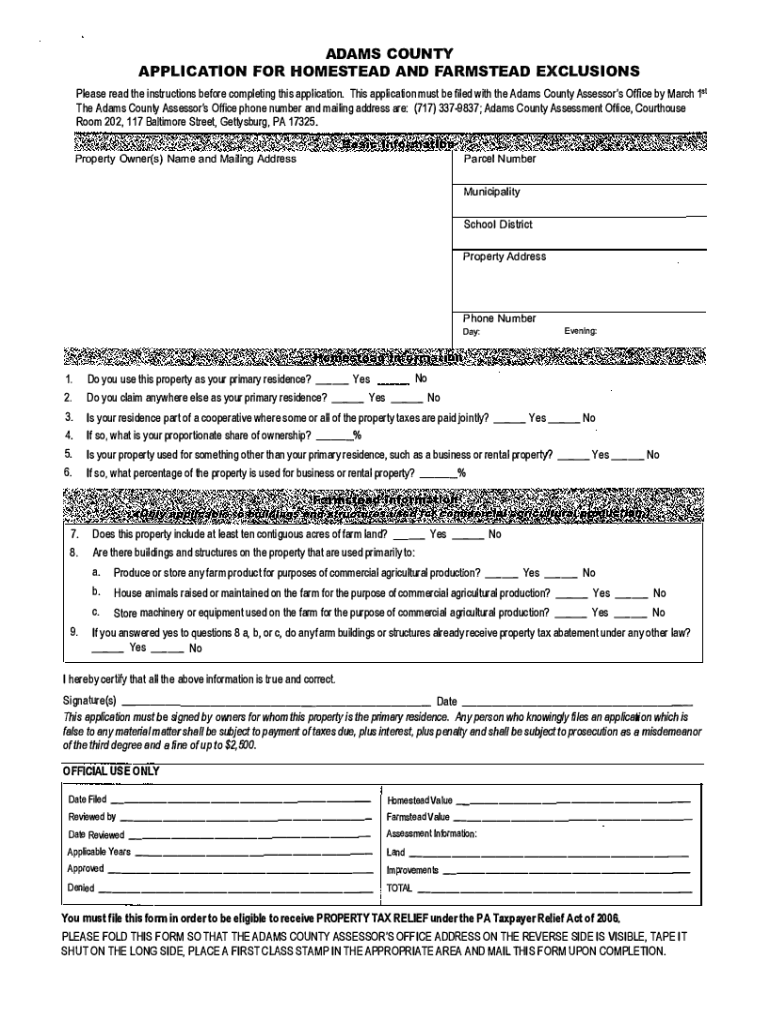

Pa Tax Exemption Form 2025 A Alice Fairfax

Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. They include property tax exemptions and property. Click here to apply online, or apply. Launching in may, monthly workshops will.

Property Tax King 2025

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value,.

Fillable Online Real Property Tax Exemptions Fax Email Print pdfFiller

To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who.

King County Senior Property Tax Exemption 2025 Karen K. Ater

They include property tax exemptions and property. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Launching in may, monthly workshops will take place where eligible king county residents will meet with.

Click Here To Apply Online, Or Apply.

Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. They include property tax exemptions and property. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income.

Exempt From Regular Property Taxes On $60,000 Or 60% Of The Valuation, Whichever Is Greater, Plus Exemption From 100%.

State law provides 2 tax benefit programs for senior citizens and persons with disabilities. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or.