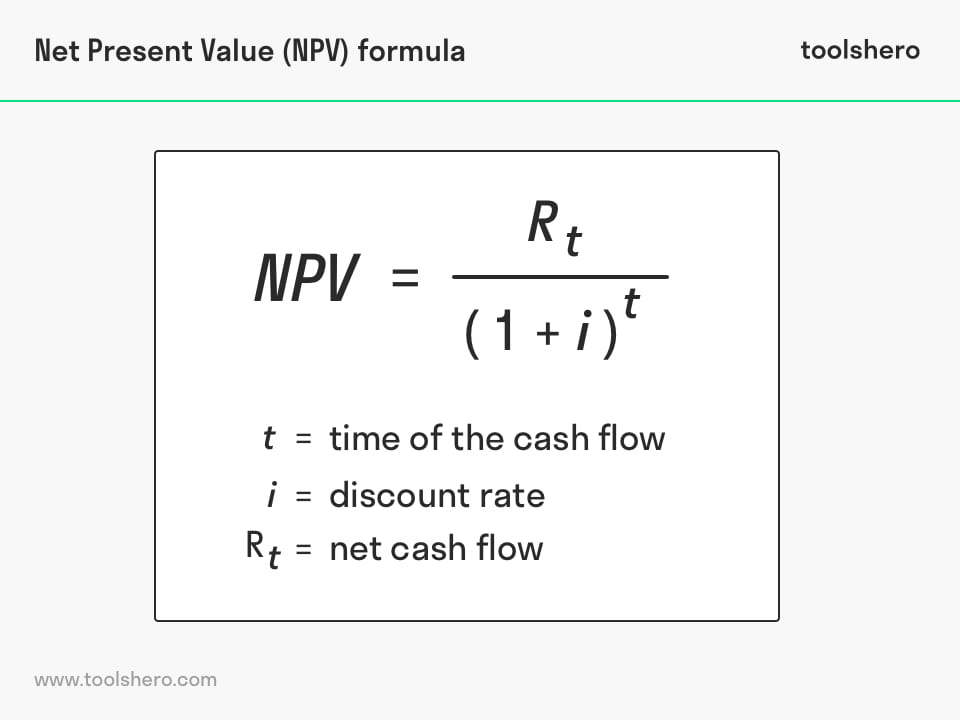

Npv Of An Investment Formula - How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment.

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment.

The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and.

Net Present Value formula and example Toolshero

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash.

