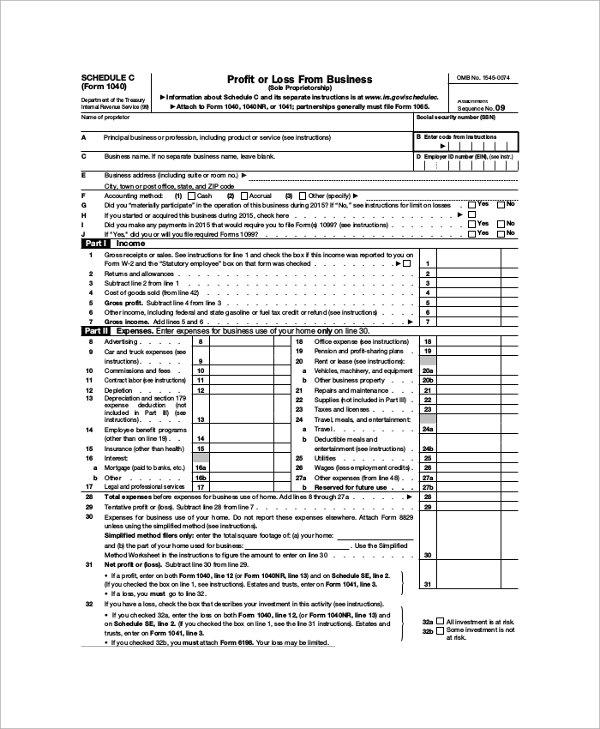

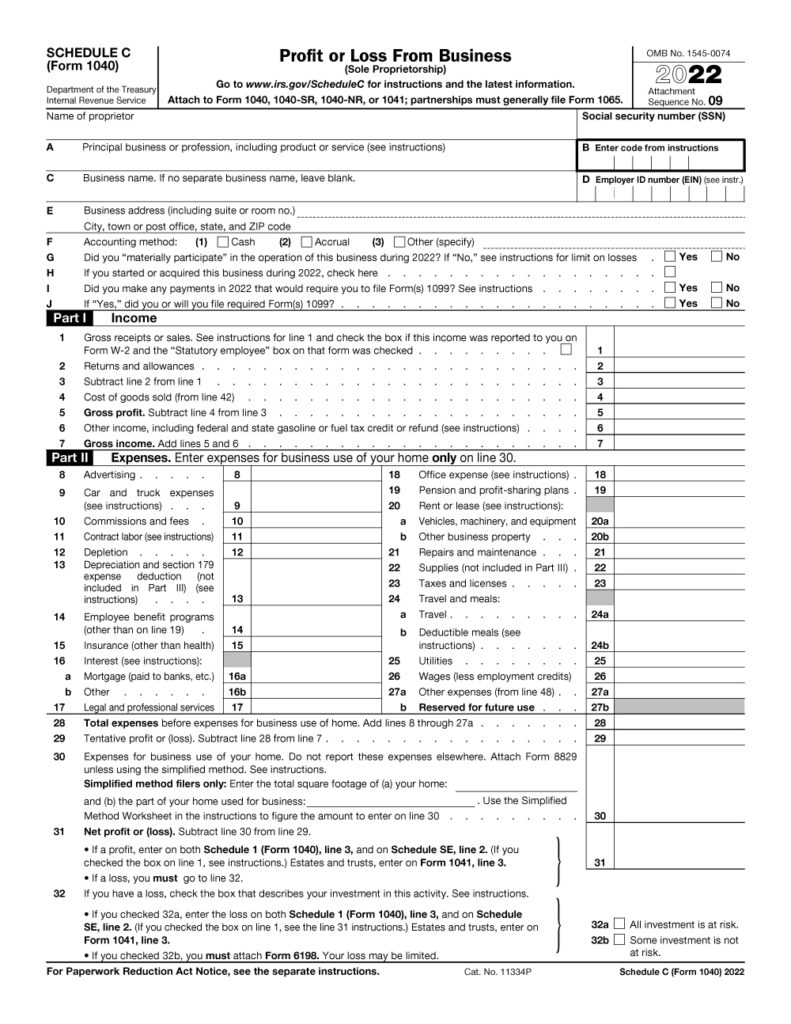

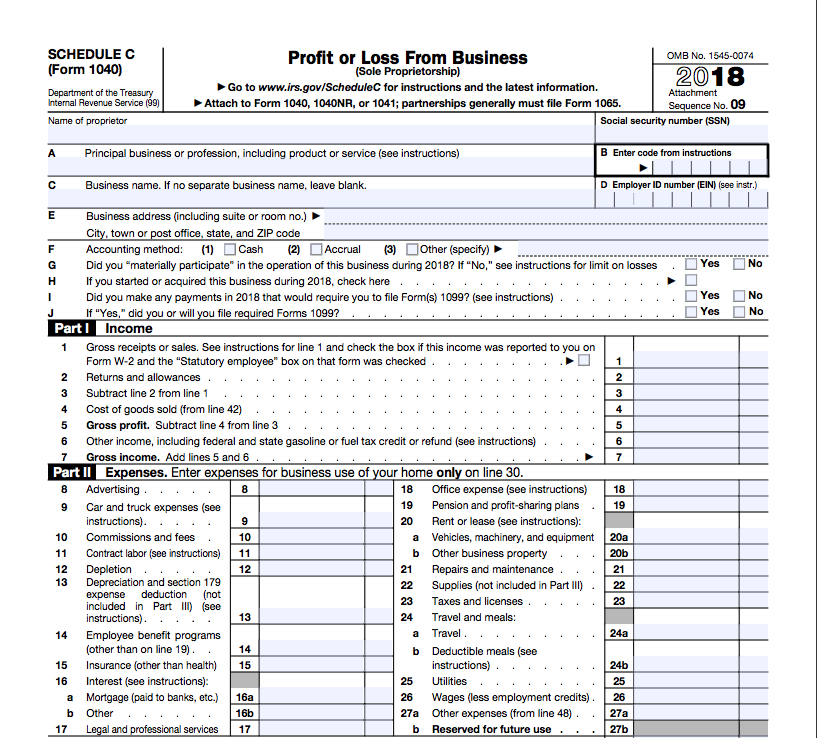

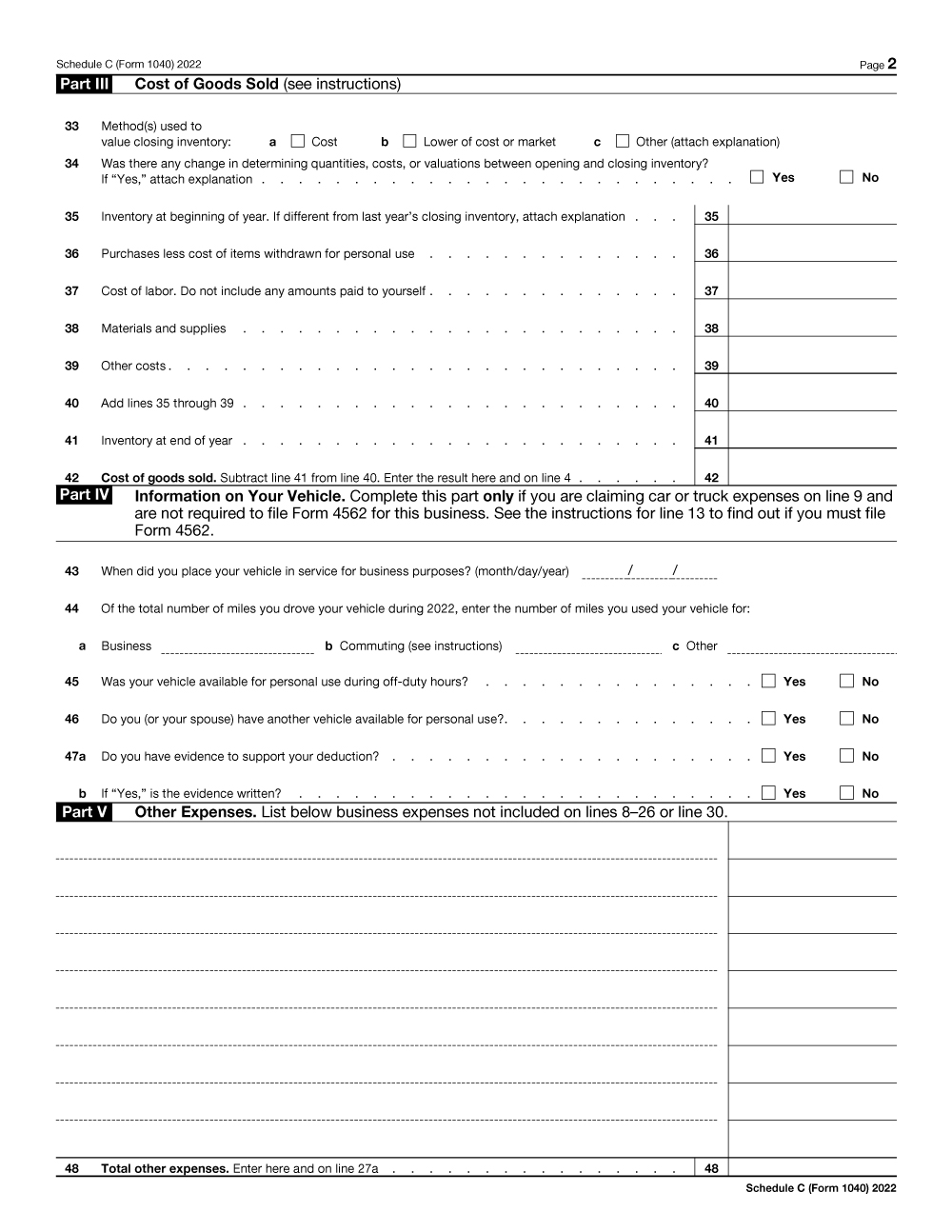

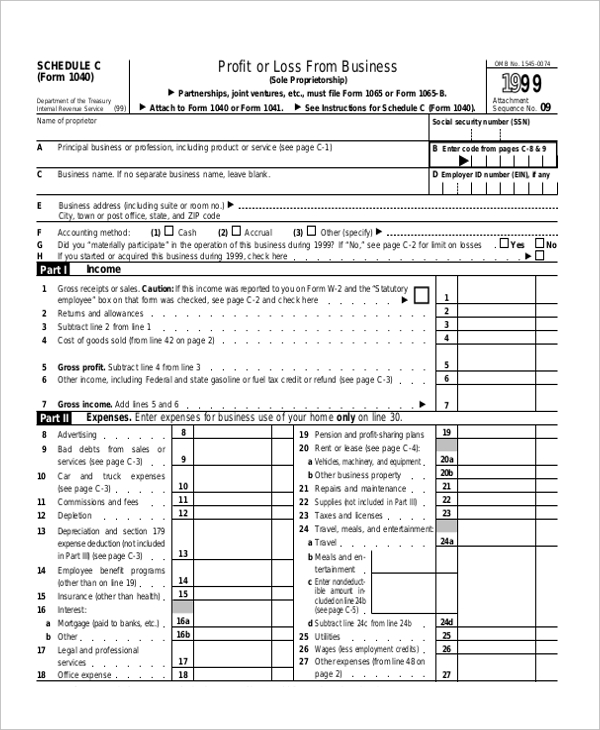

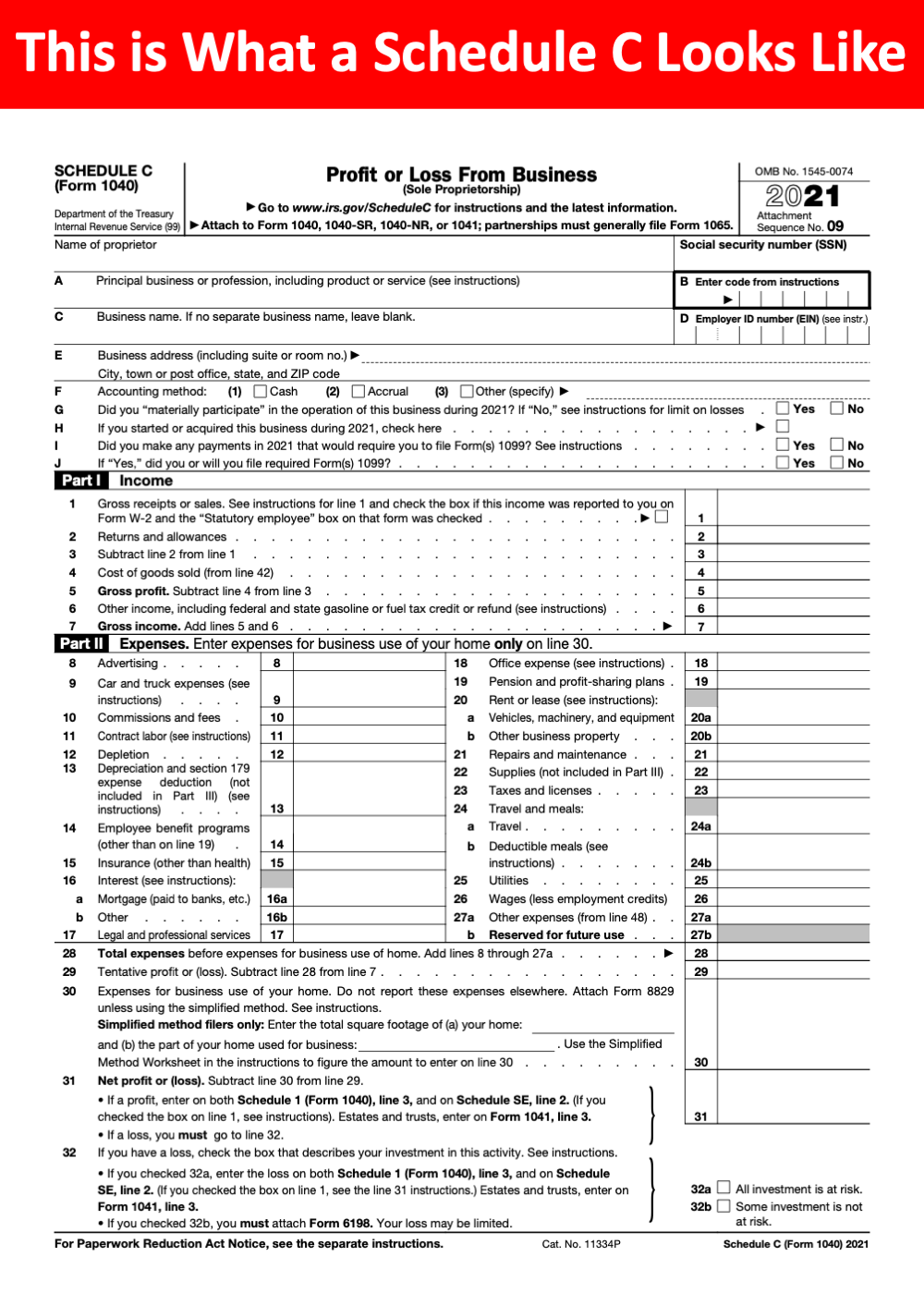

Schedule C Tax Form 2023 Printable - Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. If no separate business name, leave blank. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Accurate completion of this schedule. For real estate transactions, be sure to.

This essential form also helps. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. For real estate transactions, be sure to. Accurate completion of this schedule. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale.

Accurate completion of this schedule. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. This essential form also helps. Go to www.irs.gov/schedulec for instructions and the latest information. For real estate transactions, be sure to.

Tax Forms Schedule C at Mindy Beaty blog

This essential form also helps. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. For real estate transactions, be sure to. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Go to www.irs.gov/schedulec for instructions and.

Schedule C (Form 1040) 2023 Instructions

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. This essential form also helps. If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for instructions and.

Printable Schedule C Form 2023 Schedule Printable

For real estate transactions, be sure to. Go to www.irs.gov/schedulec for instructions and the latest information. Accurate completion of this schedule. This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor.

Schedule C Tax Calculator

Accurate completion of this schedule. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. For real estate transactions, be sure to.

Enterprise Express Tax Systems LLC on LinkedIn Who needs a schedule C

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. For real estate transactions, be sure to. Accurate completion of this schedule. This essential form also helps.

