Online Financial Calculator Npv - On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Enter the initial investments, discount rate, and cash flows in the npv calculator, and it will calculate the net present value. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. The npv is the sum of the present values of incoming and. This calculator helps you determine the net present value (npv) of an investment.

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. The npv is the sum of the present values of incoming and. This calculator helps you determine the net present value (npv) of an investment. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Enter the initial investments, discount rate, and cash flows in the npv calculator, and it will calculate the net present value.

The npv is the sum of the present values of incoming and. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. This calculator helps you determine the net present value (npv) of an investment. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Enter the initial investments, discount rate, and cash flows in the npv calculator, and it will calculate the net present value.

NPV Calculator Calculate Net Present Value Online multipl

The npv is the sum of the present values of incoming and. Enter the initial investments, discount rate, and cash flows in the npv calculator, and it will calculate the net present value. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. This calculator helps you determine the net present value (npv) of.

Free NPV Calculator Online Calculate Net Present Value AI For Data

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Enter the initial investments, discount rate, and cash flows in the npv calculator, and it will calculate the net present value. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at.

NPV or net present value in HP 10bii financial calculator HP 10bii

This calculator helps you determine the net present value (npv) of an investment. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. The npv is the sum of the present values of incoming and. Enter the initial investments, discount rate, and cash flows.

NPV Calculator Online

The npv is the sum of the present values of incoming and. This calculator helps you determine the net present value (npv) of an investment. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Enter the initial investments, discount rate, and cash flows in the npv calculator, and it will calculate the net.

Net Present Value Calculating and Using Payment Savvy

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. The npv is the sum of the present values of incoming and. Enter the initial investments, discount rate,.

Net Present Value Calculator What Is Net Present Value? For Business

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Enter the initial investments, discount rate, and cash flows in the npv calculator, and it will calculate the.

Free NPV Calculator Online Calculate Net Present Value AI For Data

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. The npv is the sum of the present values of incoming and. Enter the initial investments, discount rate,.

Risk and Managerial (Real) Options in Capital Budgeting ppt video

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. This calculator helps you determine the net present value (npv) of an investment. The npv is the sum of the present values of incoming and. Enter the initial investments, discount rate, and cash flows in the npv calculator, and it will calculate the net.

Free FREE NPV Calculator to Maximize Investment Value with Explanatory

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. This calculator helps you determine the net present value (npv) of an investment. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Enter the initial investments, discount.

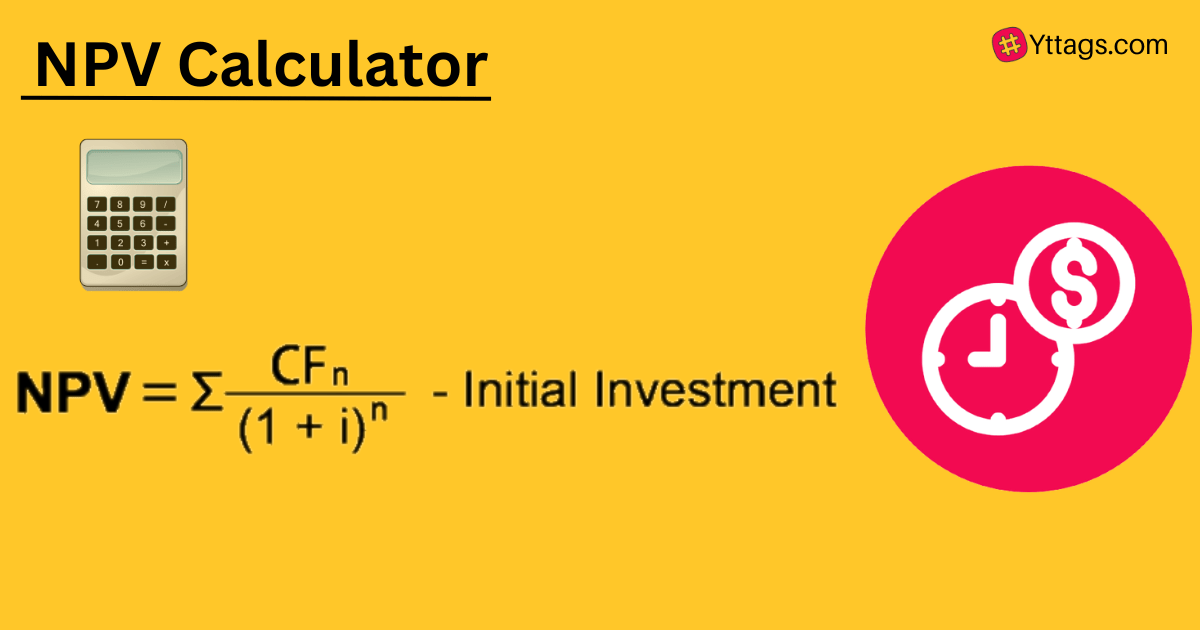

NPV Calculator Calculate Net Present Value Online Yttags

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Enter the initial investments, discount rate, and cash flows in the npv calculator, and it will calculate the net present value. Calculate the npv (net present value) of an investment with an unlimited number.

On This Page, You Can Calculate Net Present Value (Npv) Of An Investment Based On A Series Of Cash Flows That Occur At Regular Time Intervals.

The npv is the sum of the present values of incoming and. This calculator helps you determine the net present value (npv) of an investment. Enter the initial investments, discount rate, and cash flows in the npv calculator, and it will calculate the net present value. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.