Uae Vat Regulations Pdf - Liable to register for vat? The person residing in uae or in an vat implementing state is obligated to register under the decree la. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. (8) of 2017, the uae ministry of finance (“mof”) has. 18 of 2022 to amend a number. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. All countries that are full members of the cooperation council for the arab states of the.

The person residing in uae or in an vat implementing state is obligated to register under the decree la. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. All countries that are full members of the cooperation council for the arab states of the. (8) of 2017, the uae ministry of finance (“mof”) has. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. Liable to register for vat? 18 of 2022 to amend a number.

Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. The person residing in uae or in an vat implementing state is obligated to register under the decree la. All countries that are full members of the cooperation council for the arab states of the. 18 of 2022 to amend a number. Liable to register for vat? (8) of 2017, the uae ministry of finance (“mof”) has.

Uae Vat Return Hoe To File? PDF Value Added Tax Customs

All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. (8) of 2017, the uae ministry of finance (“mof”) has. 18 of 2022 to amend a number. The person residing in uae or in an vat implementing state is obligated to register under the decree la. Broadly, vat exemptions.

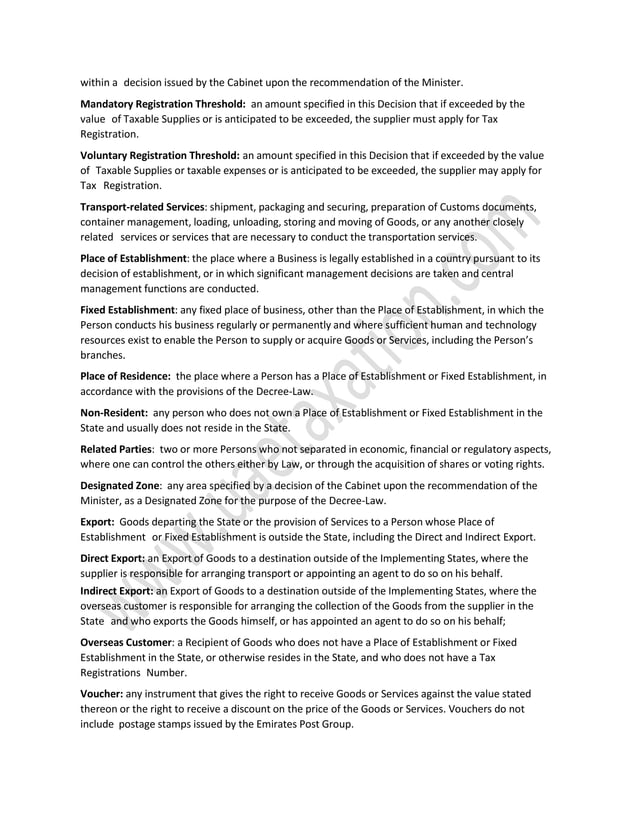

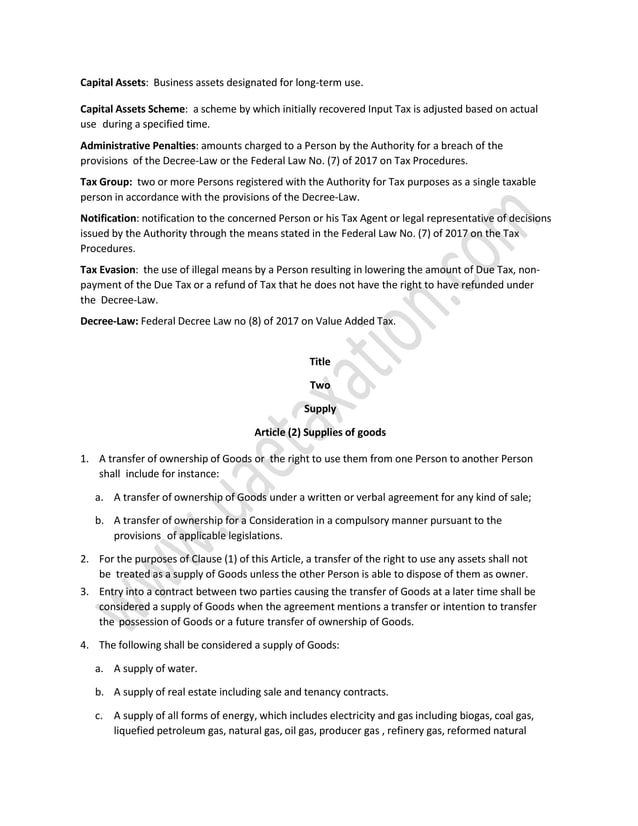

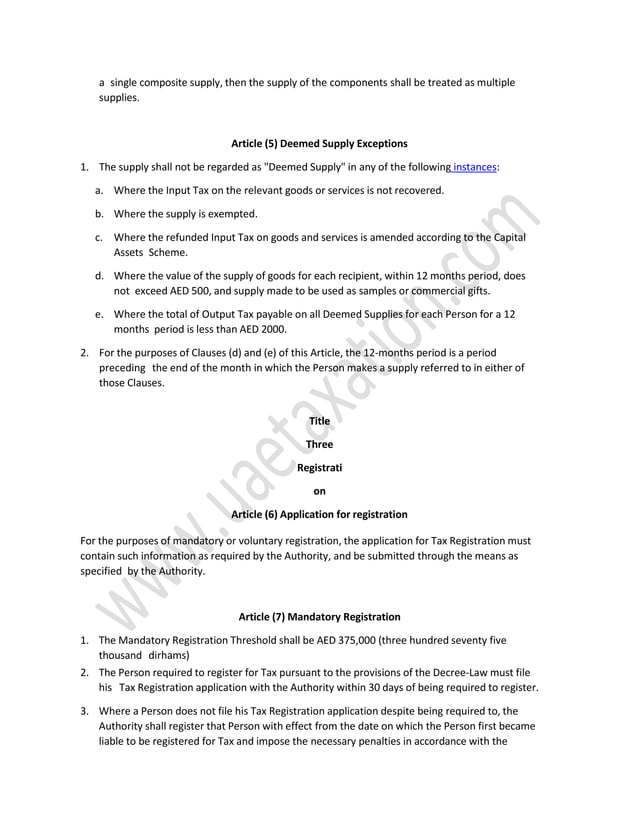

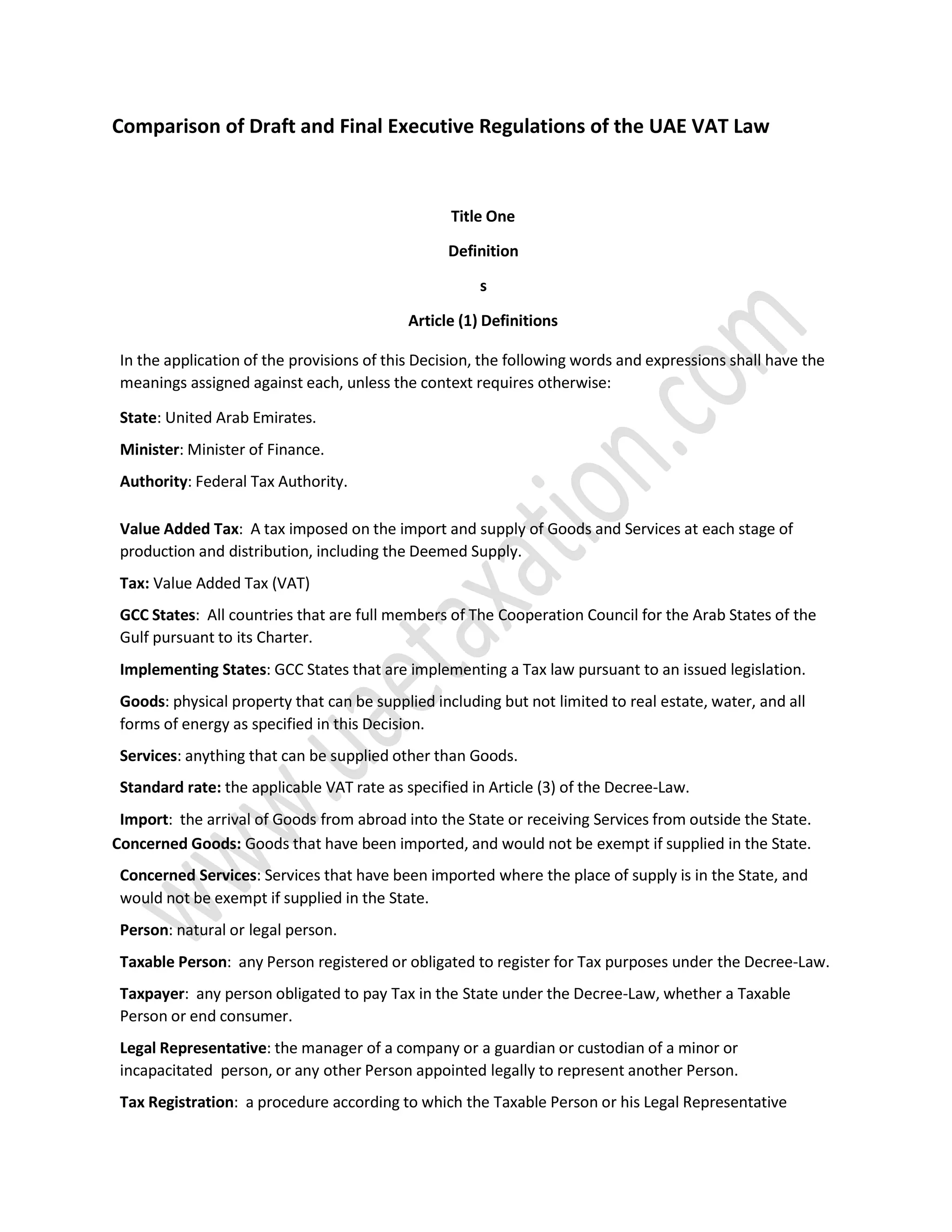

VAT in UAE Comparison of Draft and Final Executive Regulations of the

