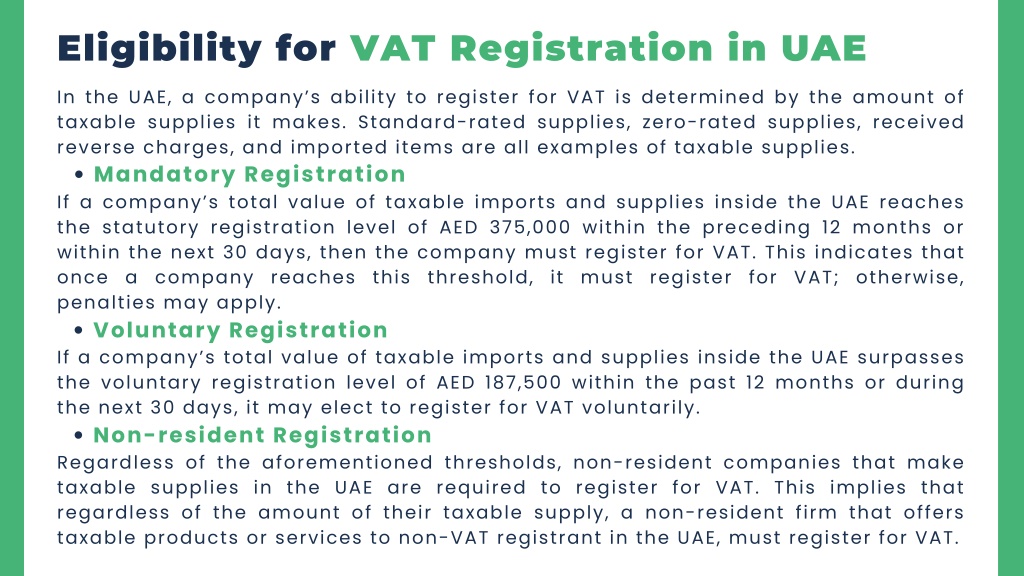

Vat Eligibility In Uae - Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the united arab emirates. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Understanding the vat framework is essential for any businesses to run their operations effectively and get them aligned with federal tax authority. This blog provides a detailed overview of who needs to register for vat in the uae, applicable thresholds, voluntary.

A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the united arab emirates. This blog provides a detailed overview of who needs to register for vat in the uae, applicable thresholds, voluntary. Understanding the vat framework is essential for any businesses to run their operations effectively and get them aligned with federal tax authority.

Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the united arab emirates. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. This blog provides a detailed overview of who needs to register for vat in the uae, applicable thresholds, voluntary. Understanding the vat framework is essential for any businesses to run their operations effectively and get them aligned with federal tax authority.

VAT Registration in UAE 2025 Application, Changes and Cancellation

Understanding the vat framework is essential for any businesses to run their operations effectively and get them aligned with federal tax authority. Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the united arab emirates. This blog provides a detailed overview of who needs to register for vat in the uae,.

Vat Uae 2025 Viola S Vance

This blog provides a detailed overview of who needs to register for vat in the uae, applicable thresholds, voluntary. Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the united arab emirates. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed..

How to Claim VAT Refund in UAE 2024? (UPDATED)

Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the united arab emirates. Understanding the vat framework is essential for any businesses to run their operations effectively and get them aligned with federal tax authority. This blog provides a detailed overview of who needs to register for vat in the uae,.

UAE VAT Registration Online Process and Eligibility Criteria

A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Understanding the vat framework is essential for any businesses to run their operations effectively and get them aligned with federal tax authority. Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the.

UAE VAT Registration Online Process and Eligibility Criteria

Understanding the vat framework is essential for any businesses to run their operations effectively and get them aligned with federal tax authority. This blog provides a detailed overview of who needs to register for vat in the uae, applicable thresholds, voluntary. Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the.

Guide to UAE VAT Registration & Eligibility

A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. This blog provides a detailed overview of who needs to register for vat in the uae, applicable thresholds, voluntary. Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the united arab emirates..

Guide The Eligibility Criteria For Refund of VAT in UAE

Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the united arab emirates. This blog provides a detailed overview of who needs to register for vat in the uae, applicable thresholds, voluntary. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed..

PPT VAT Registration in UAE PowerPoint Presentation, free download

This blog provides a detailed overview of who needs to register for vat in the uae, applicable thresholds, voluntary. Understanding the vat framework is essential for any businesses to run their operations effectively and get them aligned with federal tax authority. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed..

VAT Registration UAE Eligibility A Complete Guide InstaCo

Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the united arab emirates. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Understanding the vat framework is essential for any businesses to run their operations effectively and get them aligned with.

Vat registration in uae Artofit

Before registering and filing for vat, businesses must have a thorough understanding of vat and vat rates in the united arab emirates. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Understanding the vat framework is essential for any businesses to run their operations effectively and get them aligned with.

Before Registering And Filing For Vat, Businesses Must Have A Thorough Understanding Of Vat And Vat Rates In The United Arab Emirates.

Understanding the vat framework is essential for any businesses to run their operations effectively and get them aligned with federal tax authority. This blog provides a detailed overview of who needs to register for vat in the uae, applicable thresholds, voluntary. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed.