Vat And Corporate Tax In Uae - Vat is paid by the customer for goods and services consumed while corporate tax in uae is levied on the company for their net. Two key components of this framework are value added tax (vat) and corporate tax. Corporate tax is a direct tax on business profits, while vat is an indirect tax on goods and services. Both of these taxes play a. Two key taxes that business owners need to be aware of in the uae are value added tax (vat) and corporate tax. While both are types of taxes. Discover the key differences between vat and corporate tax in the uae. This detailed guide covers tax rates, compliance.

This detailed guide covers tax rates, compliance. Corporate tax is a direct tax on business profits, while vat is an indirect tax on goods and services. While both are types of taxes. Two key components of this framework are value added tax (vat) and corporate tax. Discover the key differences between vat and corporate tax in the uae. Two key taxes that business owners need to be aware of in the uae are value added tax (vat) and corporate tax. Vat is paid by the customer for goods and services consumed while corporate tax in uae is levied on the company for their net. Both of these taxes play a.

Corporate tax is a direct tax on business profits, while vat is an indirect tax on goods and services. Vat is paid by the customer for goods and services consumed while corporate tax in uae is levied on the company for their net. Two key taxes that business owners need to be aware of in the uae are value added tax (vat) and corporate tax. Two key components of this framework are value added tax (vat) and corporate tax. While both are types of taxes. Both of these taxes play a. This detailed guide covers tax rates, compliance. Discover the key differences between vat and corporate tax in the uae.

