Uae Vat Law Pdf - A tax levied on the importation and supply of goods and services at every stage of production and distribution,. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. (8) of 2017, the uae ministry of finance (“mof”) has. 18 of 2022 to amend a number.

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. A tax levied on the importation and supply of goods and services at every stage of production and distribution,. (8) of 2017, the uae ministry of finance (“mof”) has. 18 of 2022 to amend a number.

An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. (8) of 2017, the uae ministry of finance (“mof”) has. A tax levied on the importation and supply of goods and services at every stage of production and distribution,. 18 of 2022 to amend a number.

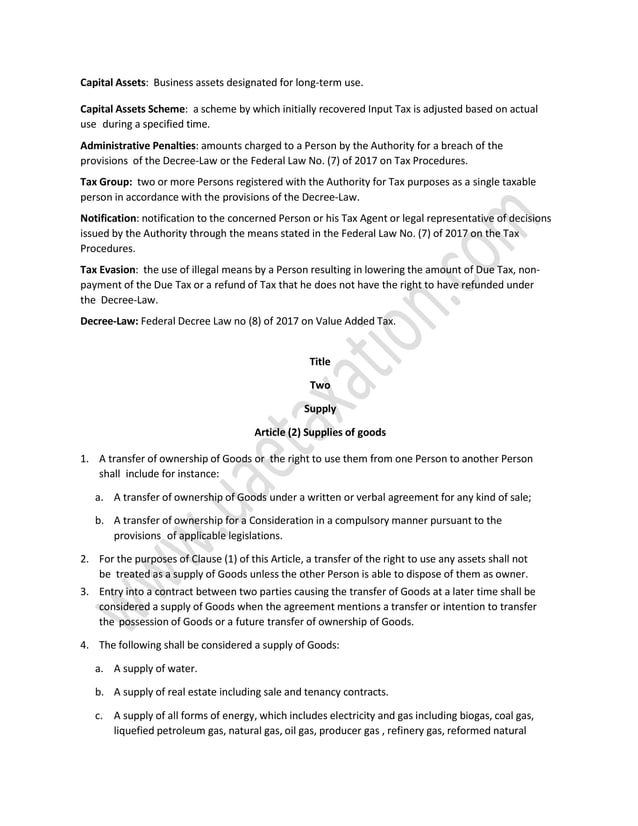

UAE VAT Law Draft Executive Regulation PDF

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. (8) of 2017, the uae ministry of finance (“mof”) has. An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. A tax levied on the.

Fillable Online UAE VAT Law Overview of the new Legislation Fax Email

18 of 2022 to amend a number. (8) of 2017, the uae ministry of finance (“mof”) has. A tax levied on the importation and supply of goods and services at every stage of production and distribution,. An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. Article 1 of uae.

UAE VAT Law Draft Executive Regulation PDF

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. (8) of 2017, the uae ministry of finance (“mof”) has. A tax levied on the.

UAE VAT Law Draft Executive Regulation PDF

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. A tax levied on the importation and supply of goods and services at every stage.

VAT in UAE Comparison of Draft and Final Executive Regulations of the

A tax levied on the importation and supply of goods and services at every stage of production and distribution,. 18 of 2022 to amend a number. (8) of 2017, the uae ministry of finance (“mof”) has. An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. Article 1 of uae.

