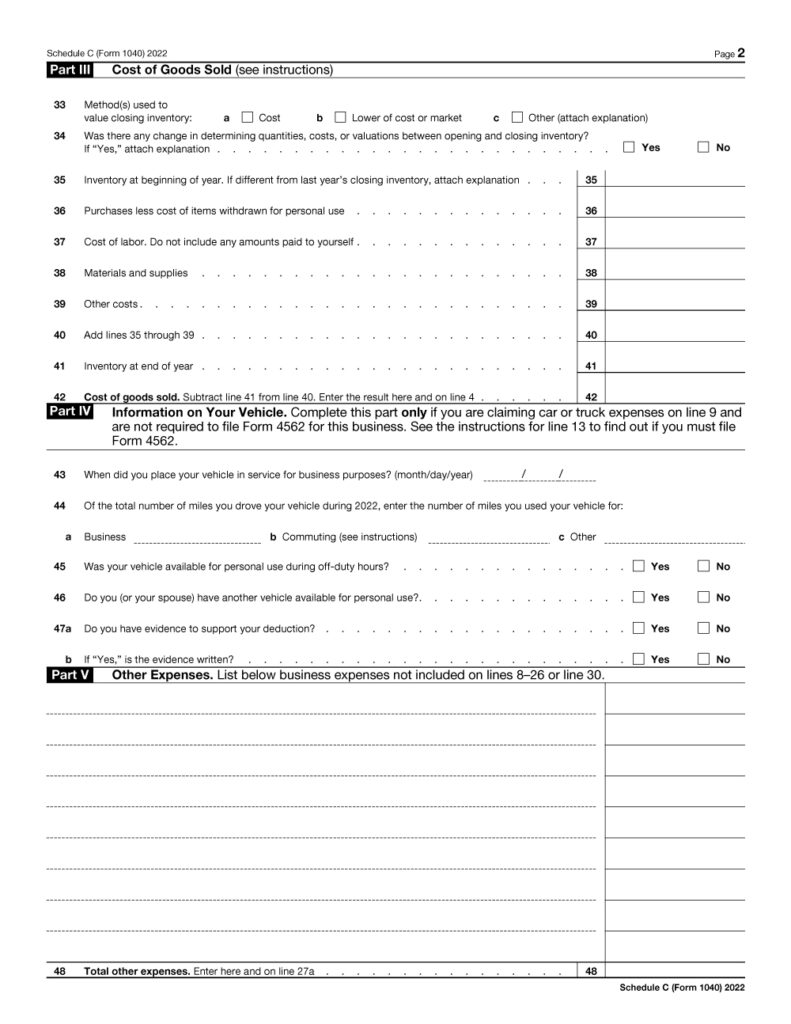

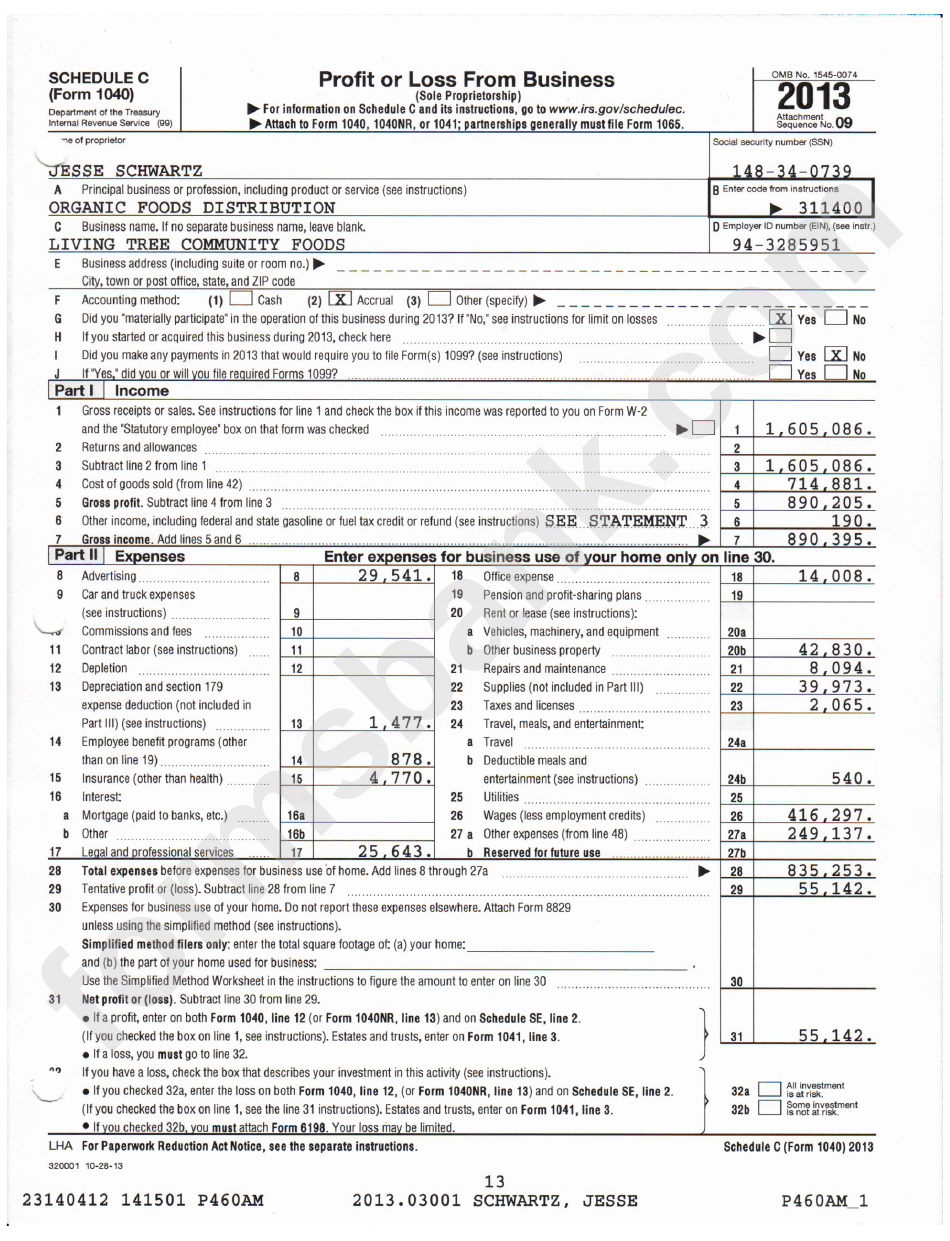

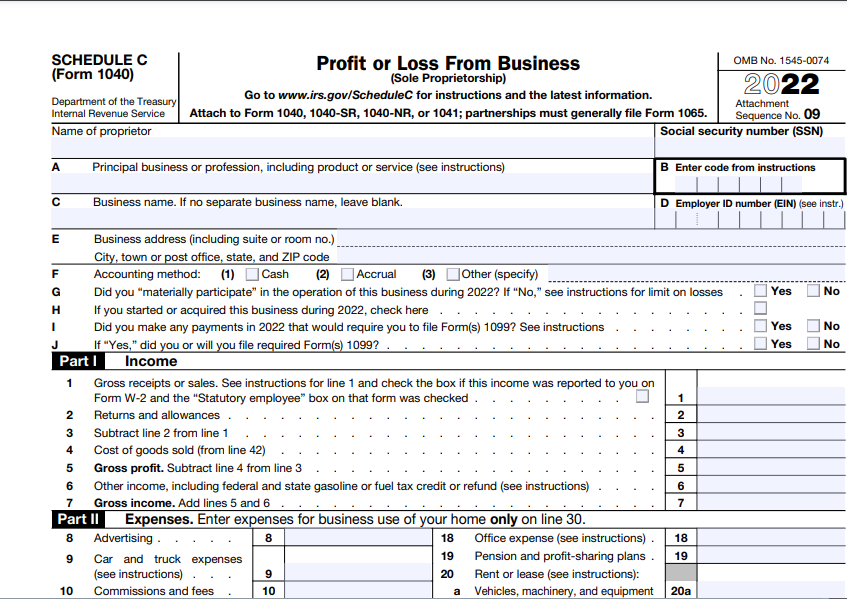

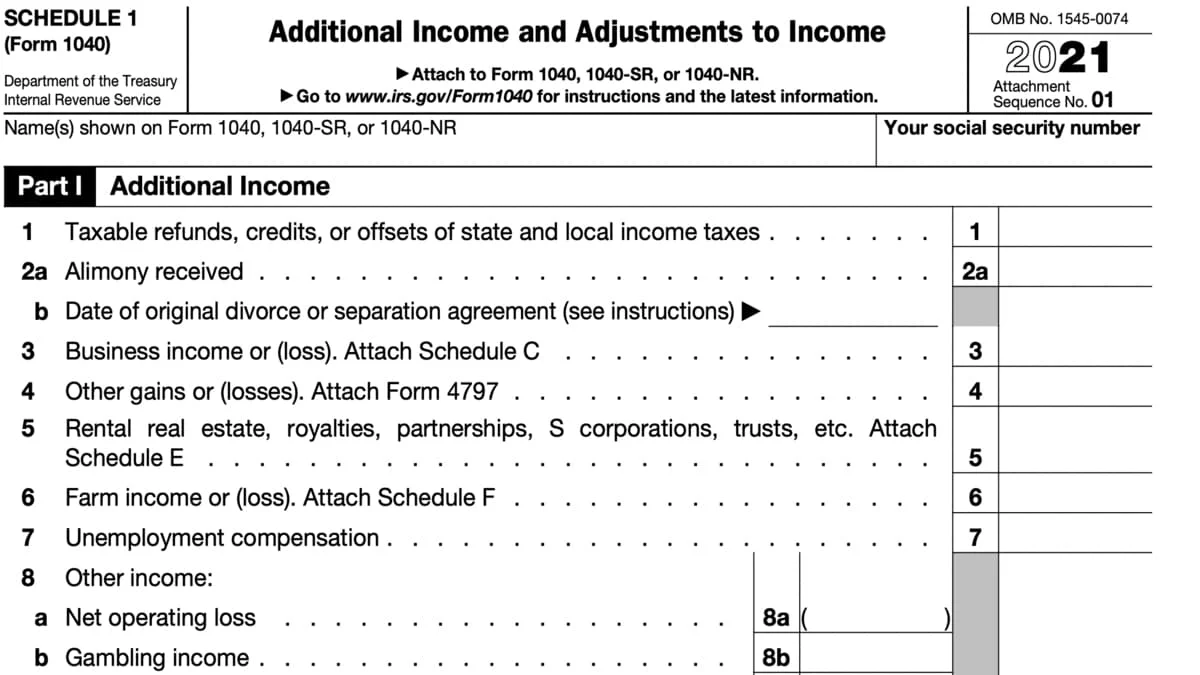

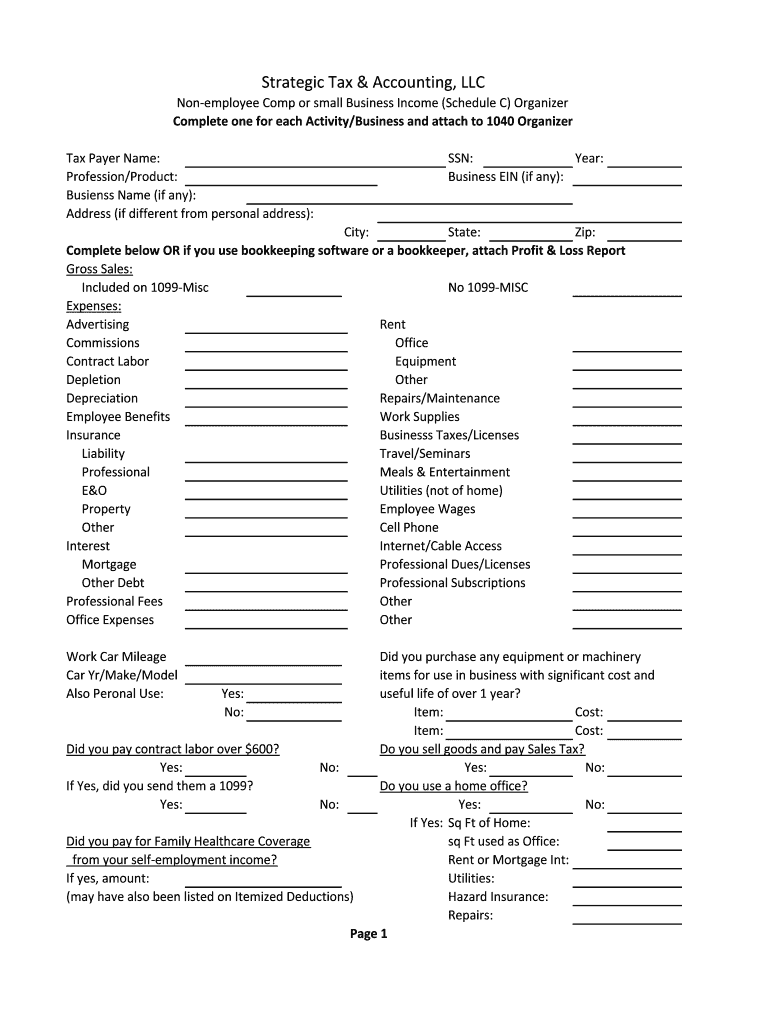

Schedule C Fillable Form 2023 - Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. 127 rows review a list of current tax year free file fillable forms and their limitations. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Go to www.irs.gov/schedulec for instructions and the latest information.

Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. 127 rows review a list of current tax year free file fillable forms and their limitations. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

127 rows review a list of current tax year free file fillable forms and their limitations. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c.

Schedule C (Form 1040) 2023 Instructions

