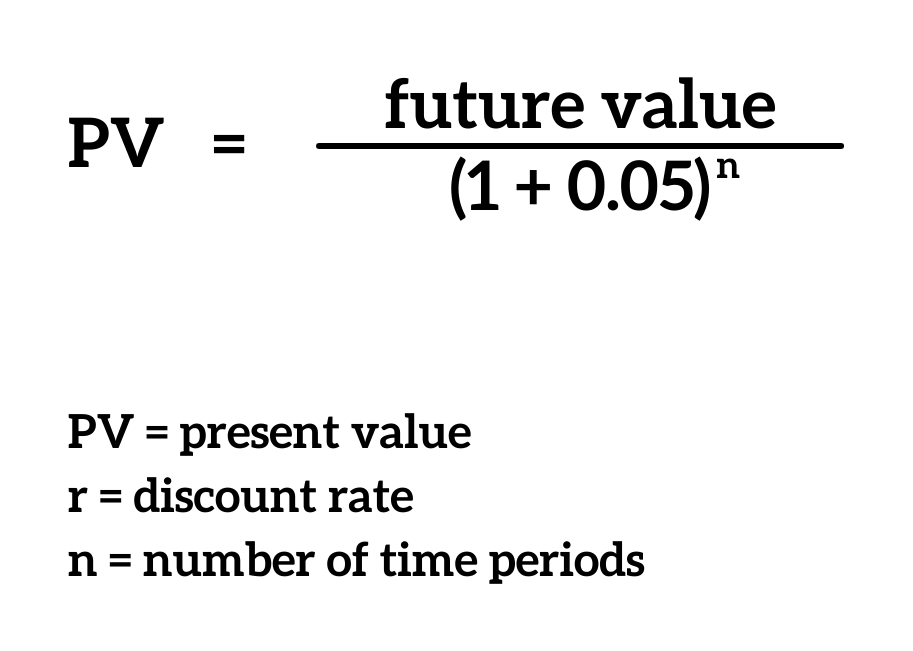

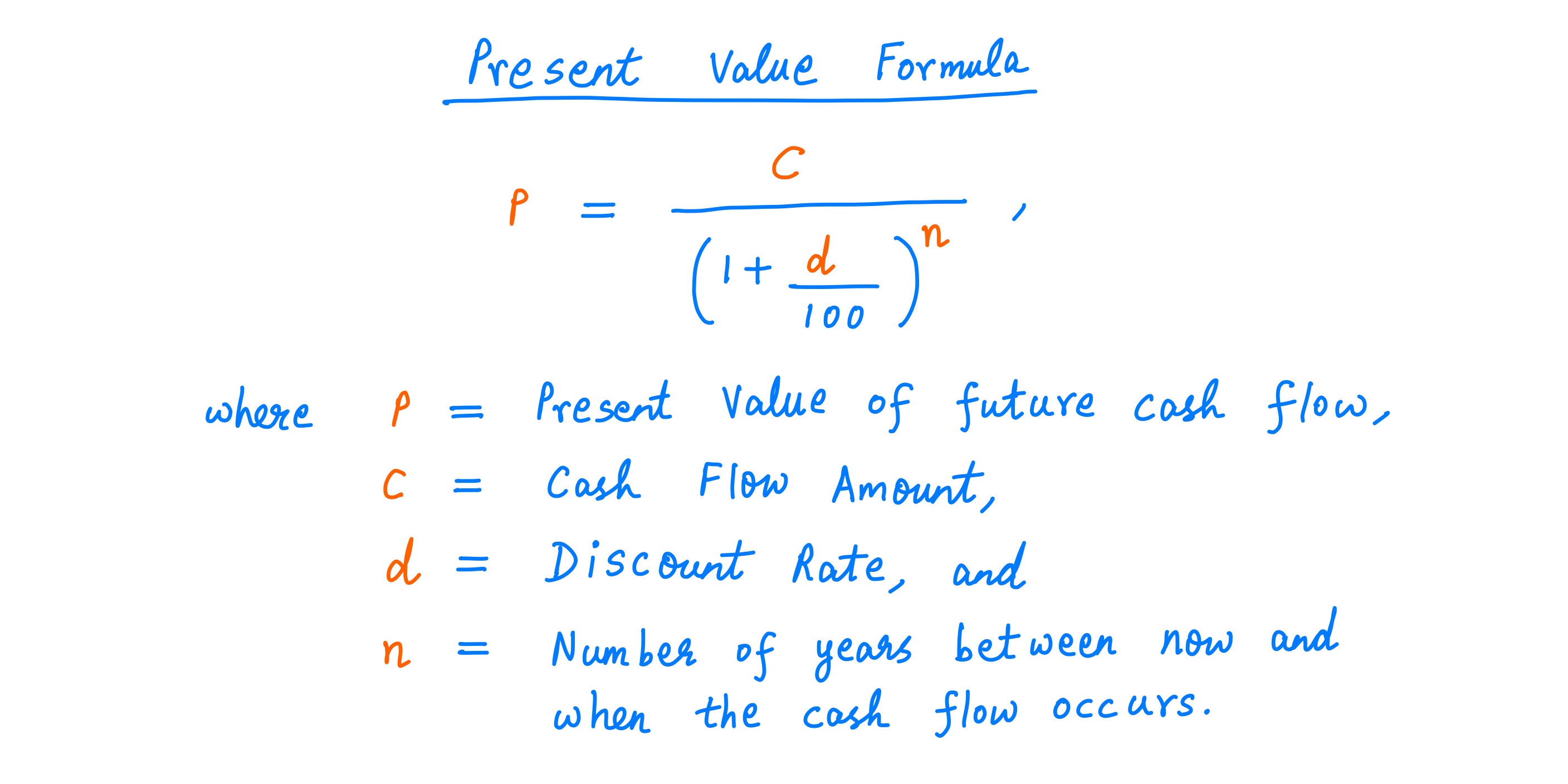

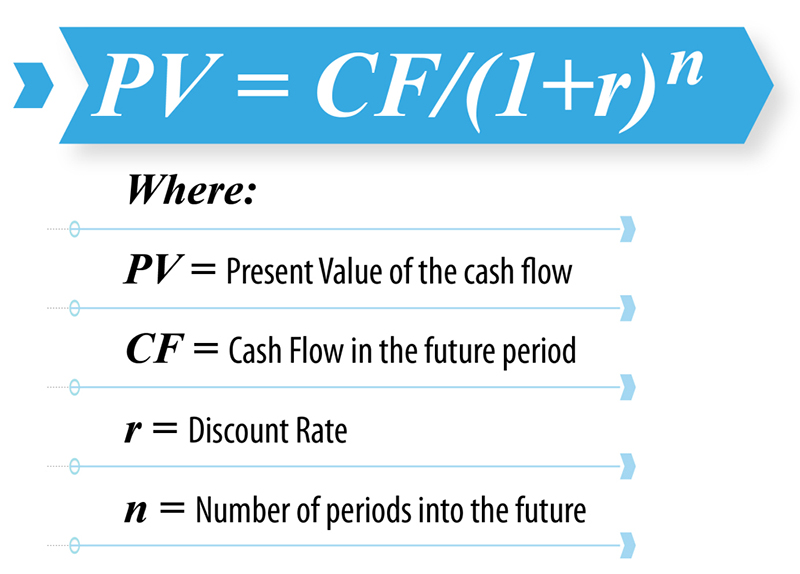

Present Value Of Cash Flows Formula - The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as: At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into.

Using the present value formula, the pv of this future cash flow can be calculated as: Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into.

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as:

PPT The Concept of Present Value PowerPoint Presentation, free

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as: At the heart of present value calculations lies a fundamental mathematical formula that.

Chapter 7 The Timing and Value of Cash Flows. ppt download

Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Using the present value formula, the pv of this future cash.

How to Calculate Present Value of Uneven Cash Flows in Excel

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Using the present value formula, the pv of this future cash.

Present Value in Finance Calculations and Applications SuperMoney

Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as: The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. At the heart of present value calculations lies a fundamental mathematical formula that.

