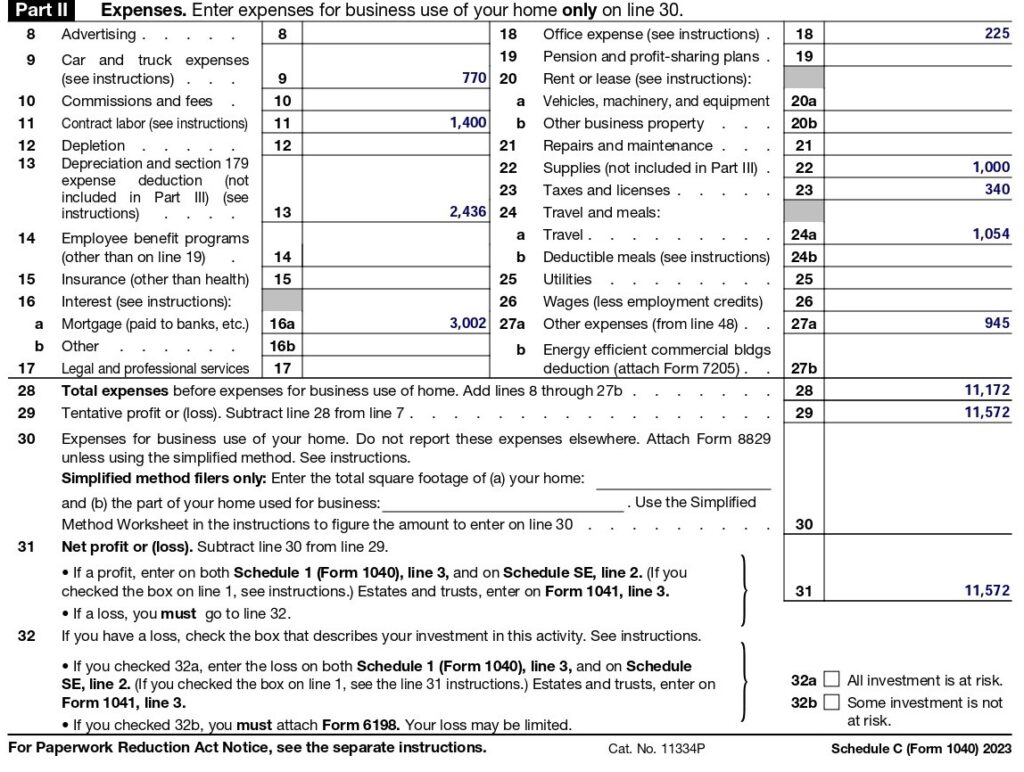

Schedule C Form 2024 Pdf - Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. 51business income (schedule c) (cont.)

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. 51business income (schedule c) (cont.) Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. (if you checked the box on. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. 51business income (schedule c) (cont.) • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

2024 Irs Schedule C 2024 Calendar Template Excel

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. 51business income (schedule c) (cont.) Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. (if you checked the box on. • if you checked.

Download Fillable Schedule C Form

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. 51business income (schedule c) (cont.) (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Download or print the.

Schedule C 2024 Herta Giralda

Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 51business income (schedule c) (cont.) (if you checked the box on. Information about schedule c (form.

Schedule C Deductions 2024 Form Nita Terese

(if you checked the box on. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. 51business income (schedule c) (cont.) • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Information about schedule c (form.

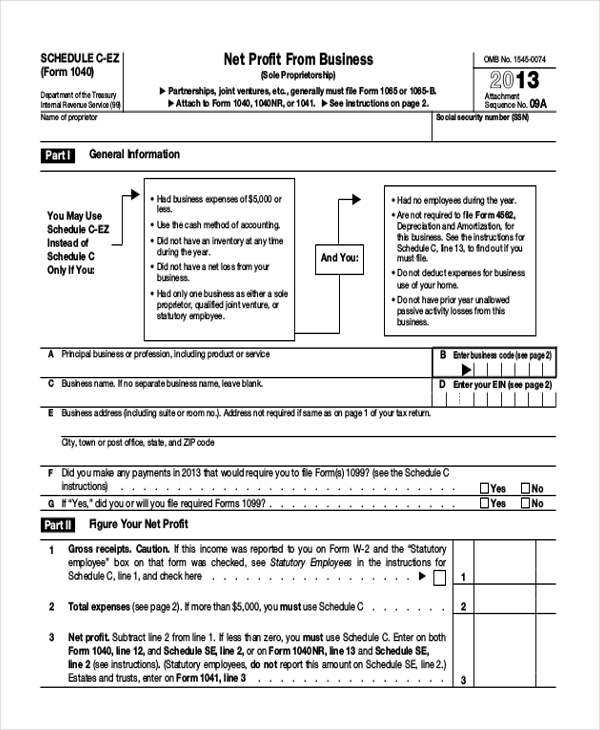

2024 Schedule C Or CEz Schedule C 2024

51business income (schedule c) (cont.) Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. • if you checked 32a, enter the loss on both.

Irs Fillable Forms 2024 Schedule C Penny Blondell

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 51business income (schedule c) (cont.) Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. (if you checked the box on. Download or print the.

How To Fill Out Schedule C in 2024 (With Example)

51business income (schedule c) (cont.) Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Download or print the 2024 federal (profit or loss from.

2024 Schedule C Form Orel Tracey

51business income (schedule c) (cont.) (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Information about schedule c (form.

2024 Schedule C Alia Louise

(if you checked the box on. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. 51business income (schedule c) (cont.) • if you checked.

2024 Schedule C Form Lizzy Margarete

(if you checked the box on. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. 51business income (schedule c) (cont.) Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. • if you checked.

Download Or Print The 2024 Federal (Profit Or Loss From Business (Sole Proprietorship)) (2024) And Other Income Tax Forms From The Federal.

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. 51business income (schedule c) (cont.) • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on.