Software Expense In Accounting - Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.

Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed.

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity.

Ledgers Accounting Software Free Download 📒📲

Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed.

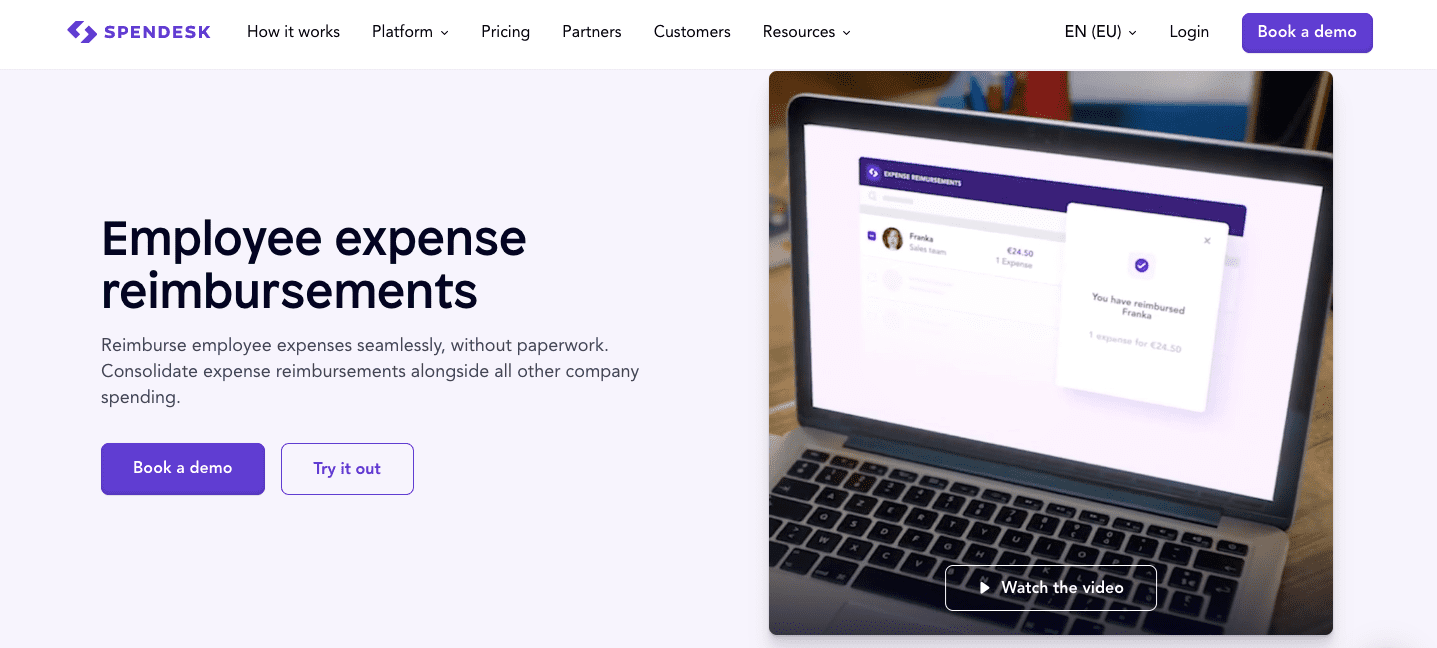

10 Best Expense Reimbursement Software & Systems 2023 2024

Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity.