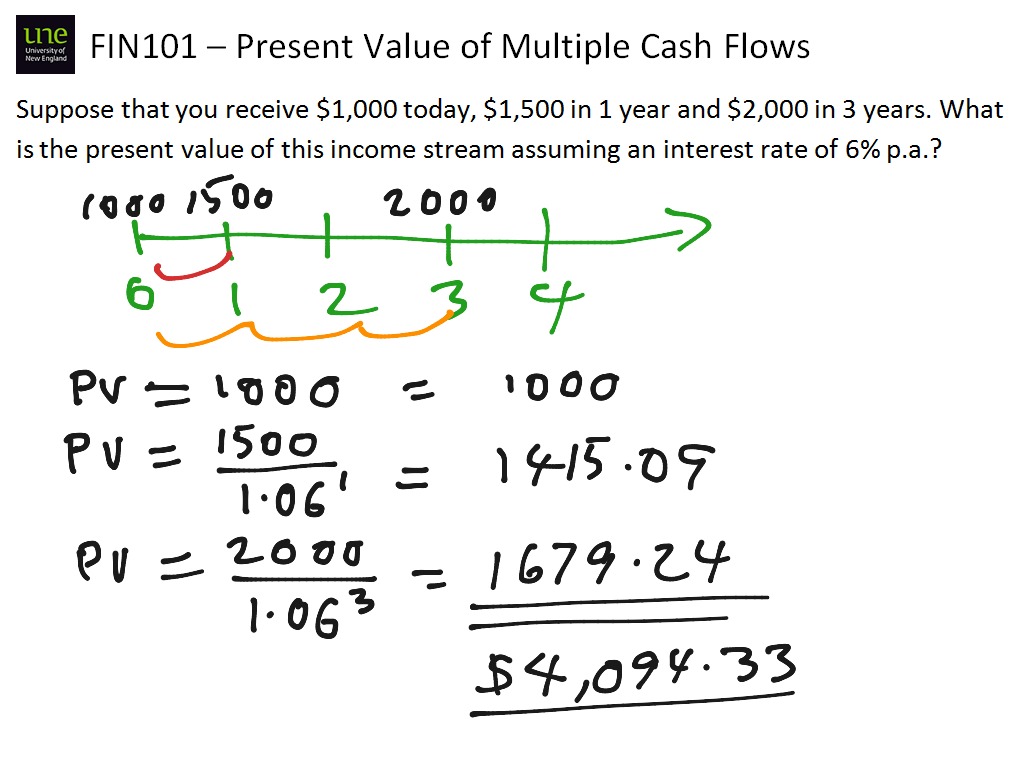

Present Value of Multiple Cash Flows Time Value Of Money ShowMe

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as: At the heart of present value calculations lies a fundamental mathematical formula that.

How To Solve Cash Flow Diagrams

Using the present value formula, the pv of this future cash flow can be calculated as: Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. The present value (pv) formula discounts the future value (fv) of a cash flow received in the.

Present Value Formula

At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash.

Present value of uneven cash flows ba ii plus FINED YouTube

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash.

Discounted Cash Flow Analysis Formula, Use, Types & Benefits IBCA

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as: At the heart of present value calculations lies a fundamental mathematical formula that.

How To Calculate Present Value Riset

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash.

At The Heart Of Present Value Calculations Lies A Fundamental Mathematical Formula That Translates Future Cash Flows Into.

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as:

n+(1+%2B+k)n.jpg)