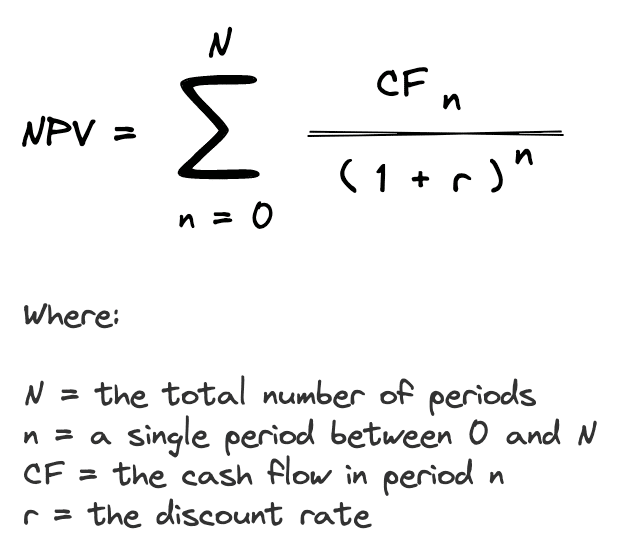

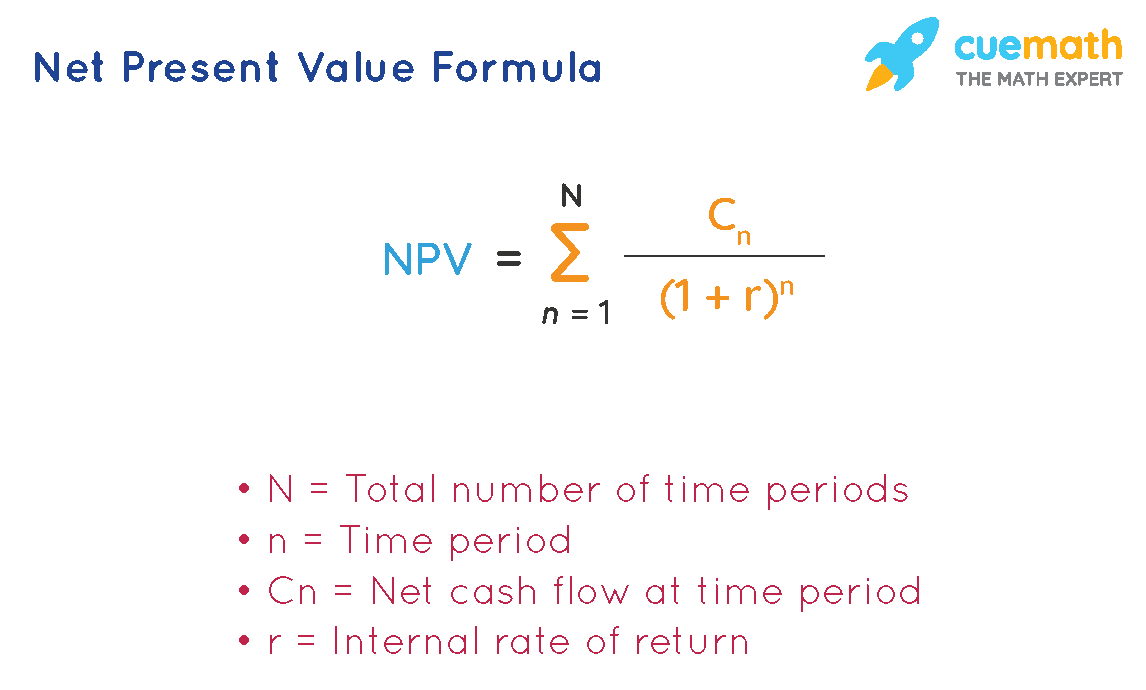

Npv Of Cash Flows Formula - How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. The npv formula is a way of calculating the net present value (npv) of a series of cash flows based on a specified discount rate. Net present value (npv) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received. Net present value is a financial metric used to determine the value of an investment by calculating the difference.

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value is a financial metric used to determine the value of an investment by calculating the difference. The npv formula is a way of calculating the net present value (npv) of a series of cash flows based on a specified discount rate. Net present value (npv) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received.

Net present value (npv) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received. Net present value is a financial metric used to determine the value of an investment by calculating the difference. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. The npv formula is a way of calculating the net present value (npv) of a series of cash flows based on a specified discount rate.

How To Calculate Net Present Value With Discount Rate In Excel Design

Net present value (npv) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received. Net present value is a financial metric used to determine the value of an investment by calculating the difference. The npv formula is a way of calculating the net present value (npv) of a series.

