Vat Applicable In Uae - An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero.

The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that.

The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. Assistance with the more likely questions that. An overview of the main vat rules and procedures in the uae and how to comply with them;

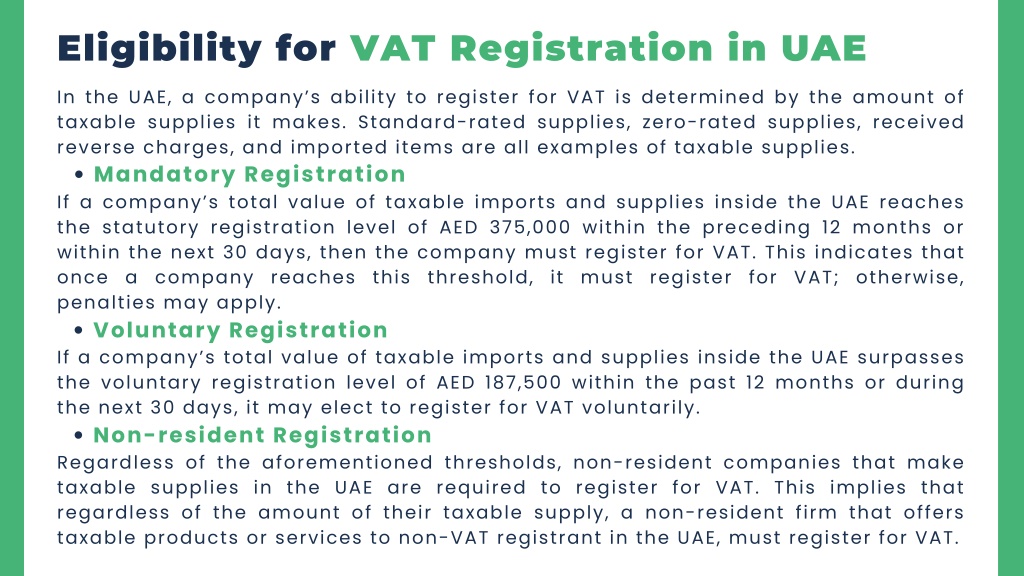

PPT VAT Registration in UAE PowerPoint Presentation, free download

The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that.

Detailed Guide to VAT Applicability on Director's Services in the UAE

The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that.

UAE VAT and VAT Reports A Complete Guide

An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero.

Is VAT applicable on services in UAE? 2021 Guide TaxHelp.ae

An overview of the main vat rules and procedures in the uae and how to comply with them; The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. Assistance with the more likely questions that.

Filing Vat Return in UAE Vat Return UAE How to file VAT Return in

Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them;

Key Points of VAT in UAE for Businesses

An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero.

Vat Uae 2025 Viola S Vance

An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero.

Is Vat Applicable On Commercial Rent

The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that.

VAT Rules for Electronic Services in the UAE • NAM Accountants

Assistance with the more likely questions that. An overview of the main vat rules and procedures in the uae and how to comply with them; The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero.

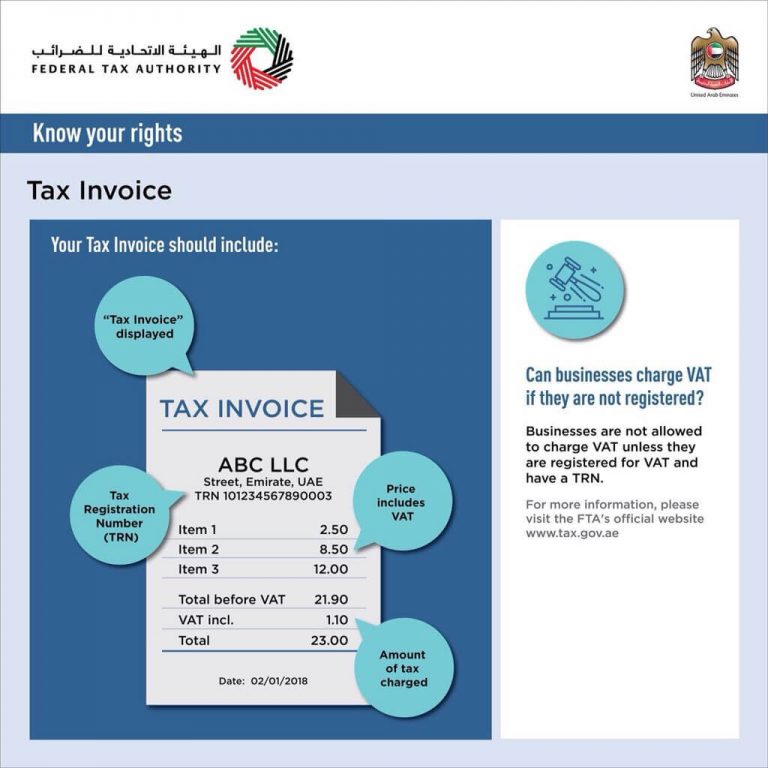

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

An overview of the main vat rules and procedures in the uae and how to comply with them; The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. Assistance with the more likely questions that.

An Overview Of The Main Vat Rules And Procedures In The Uae And How To Comply With Them;

The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. Assistance with the more likely questions that.