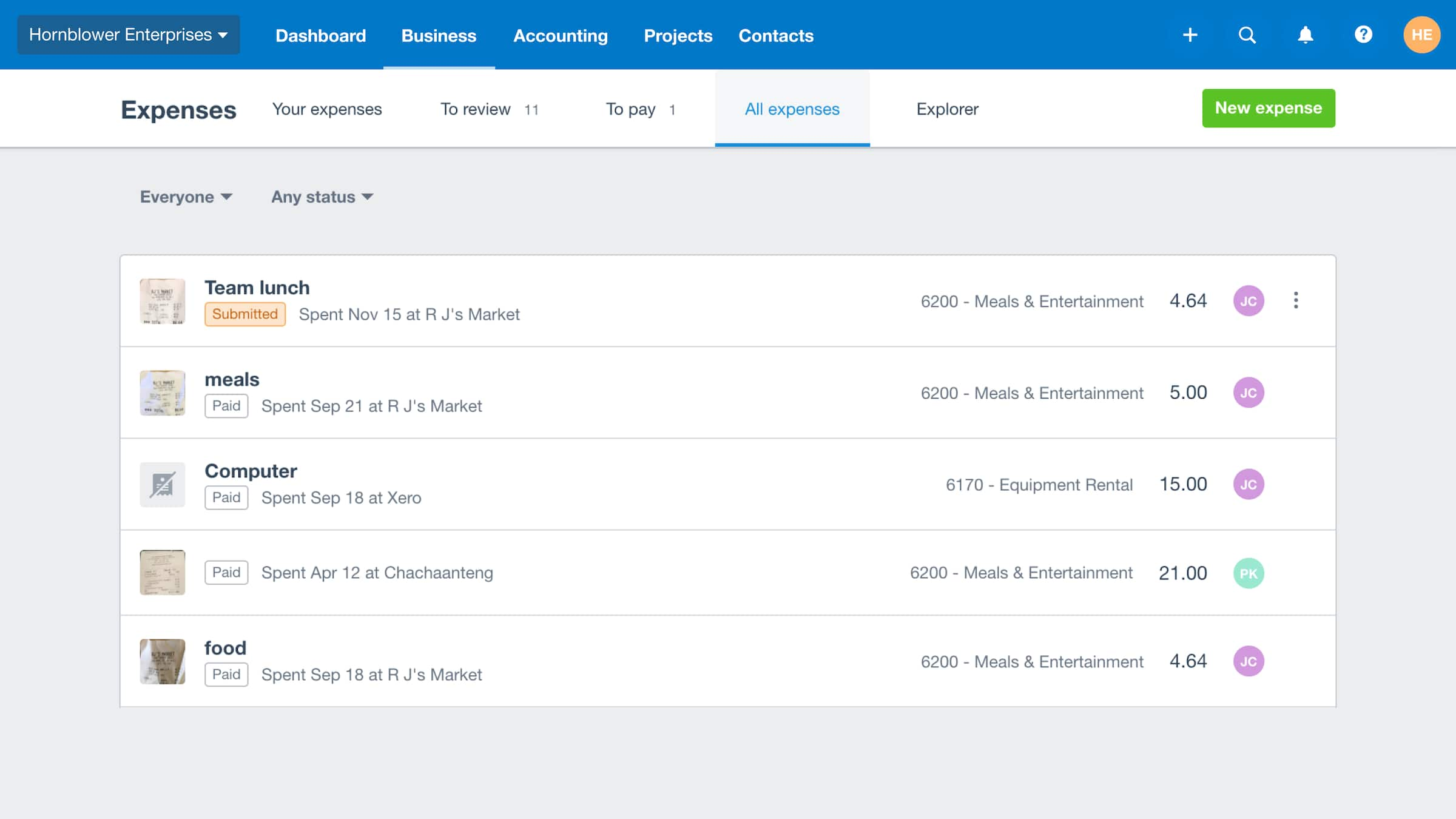

Track and Manage Expense Claims Expenses App Xero PH

Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.

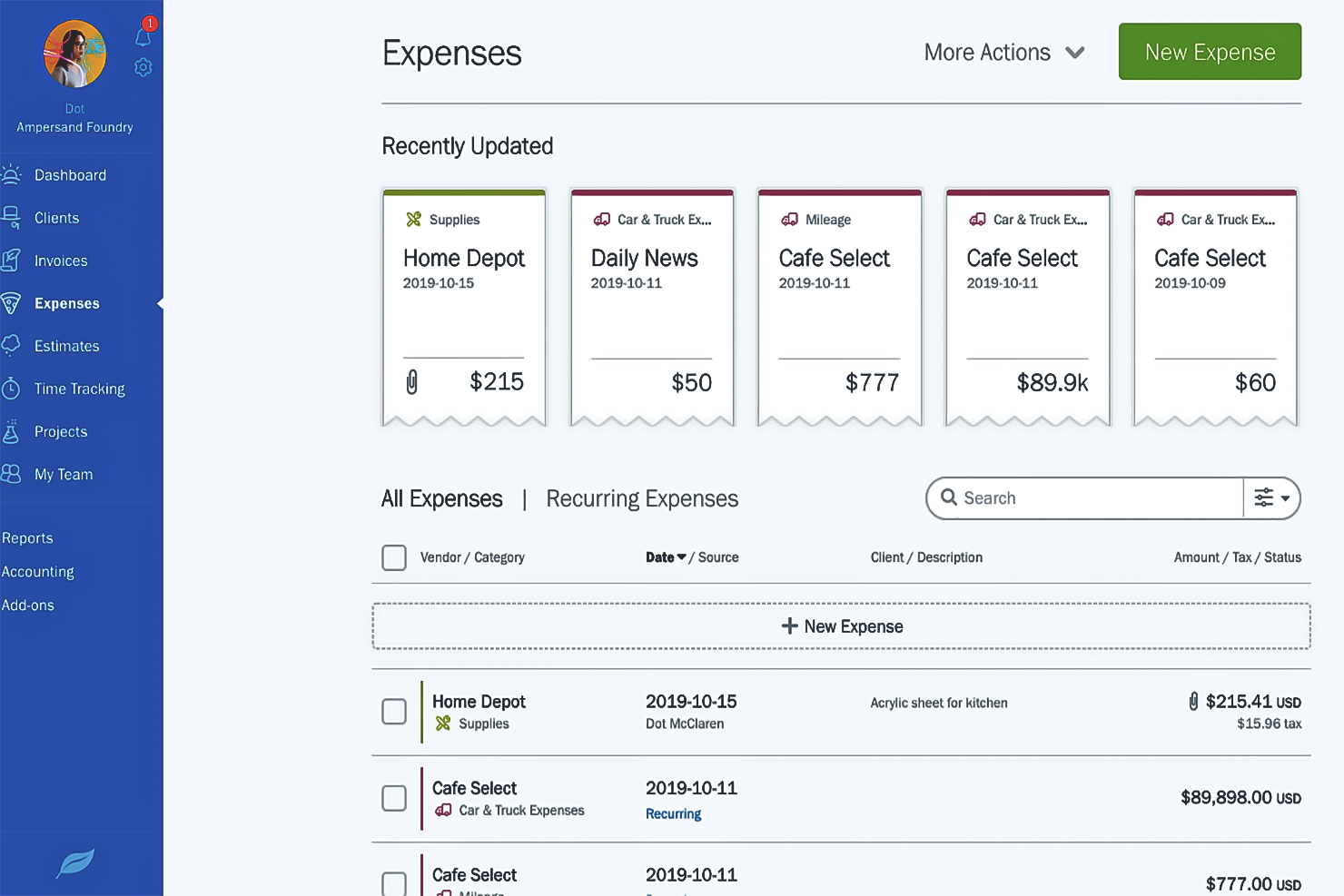

20 Best Expense Reporting Software of 2023 Reviewed & Compared

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.

What is Expense Tracking? How Will it Help Your Business?

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.

