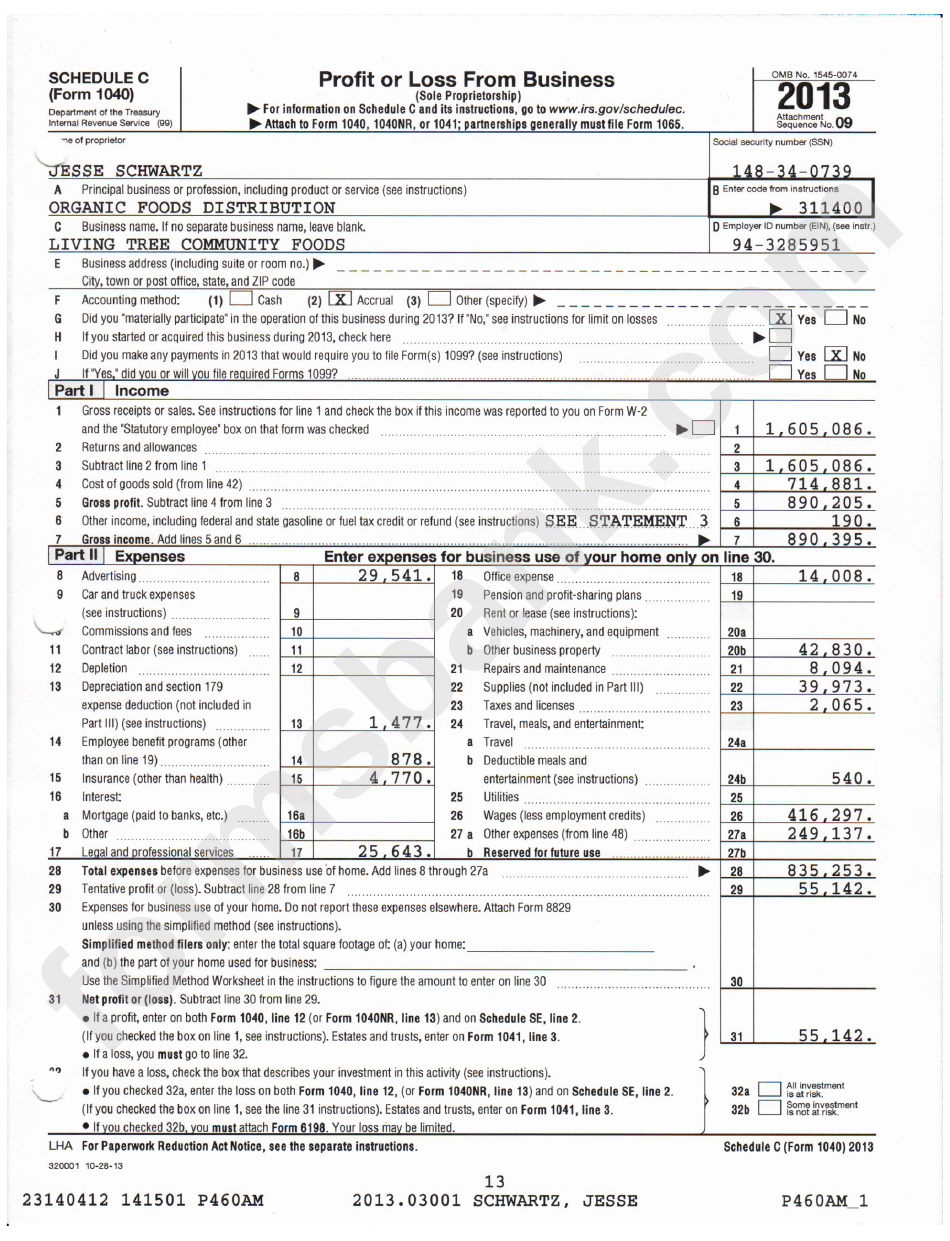

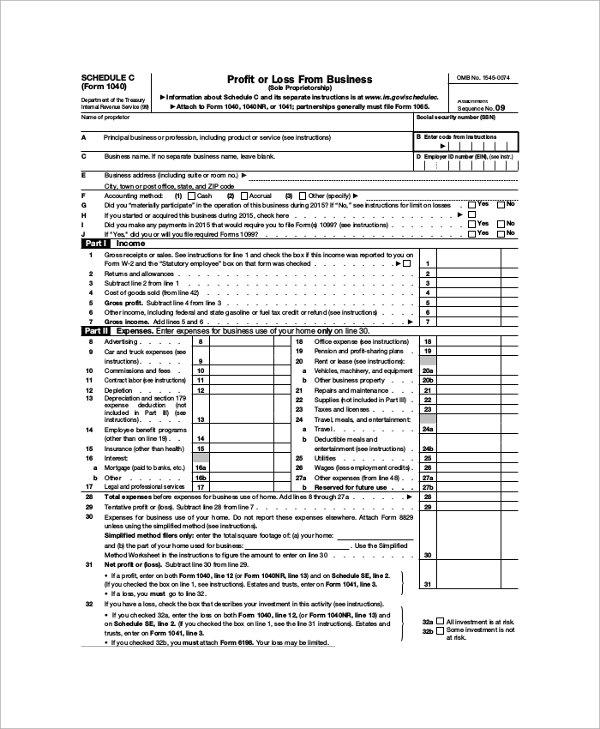

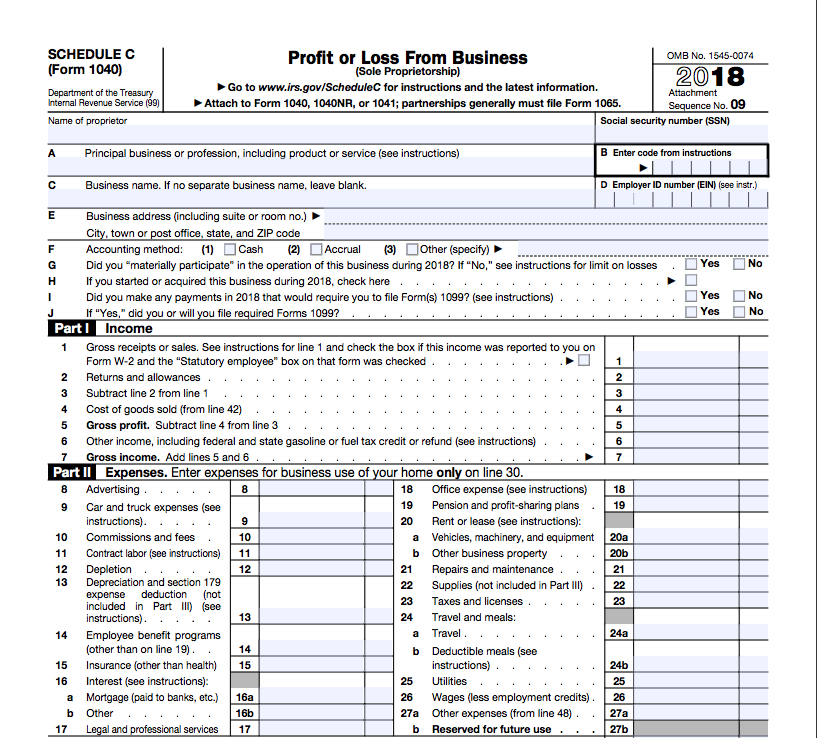

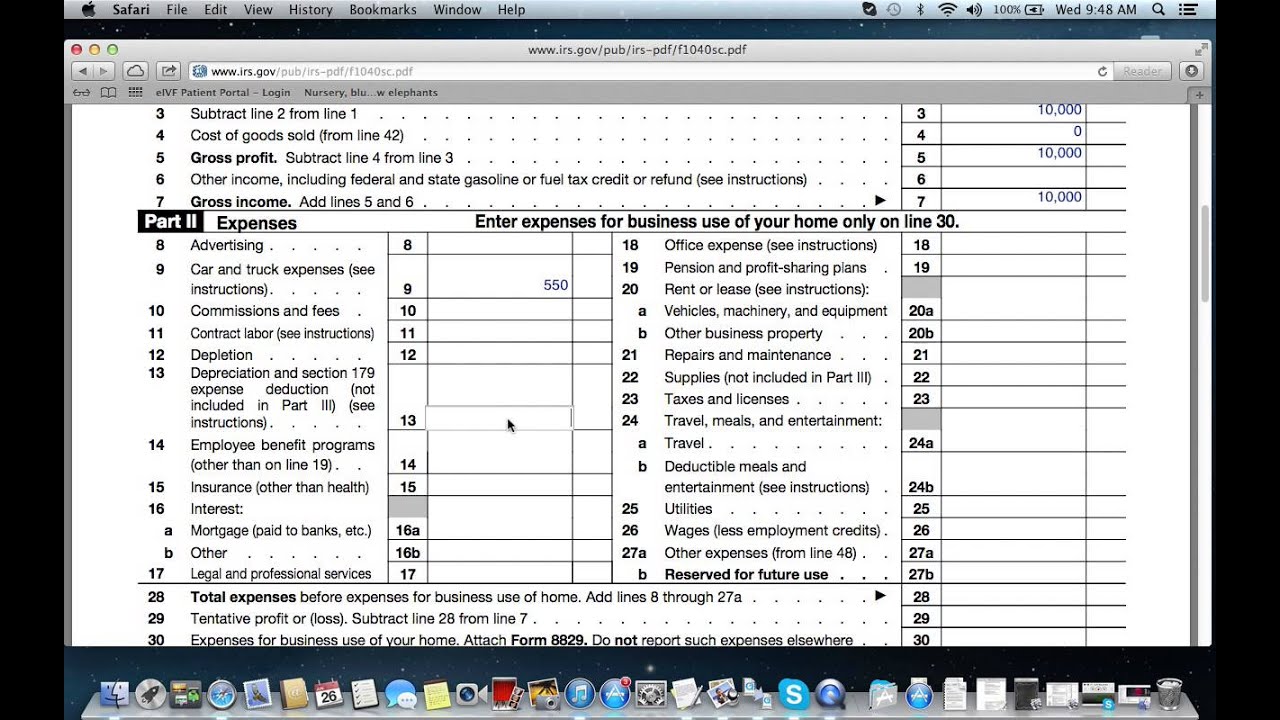

Schedule C Form Example - To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. If no separate business name, leave blank. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. What is schedule c form? Go to www.irs.gov/schedulec for instructions and the latest information. Here’s what the schedule c (form 1040) looks like: A schedule c is a tax form to report your.

Go to www.irs.gov/schedulec for instructions and the latest information. Here’s what the schedule c (form 1040) looks like: If no separate business name, leave blank. A schedule c is a tax form to report your. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. What is schedule c form? To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more.

What is schedule c form? Here’s what the schedule c (form 1040) looks like: The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. If no separate business name, leave blank. A schedule c is a tax form to report your. Go to www.irs.gov/schedulec for instructions and the latest information.

Schedule C Instructions How to Fill Out Form 1040 Excel Capital

Here’s what the schedule c (form 1040) looks like: A schedule c is a tax form to report your. What is schedule c form? If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information.

Free Printable Schedule C Tax Form

What is schedule c form? Here’s what the schedule c (form 1040) looks like: The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

Here’s what the schedule c (form 1040) looks like: To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. What is schedule c form? The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Go to.

Free Printable Schedule C Tax Form

Go to www.irs.gov/schedulec for instructions and the latest information. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Here’s what the schedule c (form 1040) looks like: What is schedule c form? To complete schedule c for your small business taxes, you'll need your business.

Calculate Schedule C Tax

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. If no separate business name, leave blank. Here’s what the schedule c (form 1040) looks like:.

Schedule C Printable Guide

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Go to www.irs.gov/schedulec for instructions and the latest information. Here’s what the schedule c (form 1040) looks like: A schedule c is a tax form to report your. If no separate business name, leave blank.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. What is schedule c form? To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. Go to www.irs.gov/schedulec for instructions and the latest information. Here’s what.

Irs Form 1040 Schedule C 2025 Michael Harris

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Here’s what the schedule c (form 1040) looks like: If no separate business name, leave blank. A schedule c is a tax form to report your. What is schedule c form?

Schedule C Form Template

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Here’s what the schedule c (form 1040) looks like: What is schedule c form? A schedule.

How to Fill Out Your Schedule C Perfectly (With Examples!)

Go to www.irs.gov/schedulec for instructions and the latest information. What is schedule c form? To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Here’s what.

To Complete Schedule C For Your Small Business Taxes, You'll Need Your Business Income, Costs Of Goods Sold, And More.

A schedule c is a tax form to report your. Go to www.irs.gov/schedulec for instructions and the latest information. What is schedule c form? Here’s what the schedule c (form 1040) looks like:

If No Separate Business Name, Leave Blank.

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)