Operating Cash Flow Ratio Formula - The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

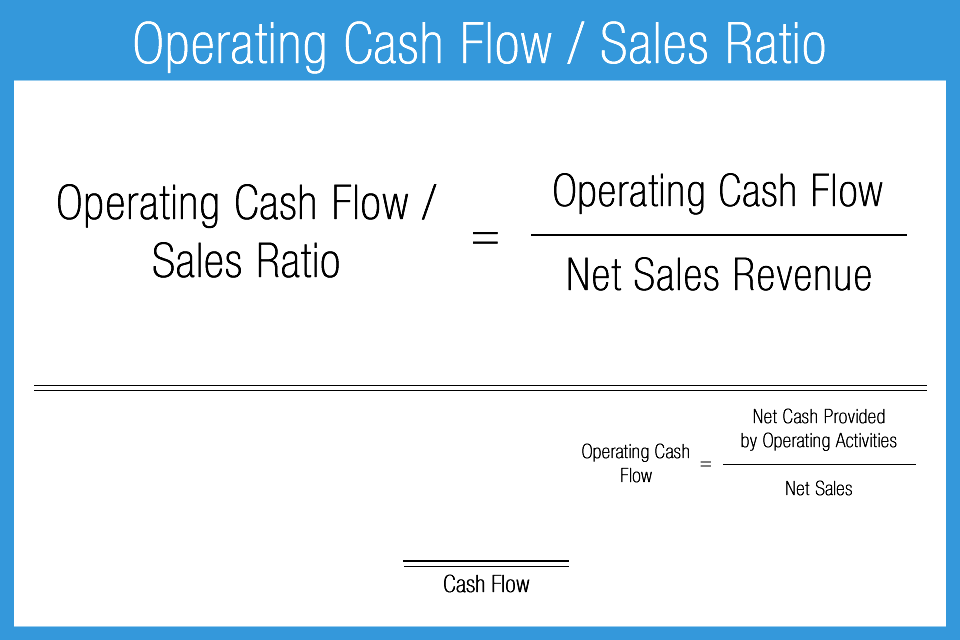

How Do You Calculate Operating Cash Flow To Sales Ratio

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

Operating free cashflow pastortune

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

operating cash flow ratio industry average Odilia Card

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

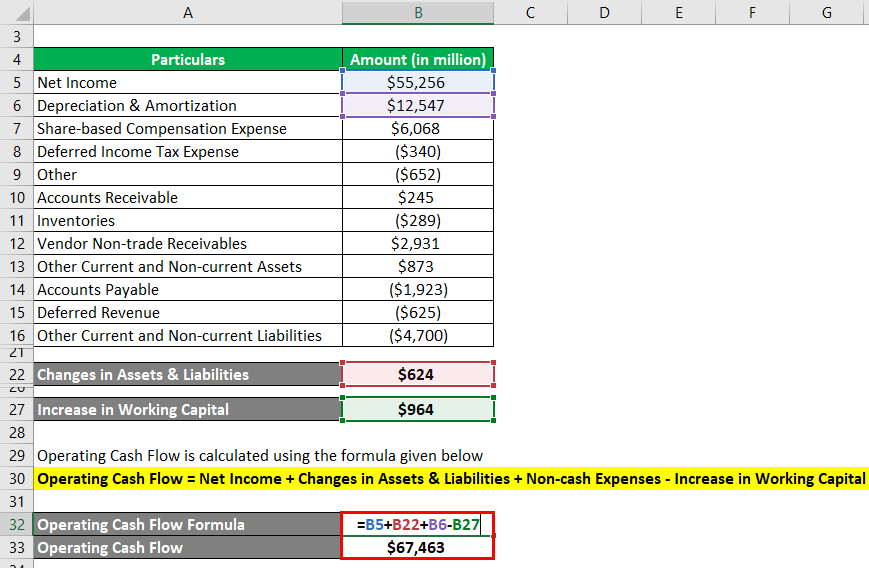

Operating Cash Flow Formula Examples with excel template & calculator

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

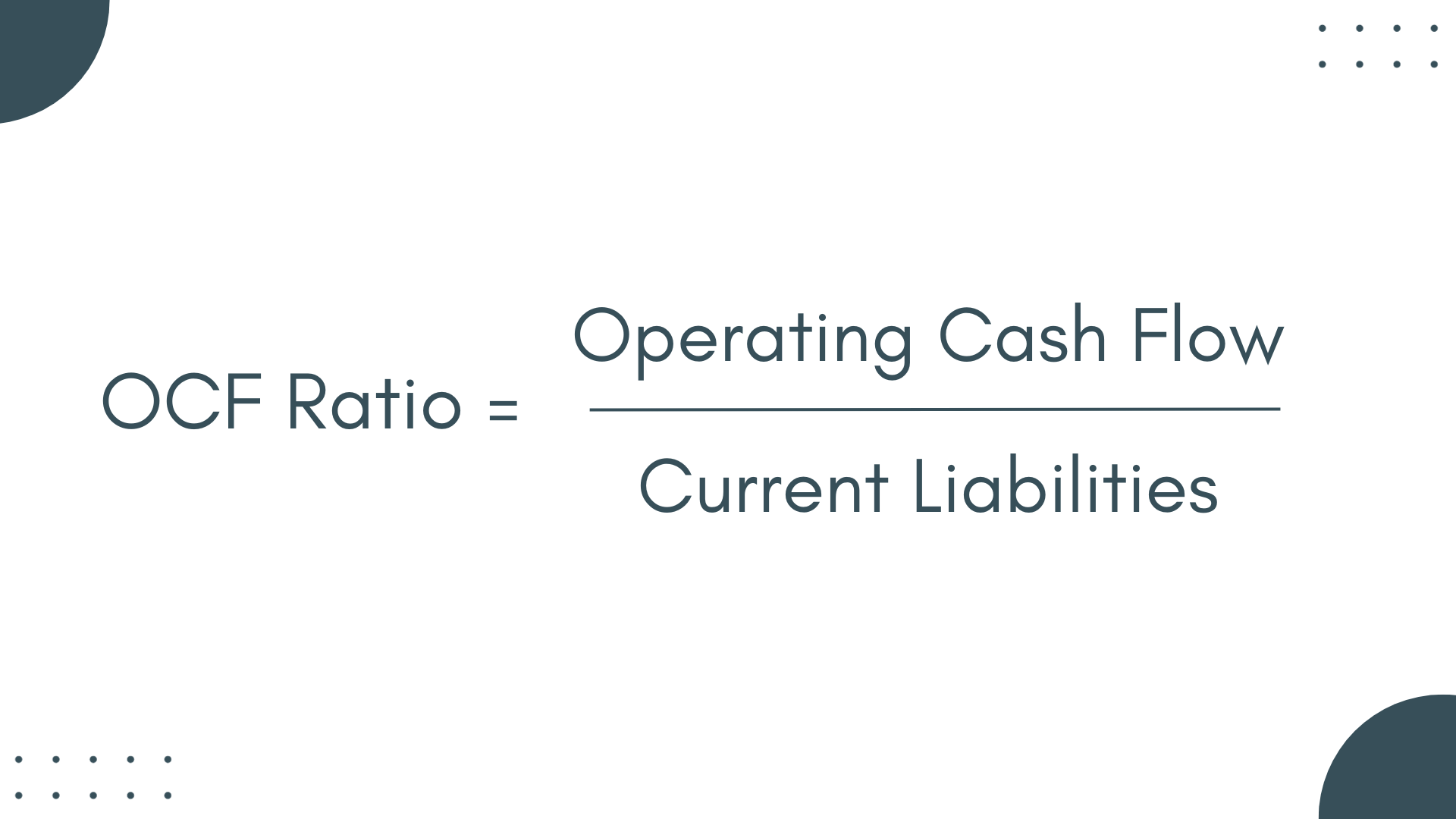

Operating Cash Flow Ratio Definition and Formula

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

Operating Cash Flow Ratio Understanding and Calculating

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

Liquidity Ratio All You Need to Know About Liquidity Ratios

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

Operating Cash Flow Overview, Example, Formula

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

cash flow calculator DrBeckmann

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

Operating Cash Flow Formula Examples with excel template & calculator

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

Learn How To Calculate Operating Cash Flow (Ocf) Using The Direct And Indirect Methods, And See An Example For A Music Retail Store.

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.