All countries that are full members of the cooperation council for the arab states of the. 18 of 2022 to amend a number. The person residing in uae or in an vat implementing state is obligated to register under the decree la. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant.

PPT Documents required for vat registration in dubai PowerPoint

All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. All countries that are full members of the cooperation council for the arab states of the. (8) of 2017, the uae ministry of finance (“mof”) has. The person residing in uae or in an vat implementing state is obligated.

VAT in UAE Comparison of Draft and Final Executive Regulations of the

All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. All countries that are full members of the cooperation council for the arab states of the. Liable to register for vat? (8) of 2017, the uae ministry of finance (“mof”) has. The person residing in uae or in an.

VAT in UAE Comparison of Draft and Final Executive Regulations of the

18 of 2022 to amend a number. (8) of 2017, the uae ministry of finance (“mof”) has. Liable to register for vat? All countries that are full members of the cooperation council for the arab states of the. The person residing in uae or in an vat implementing state is obligated to register under the decree la.

VAT in UAE Comparison of Draft and Final Executive Regulations of the

18 of 2022 to amend a number. All countries that are full members of the cooperation council for the arab states of the. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. Liable to register for vat? All countries that enjoy full membership of the cooperation council for the.

AskPankaj Value Added Tax (VAT) law of the United Arab Emirates (UAE