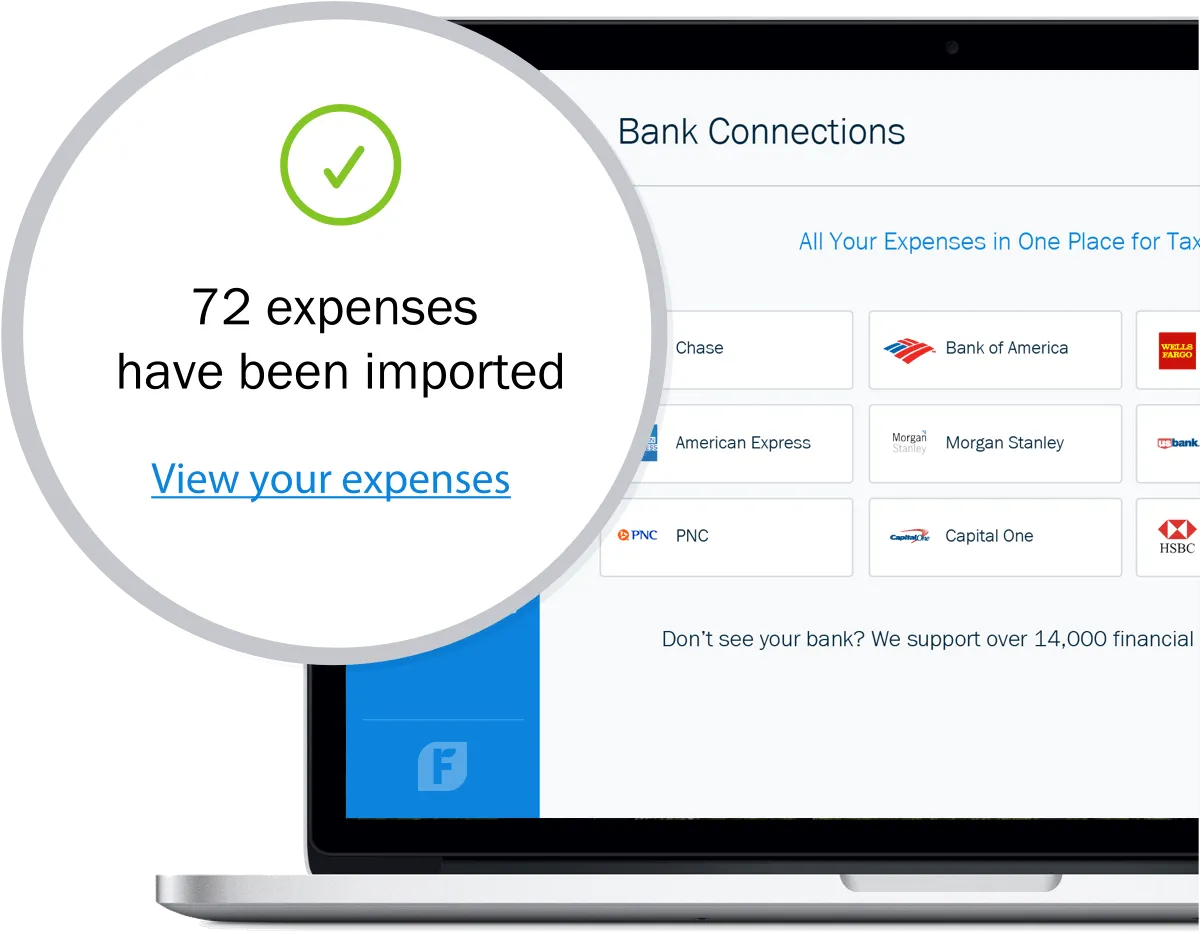

Best expense tracking software for 1099 nicevast

Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.

Best Expense Management Software in 2024

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity.