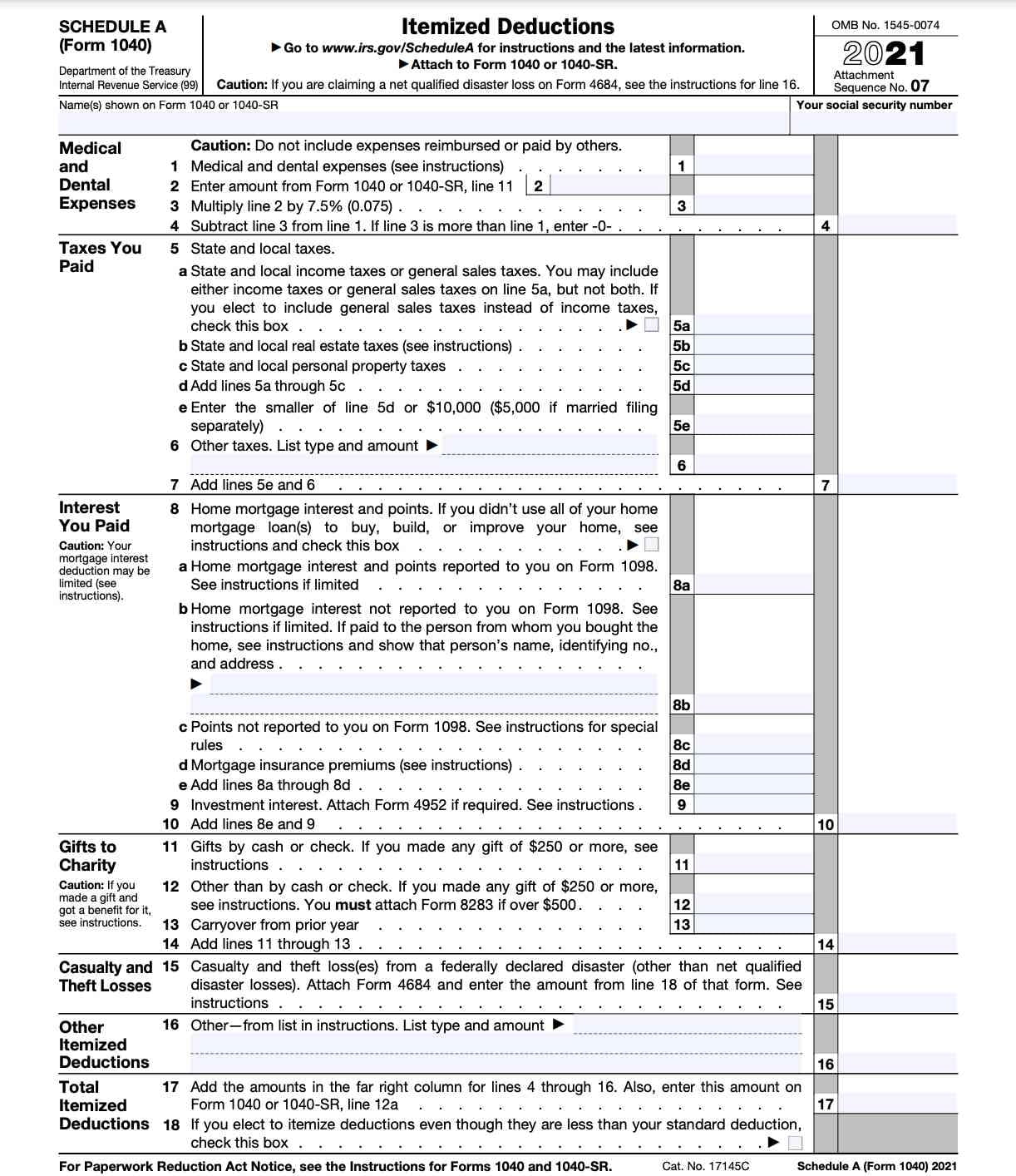

Tax Return 2023 Chart Printable Forms Free Online

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate completion of this schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or.

Schedule C (Form 1040) 2023 Instructions

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. This essential form also helps. For real estate transactions, be sure to. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Information about schedule c (form 1040), profit or loss.

Printable 1040 Schedule C

If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for instructions and the latest information. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. This.

Schedule C 2023 Form Printable Forms Free Online

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c to report income or loss from a business or profession in which you were the.

Printable Schedule C 2023

If no separate business name, leave blank. This essential form also helps. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Use schedule c to report income or loss from a.

For Real Estate Transactions, Be Sure To.

This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. If no separate business name, leave blank.

Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

Accurate completion of this schedule. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)