Net Present Value Calculating and Using Payment Savvy

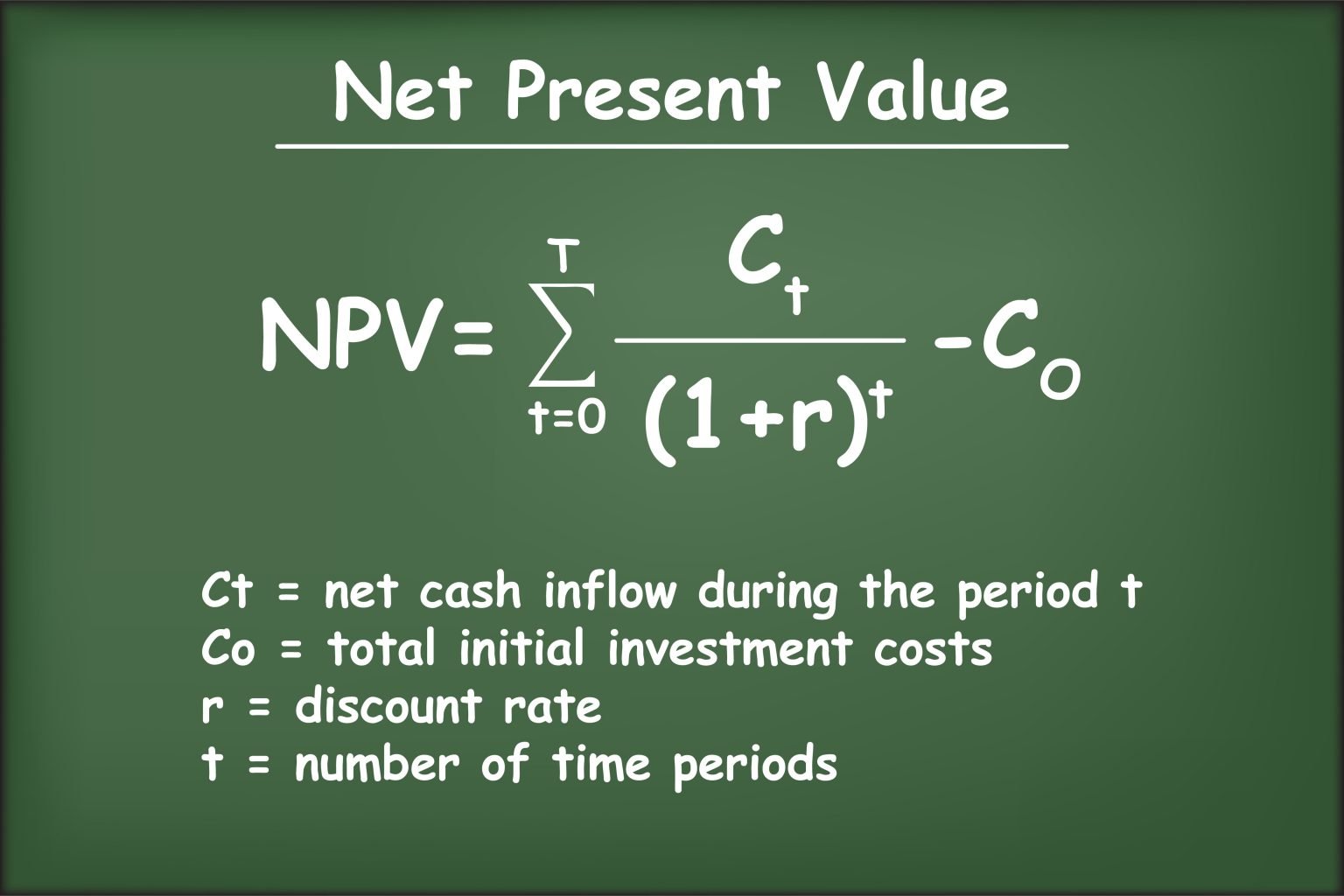

The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash.

Net Present Value (NPV) What It Means and Steps to Calculate It

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. The formula for calculating npv involves taking the present value of future cash flows and subtracting.

How to calculate the net present value (NPV) of a UX team Juan

The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future.

Net present value What is it, NPV formula, Calculation, Examples ,FAQ

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash.

Net Present Value Excel Template Sample Professional Template

The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash.