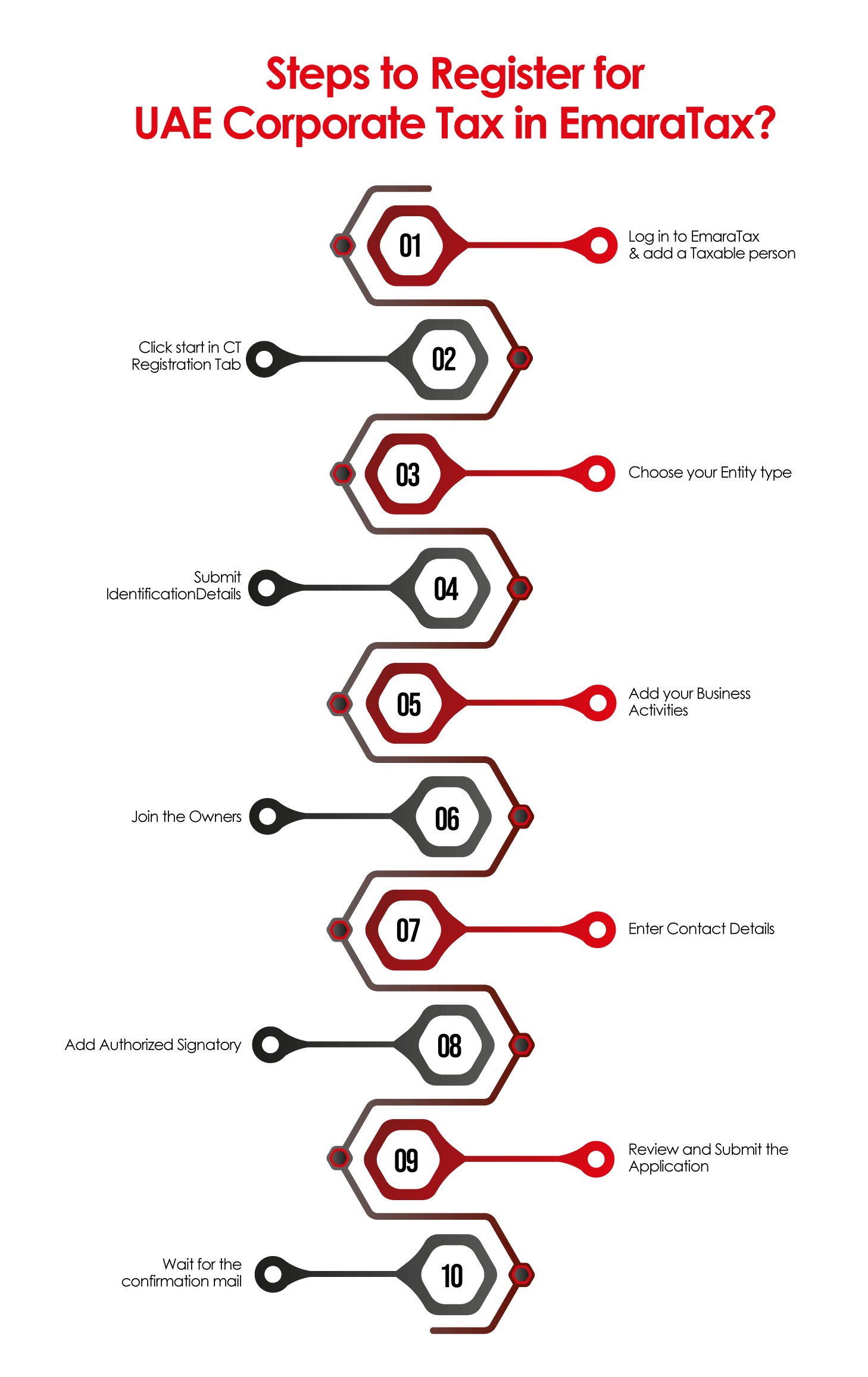

How to Register for Corporate Tax in the UAE Using Emaratax?

Corporate tax is a direct tax on business profits, while vat is an indirect tax on goods and services. Two key taxes that business owners need to be aware of in the uae are value added tax (vat) and corporate tax. Both of these taxes play a. Vat is paid by the customer for goods and services consumed while corporate.