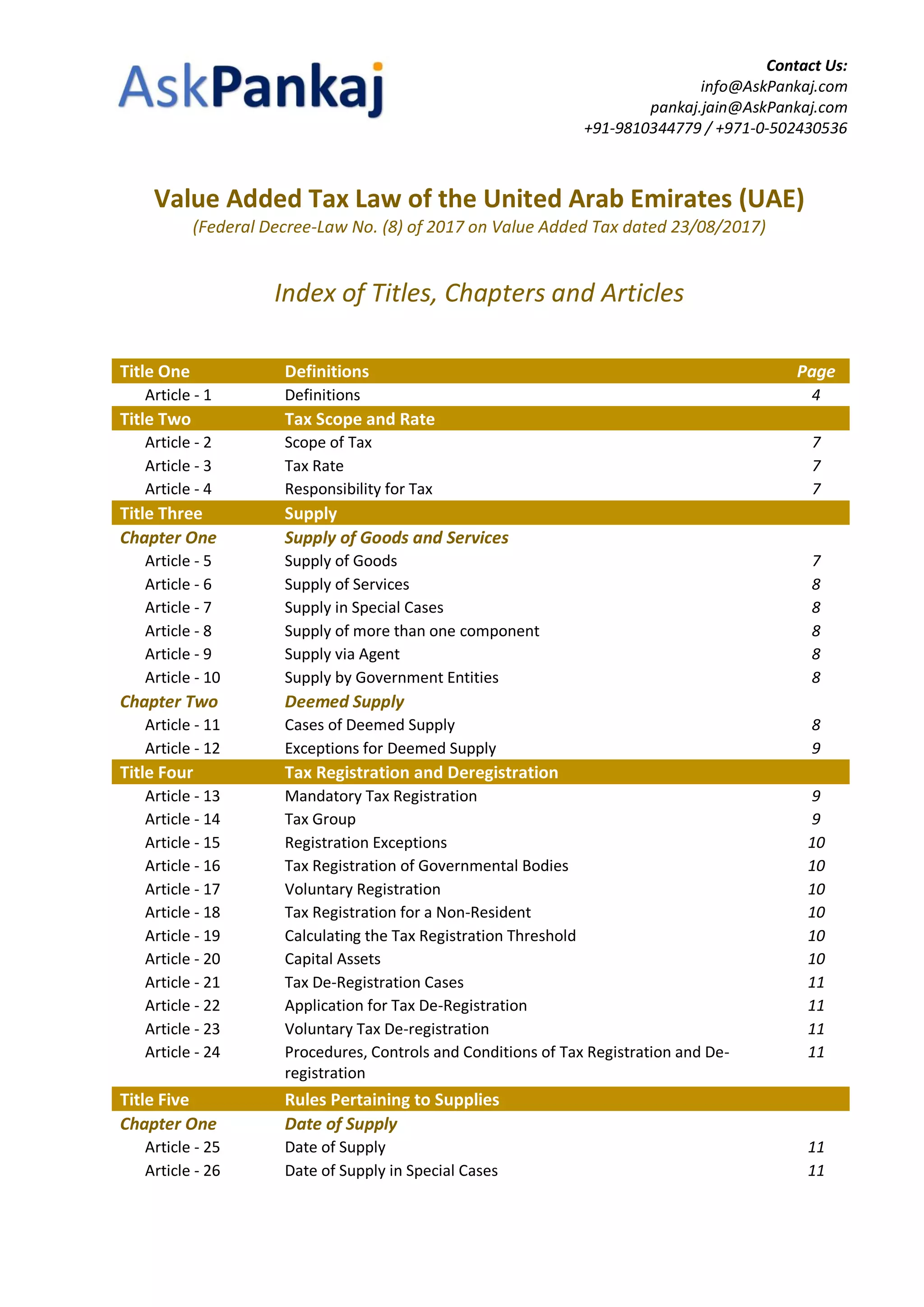

AskPankaj Value Added Tax (VAT) law of the United Arab Emirates (UAE

A tax levied on the importation and supply of goods and services at every stage of production and distribution,. (8) of 2017, the uae ministry of finance (“mof”) has. 18 of 2022 to amend a number. An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. Article 1 of uae.

UAE VAT Law Draft Executive Regulation PDF

18 of 2022 to amend a number. (8) of 2017, the uae ministry of finance (“mof”) has. An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. A tax levied on the importation and supply of goods and services at every stage of production and distribution,. Article 1 of uae.

UAE VAT Law Draft Executive Regulation PDF

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. A tax levied on the importation and supply of goods and services at every stage of production and distribution,. An export of goods to a destination outside of the implementing states, where the supplier is.

VAT in UAE Comparison of Draft and Final Executive Regulations of the

(8) of 2017, the uae ministry of finance (“mof”) has. A tax levied on the importation and supply of goods and services at every stage of production and distribution,. An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. 18 of 2022 to amend a number. Article 1 of uae.

UAE VAT Law Draft Executive Regulation PDF

18 of 2022 to amend a number. (8) of 2017, the uae ministry of finance (“mof”) has. A tax levied on the importation and supply of goods and services at every stage of production and distribution,. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single.

Article 1 Of Uae Vat Law Defines Tax Group As ‘Two Or More Persons Registered With The Authority For Tax Purposes As A Single Taxable.

(8) of 2017, the uae ministry of finance (“mof”) has. A tax levied on the importation and supply of goods and services at every stage of production and distribution,. An export of goods to a destination outside of the implementing states, where the supplier is responsible for arranging transport. 18 of 2022 to amend a number.