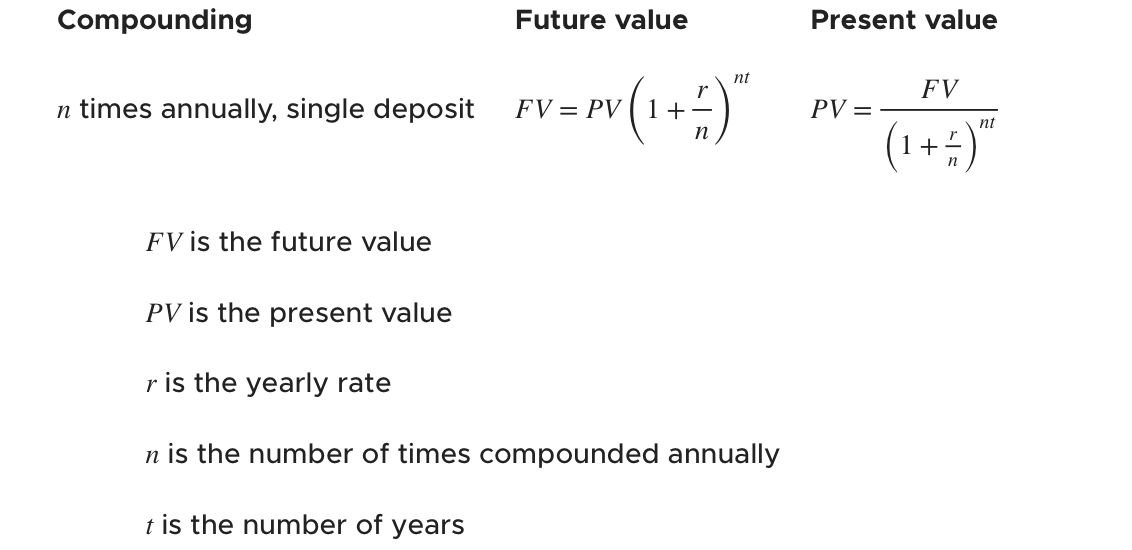

Present Value Formula

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future.

How to find present and future value of an investment — Krista King

The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash.

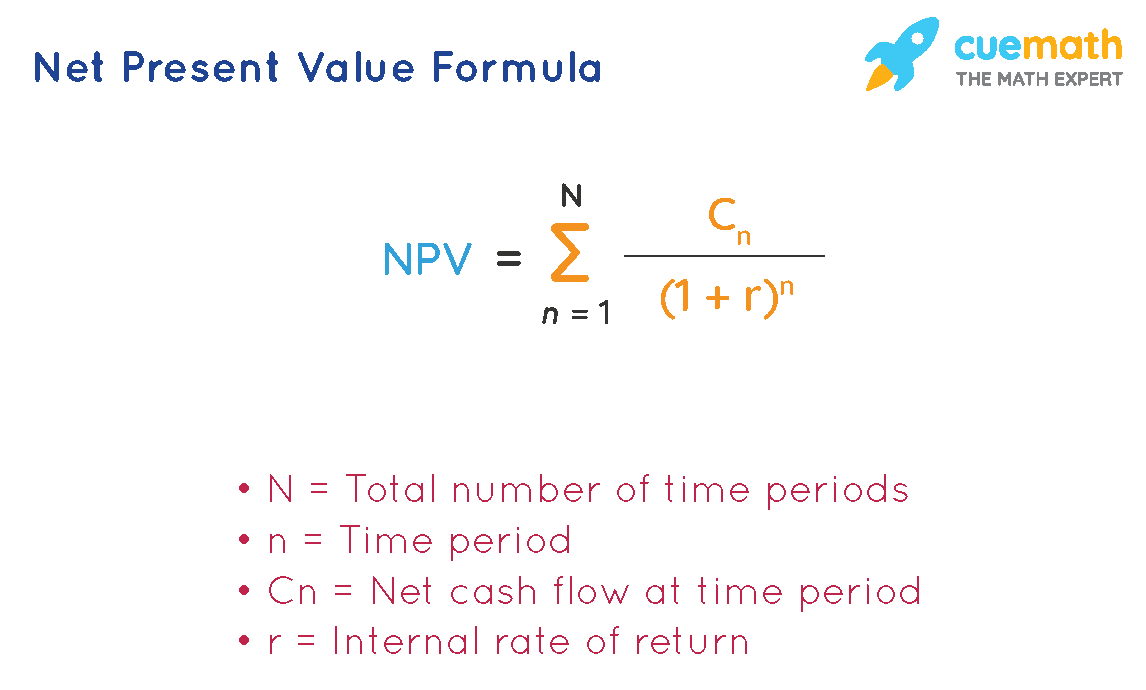

NPV Present Value) Definition, Benefits, Formula, and Examples

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future.

Net Present Value Formula Derivation, Examples

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future.

Net Present Value, Npv, Is A Capital Budgeting Formula That Calculates The Difference Between The Present Value Of The Cash Inflows And Outflows.

The formula for calculating npv involves taking the present value of future cash flows and subtracting the initial investment. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and.