NPV Formula Learn How Net Present Value Really Works, Examples

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value is a financial metric used to determine the value of an investment by calculating the difference. The npv formula is a way of calculating the net present value (npv) of a series of cash flows based.

What You Should Know About the Discount Rate PropertyMetrics

Net present value is a financial metric used to determine the value of an investment by calculating the difference. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. The npv formula is a way of calculating the net present value (npv) of a series of cash flows based.

Present Value Formula for Continuous Compounding Kline Durged

Net present value (npv) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received. The npv formula is a way of calculating the net present value (npv) of a series of cash flows based on a specified discount rate. How to calculate net present value (npv) the net present.

Net Present Value Formula Derivation, Examples

Net present value (npv) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. The npv formula is a way of calculating the net present value (npv) of.

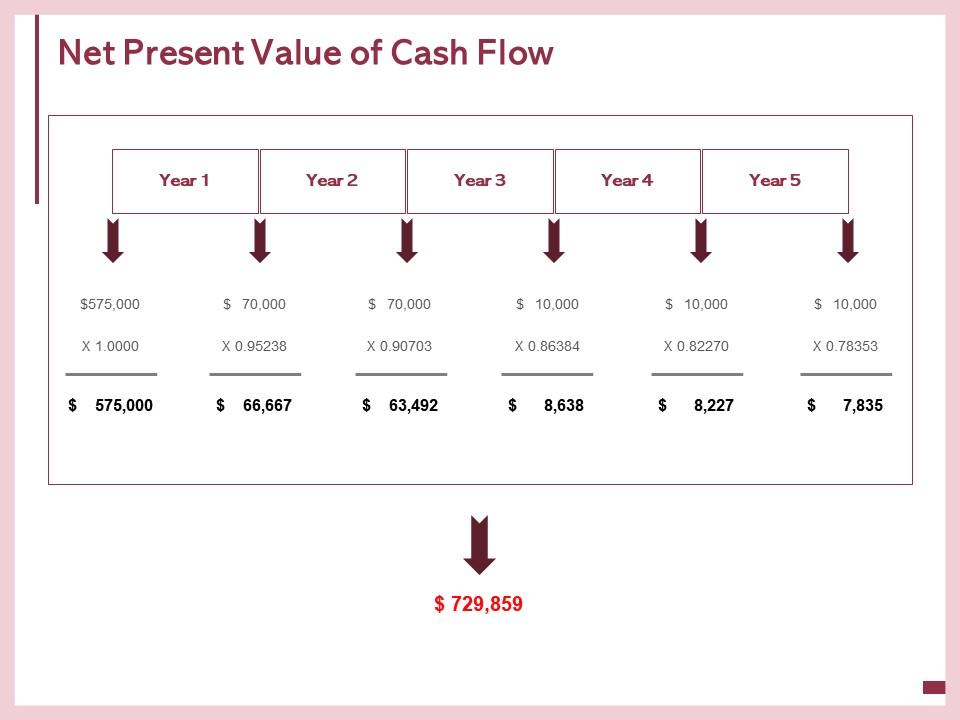

Net Present Value Example

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value (npv) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received. How to calculate net present value (npv) the net present value (npv) represents the discounted values.

NPV Present Value) Definition, Benefits, Formula, and Examples

Net present value (npv) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. The npv formula is a way of calculating the net present value (npv) of.

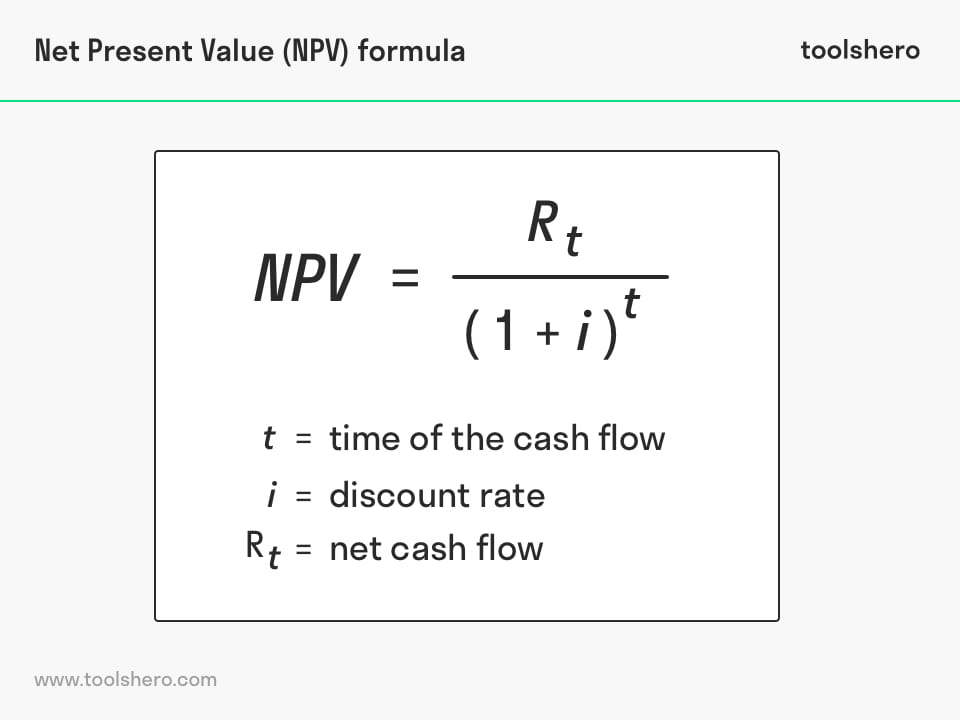

Net Present Value formula and example Toolshero

Net present value (npv) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received. The npv formula is a way of calculating the net present value (npv) of a series of cash flows based on a specified discount rate. Net present value is a financial metric used to determine.

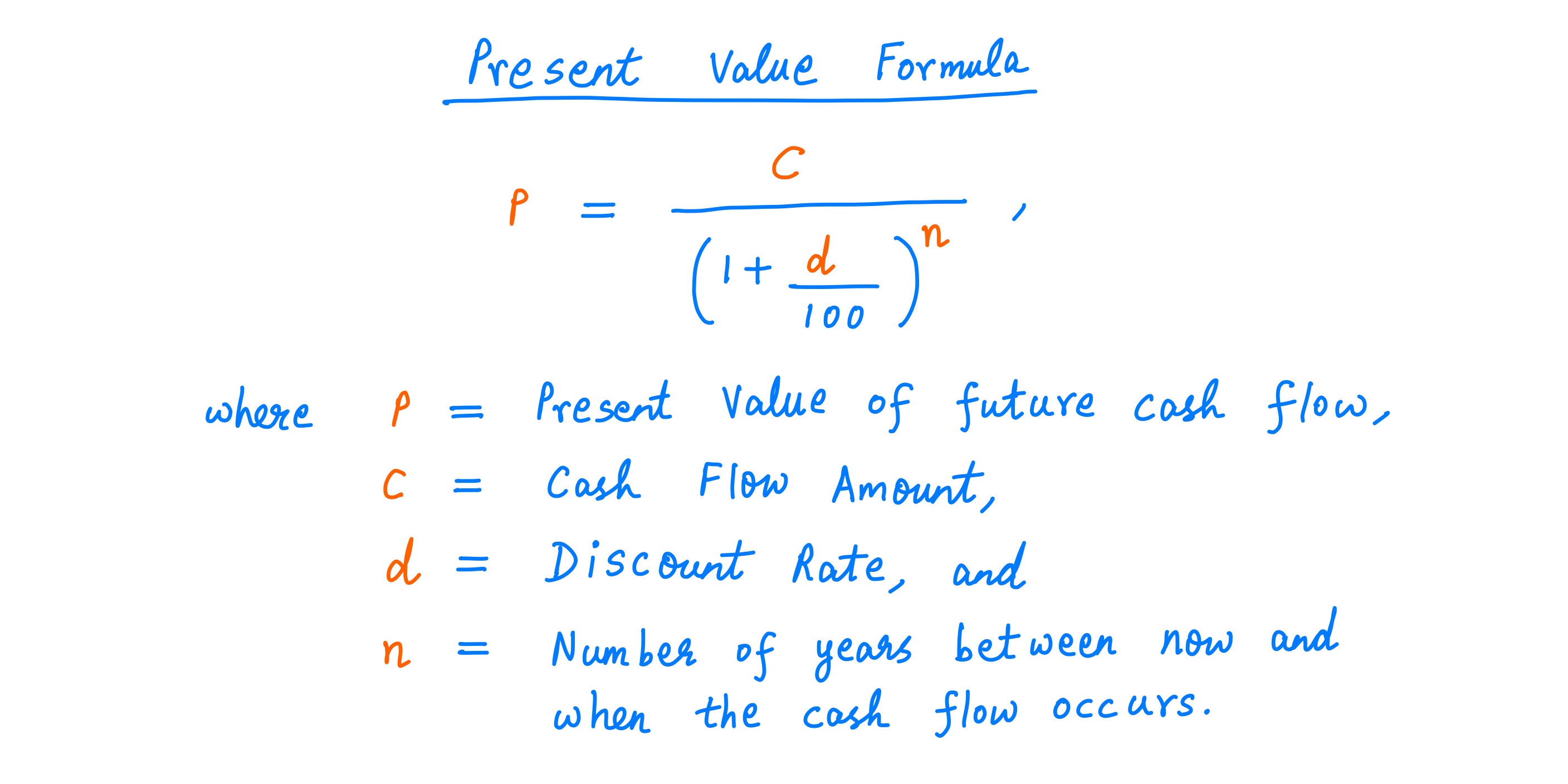

Present Value Formula

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value (npv) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received. The npv formula is a way of calculating the net present value (npv) of.

