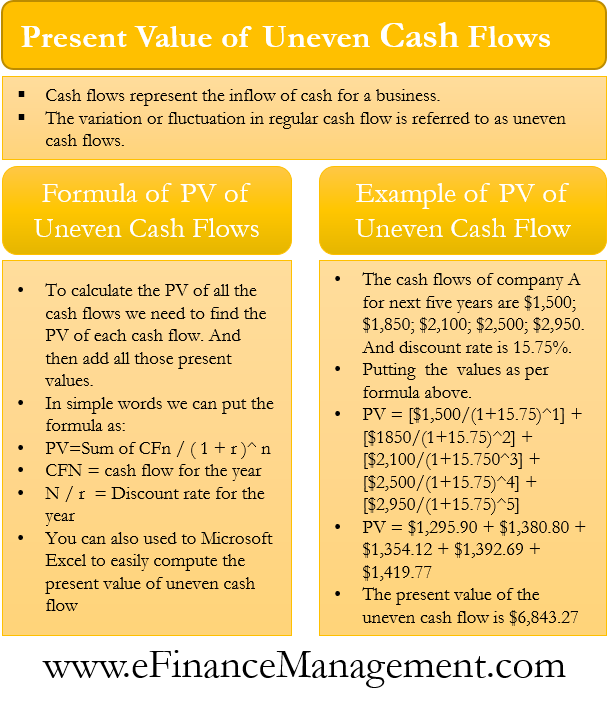

Npv Of Uneven Cash Flows Calculator - Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the.

4 Ways To Calculate NPV Wikihow Innovator

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the.

How to Calculate Future Value of Uneven Cash Flows in Excel

Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

Present value of uneven cash flows ba ii plus FINED YouTube

Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

How to Calculate Present Value of Uneven Cash Flows in Excel

Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

Cash flow stream calculator JacareAlisa

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the.

TVM (cont). ppt download

Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

Chapter 5 Discounted Cash Flow Valuation. ppt download

Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

CALCULATE NET PRESENT VALUE WITH UNEVEN CASH FLOW (Download formula for

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the.

Chapter 4 Time Value of Money. ppt download

Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

Calculate The Npv (Net Present Value) Of An Investment With An Unlimited Number Of Cash Flows.

Present value (pv) of uneven cash flows let’s assume that $1,500 will be received at the end of the first year, $1,850 at the end of the.

:max_bytes(150000):strip_icc()/ScreenShot2019-06-20at10.46.59AM-f30499c2303c44a5a883c6c1e676569b.png)