If no separate business name, leave blank. 127 rows review a list of current tax year free file fillable forms and their limitations. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Maximize your business deductions and accurately calculate your profit or loss with federal form.

Form 1040 Schedule C Sample Profit Or Loss From Busin vrogue.co

Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. 127 rows review a.

Download Fillable Schedule C Form

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for instructions and the latest information. 127 rows review a list of current tax year free file fillable forms and their limitations. Maximize your business deductions and accurately calculate your profit or loss with.

IRS Form 1040 Schedule C. Profit or Loss From Business Forms Docs

Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. 127 rows review a list of current tax year free file fillable forms and their limitations. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business,.

Printable Schedule C 2023

If no separate business name, leave blank. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. 127 rows review a list of current tax year free file fillable forms and their limitations. Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business,.

2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

127 rows review a list of current tax year free file fillable forms and their limitations. Go to www.irs.gov/schedulec for instructions and the latest information. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from.

Printable Schedule C

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. 127 rows review a list of current tax year free file fillable forms and their limitations. Maximize your business deductions and accurately calculate your profit or loss with federal form.

Net profit or loss from irs form 1040 schedule c Fill out & sign

127 rows review a list of current tax year free file fillable forms and their limitations. Go to www.irs.gov/schedulec for instructions and the latest information. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business,.

Schedule C From Taxes

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. 127 rows review a list of current tax year free file fillable forms.

Fillable Schedule C Irs Form 1040 Printable Pdf Download

127 rows review a list of current tax year free file fillable forms and their limitations. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for.

Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. 127 rows review a list of current tax year free file fillable forms and their limitations. If no separate business name, leave blank.