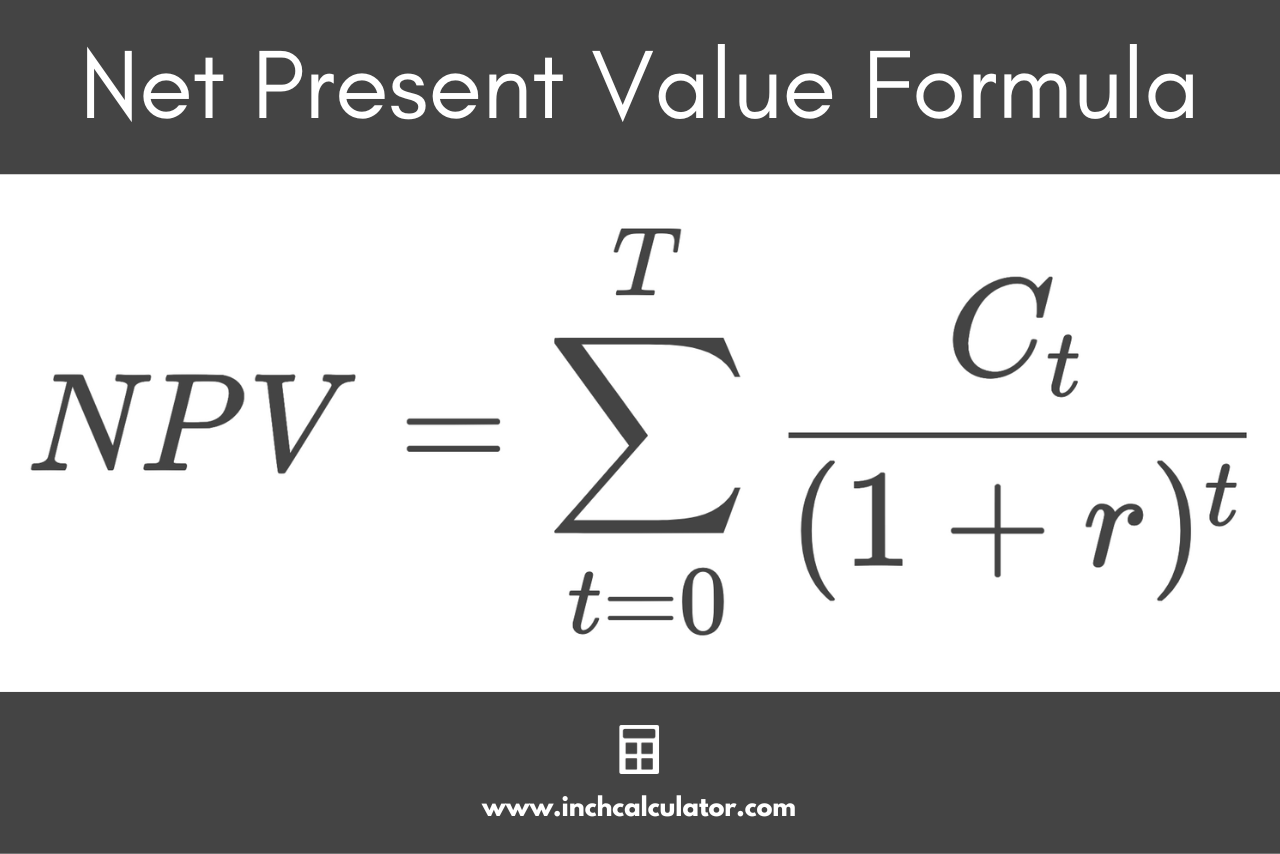

Net Present Value Calculator Inch Calculator

Net present value (npv) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received. Net present value is a financial metric used to determine the value of an investment by calculating the difference. How to calculate net present value (npv) the net present value (npv) represents the discounted values.

Net Present Value (Npv) Is A Formula Used To Determine The Present Value Of An Investment By The Discounted Sum Of All Cash Flows Received.

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. The npv formula is a way of calculating the net present value (npv) of a series of cash flows based on a specified discount rate. Net present value is a financial metric used to determine the value of an investment by calculating the difference.

:max_bytes(150000):strip_icc()/ScreenShot2019-06-20at10.46.59AM-f30499c2303c44a5a883c6c1e676569b.png)