(8) of 2017, the uae ministry of finance (“mof”) has. All countries that are full members of the cooperation council for the arab states of the. Liable to register for vat? 18 of 2022 to amend a number. The person residing in uae or in an vat implementing state is obligated to register under the decree la.

New UAE VAT rules Exemptions for businesses and registration for the 5

Liable to register for vat? All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. 18 of 2022 to amend a number. All countries that are full members of the cooperation council for the arab states of the. The person residing in uae or in an vat implementing state.

VAT in UAE Comparison of Draft and Final Executive Regulations of the

18 of 2022 to amend a number. (8) of 2017, the uae ministry of finance (“mof”) has. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. Liable to register for vat? All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant.

PPT VAT Compliance in UAE PowerPoint Presentation, free download ID

All countries that are full members of the cooperation council for the arab states of the. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. (8) of 2017, the uae ministry of finance (“mof”) has. Liable to register for vat? All countries that enjoy full membership of the cooperation.

All Countries That Enjoy Full Membership Of The Cooperation Council For The Arab States Of The Gulf Pursuant To Its Charter.

Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. All countries that are full members of the cooperation council for the arab states of the. Liable to register for vat? (8) of 2017, the uae ministry of finance (“mof”) has.

18 Of 2022 To Amend A Number.

The person residing in uae or in an vat implementing state is obligated to register under the decree la.