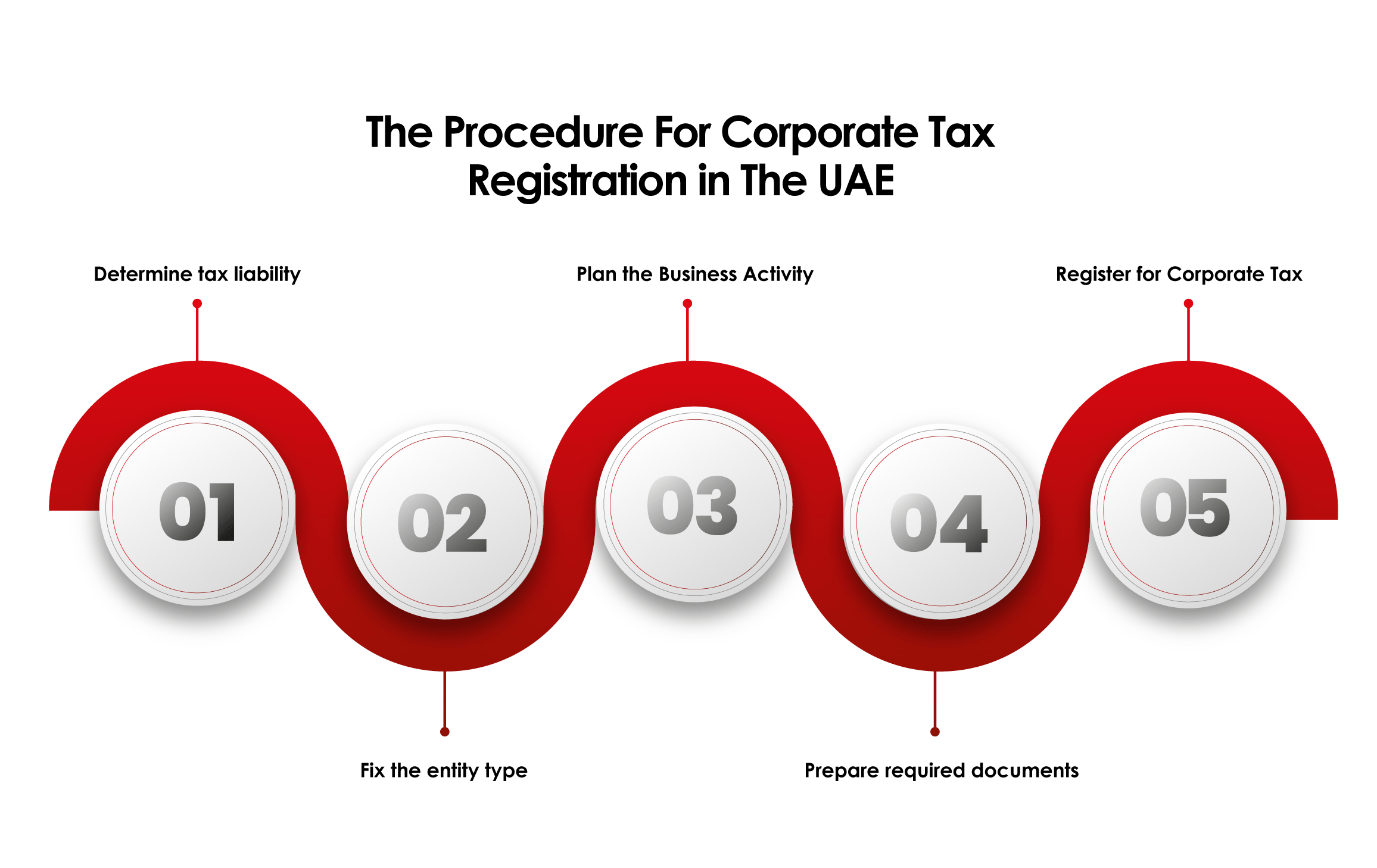

How to register corporate tax in UAE

Discover the key differences between vat and corporate tax in the uae. Two key components of this framework are value added tax (vat) and corporate tax. Corporate tax is a direct tax on business profits, while vat is an indirect tax on goods and services. Vat is paid by the customer for goods and services consumed while corporate tax in.

Corporation Tax in UAE 2025 FAQs

While both are types of taxes. Vat is paid by the customer for goods and services consumed while corporate tax in uae is levied on the company for their net. Both of these taxes play a. Corporate tax is a direct tax on business profits, while vat is an indirect tax on goods and services. This detailed guide covers tax.

Introduction of Corporate Tax in the UAE

Two key components of this framework are value added tax (vat) and corporate tax. Corporate tax is a direct tax on business profits, while vat is an indirect tax on goods and services. While both are types of taxes. Vat is paid by the customer for goods and services consumed while corporate tax in uae is levied on the company.

What is a corporate tax in UAE? NUFCA

Corporate tax is a direct tax on business profits, while vat is an indirect tax on goods and services. This detailed guide covers tax rates, compliance. Discover the key differences between vat and corporate tax in the uae. Both of these taxes play a. Two key components of this framework are value added tax (vat) and corporate tax.

Here's a breakdown of the essential points of UAE's corporate tax

While both are types of taxes. Two key components of this framework are value added tax (vat) and corporate tax. This detailed guide covers tax rates, compliance. Two key taxes that business owners need to be aware of in the uae are value added tax (vat) and corporate tax. Corporate tax is a direct tax on business profits, while vat.

A Guide to Corporate Tax Registration in UAE BMS Auditing

Corporate tax is a direct tax on business profits, while vat is an indirect tax on goods and services. Two key components of this framework are value added tax (vat) and corporate tax. Both of these taxes play a. Discover the key differences between vat and corporate tax in the uae. Vat is paid by the customer for goods and.

Corporate Tax in the UAE A Comprehensive Guide for Business Owners

This detailed guide covers tax rates, compliance. While both are types of taxes. Two key components of this framework are value added tax (vat) and corporate tax. Vat is paid by the customer for goods and services consumed while corporate tax in uae is levied on the company for their net. Corporate tax is a direct tax on business profits,.

VAT and Corporate tax ServicesVAT and Corporate tax Services in UAE

Vat is paid by the customer for goods and services consumed while corporate tax in uae is levied on the company for their net. While both are types of taxes. Both of these taxes play a. Two key components of this framework are value added tax (vat) and corporate tax. Corporate tax is a direct tax on business profits, while.

Know About Corporate Tax in UAE

Vat is paid by the customer for goods and services consumed while corporate tax in uae is levied on the company for their net. Corporate tax is a direct tax on business profits, while vat is an indirect tax on goods and services. Two key taxes that business owners need to be aware of in the uae are value added.

Discover The Key Differences Between Vat And Corporate Tax In The Uae.

Two key taxes that business owners need to be aware of in the uae are value added tax (vat) and corporate tax. While both are types of taxes. Two key components of this framework are value added tax (vat) and corporate tax. Vat is paid by the customer for goods and services consumed while corporate tax in uae is levied on the company for their net.

Both Of These Taxes Play A.

Corporate tax is a direct tax on business profits, while vat is an indirect tax on goods and services. This detailed guide covers tax rates, compliance.