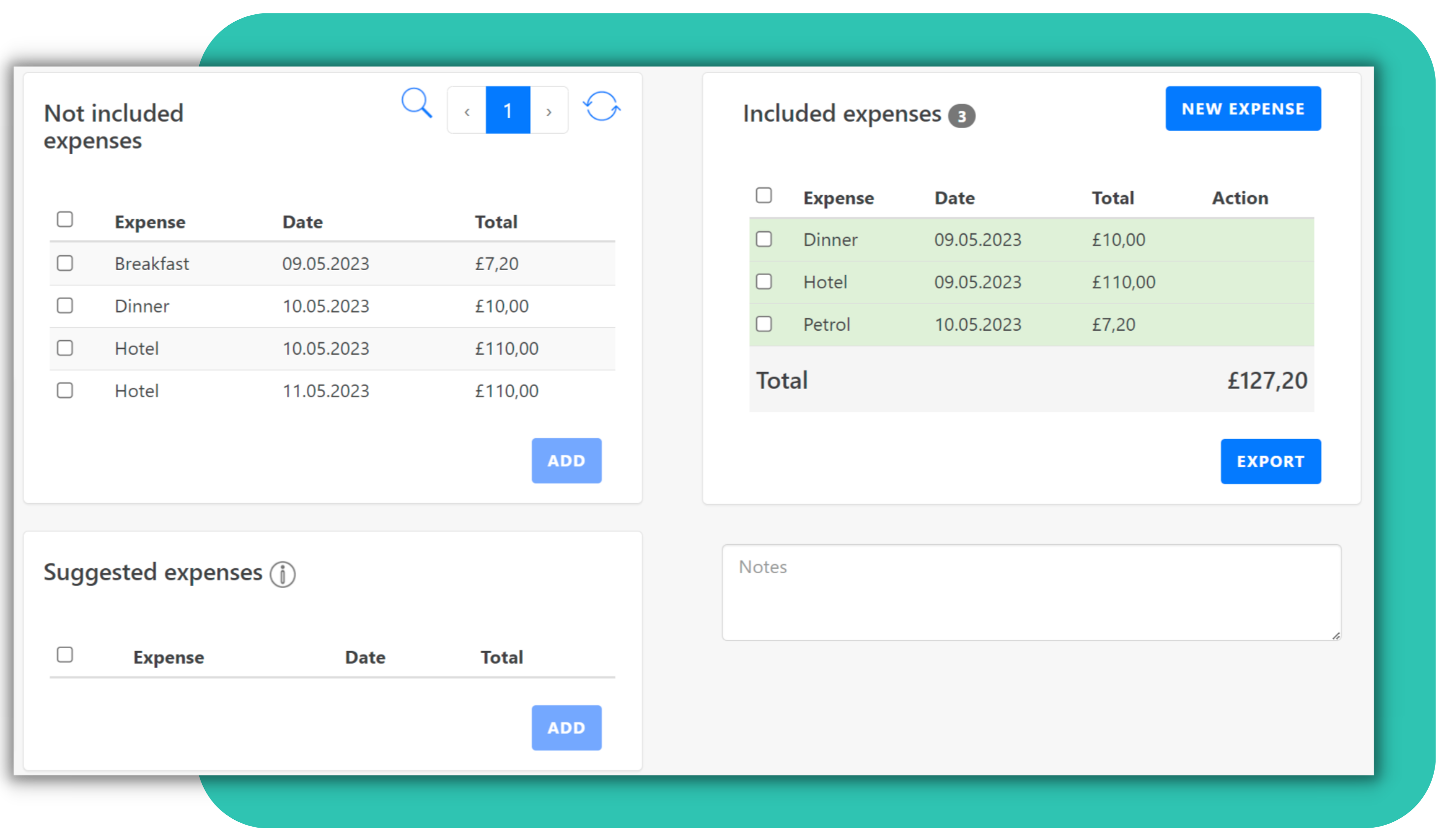

Expense Management System Easy and Digital Expense Tracking

Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed.

Time & Expense Management Software Sage Intacct

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity.

10 Best Ways to Track Expenses in 2025 Financfy

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity.

Capitalized Software Development Costs Related To Software To Be Sold, Leased, Or Otherwise Marketed, Whether Acquired Or Developed.

Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.